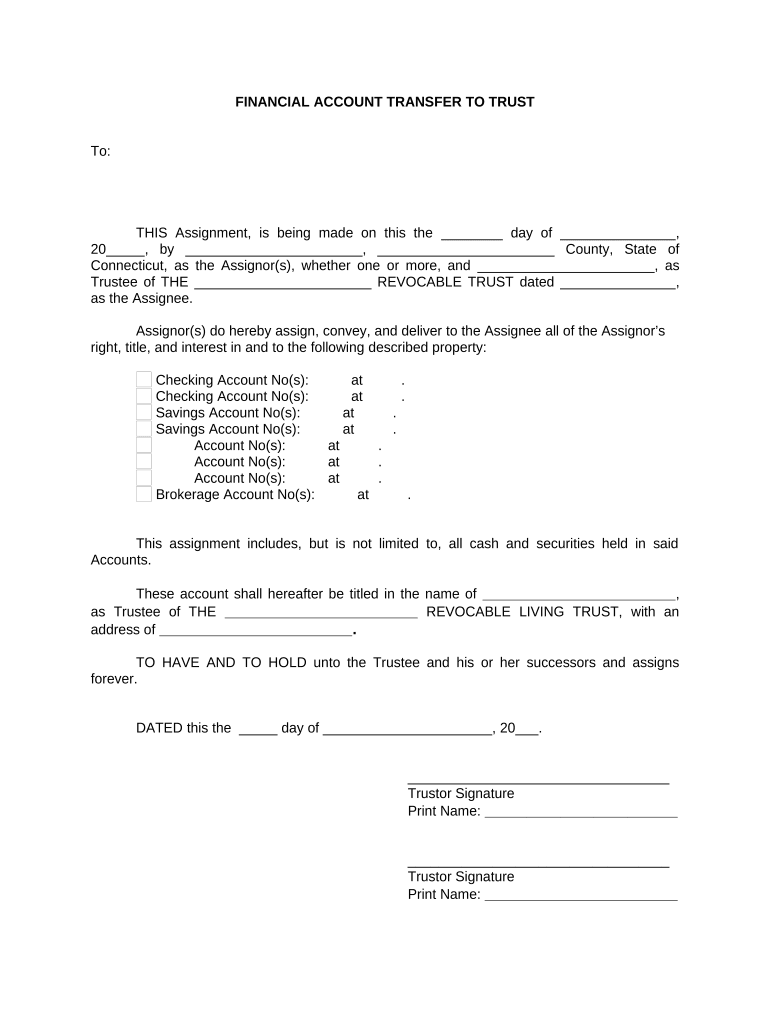

Financial Account Transfer to Living Trust Connecticut Form

Understanding the Financial Account Transfer To Living Trust in Connecticut

The Financial Account Transfer To Living Trust in Connecticut is a legal document that facilitates the transfer of financial assets into a living trust. This process is essential for individuals looking to manage their estate efficiently and ensure that their assets are distributed according to their wishes after their passing. By transferring financial accounts into a living trust, individuals can avoid probate, which can be a lengthy and costly process. It is important to understand the specific requirements and implications of this transfer to ensure that it is executed correctly.

Steps to Complete the Financial Account Transfer To Living Trust in Connecticut

Completing the Financial Account Transfer To Living Trust in Connecticut involves several key steps:

- Review the Trust Document: Ensure that the living trust document is properly drafted and includes all necessary provisions.

- List Financial Accounts: Identify all financial accounts that you wish to transfer into the trust, such as bank accounts, investment accounts, and retirement accounts.

- Contact Financial Institutions: Reach out to each financial institution to inquire about their specific requirements for transferring accounts into a trust.

- Complete Required Forms: Fill out any forms provided by the financial institutions, which may include a change of ownership or beneficiary designation.

- Submit Documentation: Provide the completed forms along with a copy of the trust document to the financial institutions.

- Confirm Transfer Completion: Follow up with the institutions to ensure that the accounts have been successfully transferred into the trust.

Legal Considerations for the Financial Account Transfer To Living Trust in Connecticut

When transferring financial accounts to a living trust in Connecticut, it is crucial to adhere to state laws and regulations. The trust must be properly established and compliant with Connecticut trust laws. Additionally, the financial institutions involved may have their own policies regarding such transfers. It is advisable to consult with a legal professional who specializes in estate planning to ensure that all legal requirements are met and that the transfer is executed correctly.

Required Documents for the Financial Account Transfer To Living Trust in Connecticut

To successfully complete the Financial Account Transfer To Living Trust in Connecticut, certain documents are typically required:

- Trust Document: A copy of the living trust agreement that outlines the terms and conditions of the trust.

- Identification: Valid identification for the trustee, such as a driver's license or passport.

- Account Statements: Recent statements for the financial accounts being transferred.

- Transfer Forms: Any specific forms required by the financial institutions for the transfer process.

State-Specific Rules for the Financial Account Transfer To Living Trust in Connecticut

Connecticut has specific rules governing the establishment and management of living trusts. These rules dictate how assets can be transferred into a trust, the rights of the trustee and beneficiaries, and the legal obligations of all parties involved. Understanding these regulations is essential for ensuring that the transfer is valid and that the trust operates according to state laws. It is recommended to consult with an estate planning attorney familiar with Connecticut law to navigate these complexities.

Examples of Using the Financial Account Transfer To Living Trust in Connecticut

There are various scenarios in which individuals might choose to transfer financial accounts to a living trust in Connecticut:

- Estate Planning: Individuals looking to streamline their estate planning process may transfer accounts to avoid probate.

- Tax Benefits: Certain transfers may provide tax advantages or help in asset protection.

- Control Over Assets: A living trust allows individuals to maintain control over their assets during their lifetime while specifying how they should be managed after their death.

Quick guide on how to complete financial account transfer to living trust connecticut

Complete Financial Account Transfer To Living Trust Connecticut effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage Financial Account Transfer To Living Trust Connecticut on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The easiest way to edit and eSign Financial Account Transfer To Living Trust Connecticut with ease

- Find Financial Account Transfer To Living Trust Connecticut and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow satisfies your document management needs with just a few clicks from any device you prefer. Modify and eSign Financial Account Transfer To Living Trust Connecticut and ensure excellent communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for Financial Account Transfer To Living Trust in Connecticut?

The process for Financial Account Transfer To Living Trust in Connecticut typically involves gathering the necessary documentation, including the trust agreement and account statements. You will need to complete specific forms provided by your financial institution, ensuring they comply with Connecticut state law. Using airSlate SignNow can simplify this process by allowing you to securely eSign documents online.

-

What are the benefits of transferring financial accounts to a living trust in Connecticut?

Transferring financial accounts to a living trust in Connecticut helps avoid probate, ensuring a smoother transition of assets upon your passing. It provides privacy since the trust does not go through public probate proceedings. Additionally, living trusts can offer better control over how assets are managed and distributed, making them a beneficial estate planning tool.

-

Are there any costs associated with Financial Account Transfer To Living Trust in Connecticut?

Yes, there may be costs associated with the Financial Account Transfer To Living Trust in Connecticut, such as legal fees for drafting the trust document and possible administrative fees from your financial institution. It's essential to consult with an estate planning attorney to understand the expected expenses. Using airSlate SignNow can minimize some costs by streamlining the documentation process.

-

What documents are needed for Financial Account Transfer To Living Trust in Connecticut?

To complete a Financial Account Transfer To Living Trust in Connecticut, you'll typically need the trust agreement, personal identification, and documents related to the financial accounts being transferred. Banks and financial institutions may require additional forms specific to their policies. airSlate SignNow can help organize and securely send these documents for eSigning.

-

What features does airSlate SignNow offer for facilitating this transfer?

airSlate SignNow provides an intuitive platform that allows users to eSign documents securely, ensuring a quick and hassle-free Financial Account Transfer To Living Trust in Connecticut. Key features include customizable templates, automated reminders, and real-time tracking of document status. These tools help ensure that the entire process runs smoothly and efficiently.

-

How does airSlate SignNow ensure the security of documents during the transfer process?

airSlate SignNow employs state-of-the-art encryption and security protocols to protect your documents during the Financial Account Transfer To Living Trust in Connecticut. All eSigned documents are securely stored and protected from unauthorized access. Committing to a secure platform ensures that your sensitive information remains confidential throughout the process.

-

Can I integrate airSlate SignNow with other tools to manage my estate planning?

Yes, airSlate SignNow offers integrations with a variety of tools that can help you streamline your estate planning, including document management systems and cloud storage services. This allows for a cohesive workflow when managing your Financial Account Transfer To Living Trust in Connecticut. These integrations enhance productivity, ensuring all your documents remain organized and easily accessible.

Get more for Financial Account Transfer To Living Trust Connecticut

- Sworn statement for no lien on vehicle form

- Inventory and condition form example filled out

- Vehicle log book template download form

- Youngteentube form

- Seminary test answers form

- Hacienda formularios sc 811

- Microsoft word deductivereasoninglab docx form

- Solicite ayuda en la ciudad de nueva york access nyc form

Find out other Financial Account Transfer To Living Trust Connecticut

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple