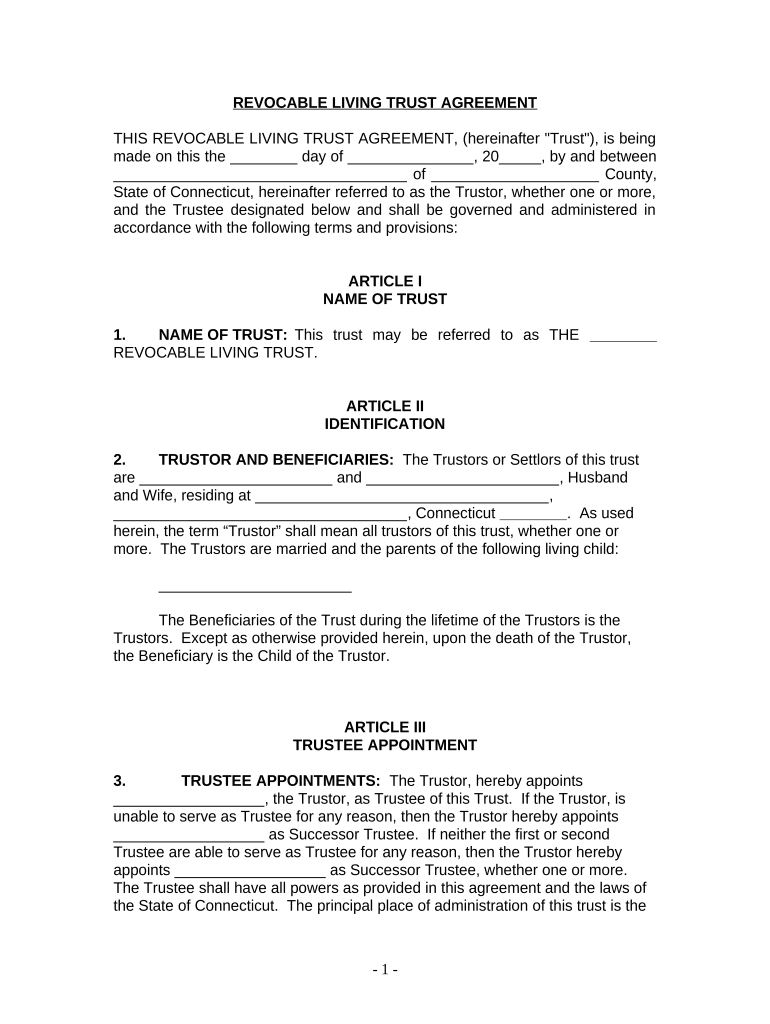

Living Trust for Husband and Wife with One Child Connecticut Form

What is the Living Trust For Husband And Wife With One Child Connecticut

A living trust for husband and wife with one child in Connecticut is a legal document that allows couples to manage their assets during their lifetime and specify how those assets will be distributed upon their passing. This type of trust is particularly beneficial for ensuring that the couple's child is taken care of after their death. Unlike a will, a living trust can help avoid probate, making the transfer of assets smoother and faster. It provides flexibility, allowing the couple to modify the trust as their circumstances change.

Key Elements of the Living Trust For Husband And Wife With One Child Connecticut

Several key elements define a living trust for husband and wife with one child in Connecticut:

- Trustees: Typically, both spouses act as co-trustees, allowing them to manage the trust assets together.

- Beneficiaries: The couple's child is often named as the primary beneficiary, ensuring they receive the assets after both parents pass away.

- Assets Included: The trust can hold various assets, including real estate, bank accounts, and investments.

- Distribution Instructions: The trust document outlines how and when the assets will be distributed to the child, which can include provisions for their education or other needs.

Steps to Complete the Living Trust For Husband And Wife With One Child Connecticut

Completing a living trust involves several important steps:

- Gather Information: Collect details about all assets, including property, bank accounts, and investments.

- Choose a Trustee: Decide whether both spouses will serve as co-trustees or if a third party will be appointed.

- Draft the Trust Document: Create the trust document, ensuring it includes all necessary provisions and complies with Connecticut laws.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary public to validate it.

- Fund the Trust: Transfer ownership of the assets into the trust, which may involve changing titles and updating account information.

State-Specific Rules for the Living Trust For Husband And Wife With One Child Connecticut

Connecticut has specific rules governing living trusts that couples should be aware of:

- Revocability: Most living trusts are revocable, meaning the couple can change or dissolve the trust at any time.

- Tax Implications: Assets in a living trust are still considered part of the couple's estate for tax purposes.

- Witness Requirements: Connecticut law does not require witnesses for the signing of a living trust, but notarization is necessary.

How to Use the Living Trust For Husband And Wife With One Child Connecticut

Using a living trust effectively involves ongoing management and understanding its functions:

- Asset Management: The trustees manage the assets during their lifetime, making decisions about investments and distributions.

- Updating the Trust: As life circumstances change, such as the birth of additional children or changes in financial status, the trust should be updated to reflect these changes.

- Distribution After Death: Upon the death of both spouses, the trust assets are distributed according to the instructions laid out in the trust document, bypassing the probate process.

Legal Use of the Living Trust For Husband And Wife With One Child Connecticut

The legal use of a living trust in Connecticut provides several advantages:

- Avoiding Probate: Assets in a living trust do not go through probate, allowing for quicker distribution to beneficiaries.

- Privacy: Unlike wills, which become public records, living trusts remain private.

- Control Over Distribution: The trust allows the couple to specify conditions for asset distribution, such as age or milestones for their child.

Quick guide on how to complete living trust for husband and wife with one child connecticut

Finalize Living Trust For Husband And Wife With One Child Connecticut seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Living Trust For Husband And Wife With One Child Connecticut on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign Living Trust For Husband And Wife With One Child Connecticut effortlessly

- Locate Living Trust For Husband And Wife With One Child Connecticut and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to preserve your modifications.

- Choose how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious form searches, or errors that require new document printouts. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Living Trust For Husband And Wife With One Child Connecticut and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child Connecticut?

A Living Trust For Husband And Wife With One Child Connecticut is a legal arrangement that allows spouses to manage assets for themselves and their child during their lifetime and ensures a smooth transition of those assets upon their passing. This type of trust helps avoid probate, providing a streamlined process for asset distribution while offering flexibility and control.

-

How does a Living Trust For Husband And Wife With One Child Connecticut benefit my family?

Creating a Living Trust For Husband And Wife With One Child Connecticut provides several benefits, including asset protection, privacy, and avoiding probate fees. This trust structure allows you to dictate how your assets will be managed and distributed, ensuring that your child's needs are met while minimizing stress for your loved ones.

-

What are the costs associated with setting up a Living Trust For Husband And Wife With One Child Connecticut?

The cost of establishing a Living Trust For Husband And Wife With One Child Connecticut can vary depending on complexity and whether you seek professional legal assistance. On average, setting up a trust may range from a few hundred to several thousand dollars, depending on your specific needs and the attorney's fees involved.

-

Can I modify my Living Trust For Husband And Wife With One Child Connecticut after it's created?

Yes, one of the advantages of a Living Trust For Husband And Wife With One Child Connecticut is that it can be amended or revoked at any time during your lifetime. This flexibility allows you to make changes as your circumstances or wishes evolve, ensuring that the trust remains aligned with your current situation and family needs.

-

What assets can be included in a Living Trust For Husband And Wife With One Child Connecticut?

A Living Trust For Husband And Wife With One Child Connecticut can encompass various types of assets, including real estate, bank accounts, investments, and personal property. By funding your trust with these assets, you ensure they are managed according to your wishes and distributed to your child without the lengthy probate process.

-

How does airSlate SignNow facilitate the creation of a Living Trust For Husband And Wife With One Child Connecticut?

airSlate SignNow simplifies the process of creating a Living Trust For Husband And Wife With One Child Connecticut by providing an easy-to-use platform for drafting and eSigning documents. With its cost-effective solutions, users can streamline the paperwork involved, making it faster and more convenient to establish and manage their trust.

-

Is a Living Trust For Husband And Wife With One Child Connecticut suitable for everyone?

While a Living Trust For Husband And Wife With One Child Connecticut is beneficial for many couples, it may not be necessary for everyone. Factors such as the size of your estate, specific family dynamics, and personal preferences should be considered to determine if this trust aligns with your estate planning goals.

Get more for Living Trust For Husband And Wife With One Child Connecticut

Find out other Living Trust For Husband And Wife With One Child Connecticut

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement