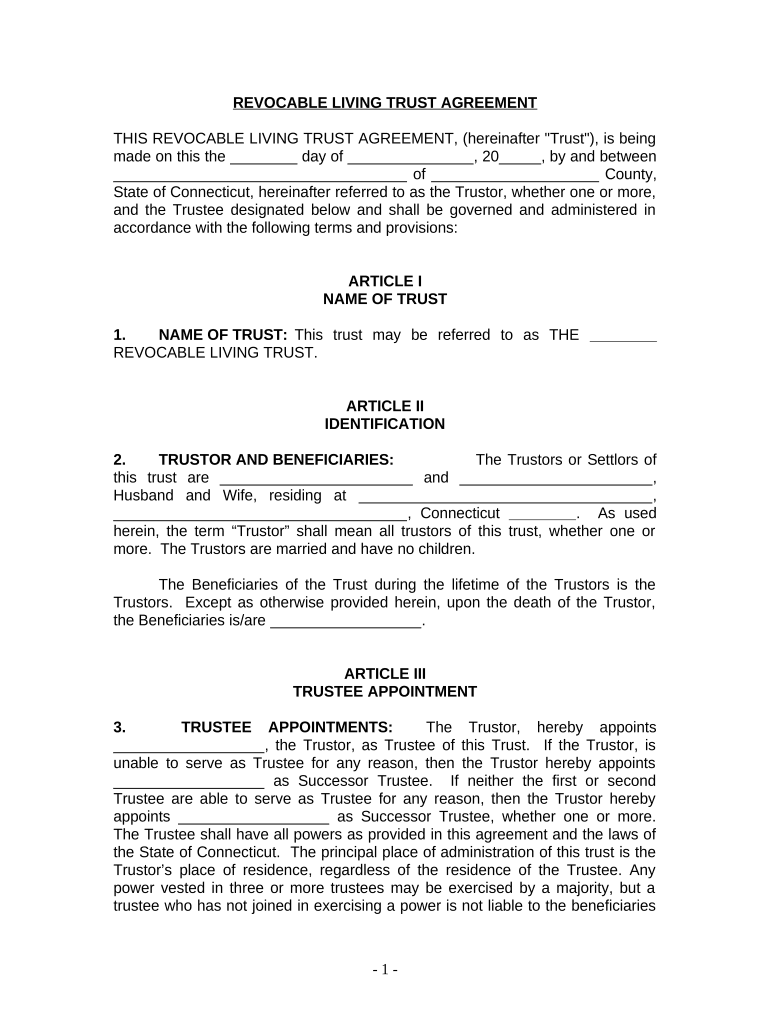

Living Trust for Husband and Wife with No Children Connecticut Form

What is the Living Trust For Husband And Wife With No Children Connecticut

A living trust for husband and wife with no children in Connecticut is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed after their death. This type of trust is particularly beneficial for couples without children, as it provides a streamlined process for asset management and distribution. The trust can help avoid probate, ensuring that the couple's wishes are honored without the lengthy court process typically associated with estate distribution.

Steps to Complete the Living Trust For Husband And Wife With No Children Connecticut

Completing a living trust involves several key steps:

- Identify assets: List all assets that will be included in the trust, such as real estate, bank accounts, and investments.

- Choose a trustee: Designate a trustee, who will manage the trust. This can be one or both spouses.

- Draft the trust document: Create the trust document, outlining the terms and conditions of the trust. This document should include details on asset distribution and management.

- Sign the document: Both spouses must sign the trust document in the presence of a notary public to ensure its validity.

- Fund the trust: Transfer ownership of the identified assets into the trust. This may involve changing titles or account names.

Legal Use of the Living Trust For Husband And Wife With No Children Connecticut

The legal use of a living trust for husband and wife with no children in Connecticut is governed by state laws. This trust serves as a legally binding document that outlines the management and distribution of assets. It is essential that the trust complies with Connecticut's legal requirements to ensure its enforceability. Properly executed, the trust can provide significant benefits, including avoiding probate and maintaining privacy regarding asset distribution.

State-Specific Rules for the Living Trust For Husband And Wife With No Children Connecticut

Connecticut has specific rules regarding living trusts. These include:

- Trusts must be in writing and signed by the grantors.

- Notarization is required for the trust document to be legally binding.

- Assets must be properly transferred into the trust to avoid probate.

- Trustees must adhere to fiduciary duties, managing the trust in the best interest of the beneficiaries.

How to Obtain the Living Trust For Husband And Wife With No Children Connecticut

Obtaining a living trust in Connecticut can be done through several methods:

- Consult an attorney: Engaging a legal professional can ensure that the trust is tailored to meet specific needs and complies with state laws.

- Online resources: There are various online platforms that provide templates and guidance for creating a living trust.

- Legal document services: Some services specialize in preparing legal documents, including living trusts, for a fee.

Key Elements of the Living Trust For Husband And Wife With No Children Connecticut

Key elements of a living trust for husband and wife with no children include:

- Grantors: The individuals creating the trust, typically both spouses.

- Trustee: The person or entity responsible for managing the trust, which can be one or both spouses.

- Beneficiaries: The individuals or entities that will receive the assets from the trust upon the death of the grantors.

- Terms of distribution: Clear instructions on how and when the assets will be distributed to beneficiaries.

Quick guide on how to complete living trust for husband and wife with no children connecticut

Prepare Living Trust For Husband And Wife With No Children Connecticut effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally-friendly option to conventional printed and signed papers, enabling you to acquire the correct form and securely store it online. airSlate SignNow offers all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Living Trust For Husband And Wife With No Children Connecticut on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Living Trust For Husband And Wife With No Children Connecticut effortlessly

- Locate Living Trust For Husband And Wife With No Children Connecticut and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, through email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign Living Trust For Husband And Wife With No Children Connecticut while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Husband and Wife with No Children in Connecticut?

A Living Trust for Husband and Wife with No Children in Connecticut is a legal document that allows couples to manage their assets during their lifetime and provide for the distribution of those assets after passing. This trust helps avoid probate, ensuring a smoother transfer of property to beneficiaries.

-

What are the benefits of establishing a Living Trust for Husband and Wife with No Children in Connecticut?

One signNow benefit of a Living Trust for Husband and Wife with No Children in Connecticut is that it allows for greater control over asset distribution without the hassle of probate. Additionally, it can reduce estate taxes and provide privacy, as the trust does not become public record.

-

How does the pricing work for creating a Living Trust for Husband and Wife with No Children in Connecticut?

The pricing for creating a Living Trust for Husband and Wife with No Children in Connecticut varies based on the complexity of your assets and the services used. Typically, online services like airSlate SignNow offer cost-effective solutions to prepare your trust documents, often at a fraction of traditional attorney fees.

-

Can I customize my Living Trust for Husband and Wife with No Children in Connecticut?

Yes, when you create a Living Trust for Husband and Wife with No Children in Connecticut, you have the flexibility to customize it to meet your specific needs and wishes. You can include detailed provisions regarding asset distribution, management, and any other personal considerations.

-

Is a Living Trust for Husband and Wife with No Children in Connecticut revocable?

Yes, a Living Trust for Husband and Wife with No Children in Connecticut is typically revocable, meaning that you can change or dissolve it as long as you and your spouse are alive and competent. This dynamic feature allows you to adjust your trust as your circumstances or wishes change.

-

What happens to a Living Trust for Husband and Wife with No Children in Connecticut after both spouses pass away?

After both spouses pass away, a Living Trust for Husband and Wife with No Children in Connecticut allows for the seamless transfer of assets to designated beneficiaries according to the terms set forth in the trust. This avoids the lengthy probate process and maintains the privacy of the estate.

-

Can a Living Trust for Husband and Wife with No Children in Connecticut include non-titled assets?

Yes, a Living Trust for Husband and Wife with No Children in Connecticut can include non-titled assets, such as personal belongings, jewelry, and cash. However, it's important to specify how these assets should be managed and distributed within the trust.

Get more for Living Trust For Husband And Wife With No Children Connecticut

- Consent letter sample for personal information

- Smart by shel silverstein pdf form

- Termination of guardianship forms

- Cf 1e form download

- Care and needs scale online form

- Renovate right pamphlet pdf form

- Sickle cell anemia pedigree worksheet answers form

- Scout evaluation forms pdf bsa troop 429 bsatroop429

Find out other Living Trust For Husband And Wife With No Children Connecticut

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF