Ct Llc Form

What is the CT LLC?

The CT LLC, or Connecticut Limited Liability Company, is a legal business structure that combines the benefits of a corporation and a partnership. This form allows for limited liability protection for its owners, known as members, meaning their personal assets are generally protected from business debts and liabilities. The CT LLC is a popular choice for small business owners in Connecticut due to its flexibility in management and tax treatment.

How to Obtain the CT LLC

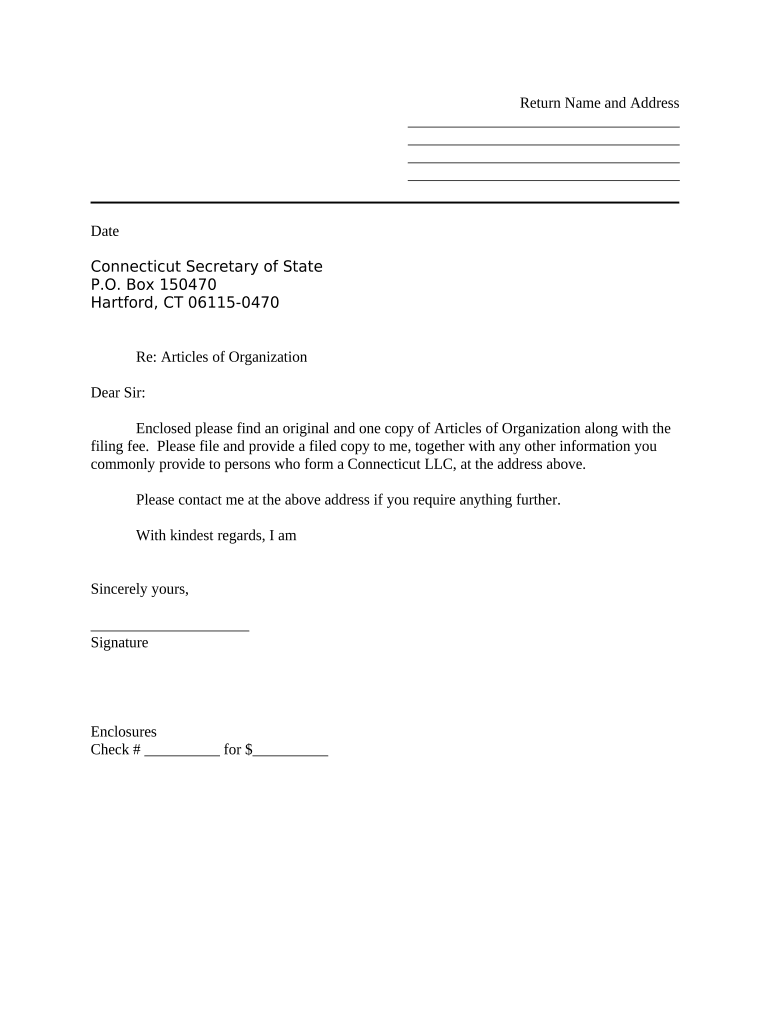

To obtain a CT LLC, you must first choose a unique name for your business that complies with Connecticut naming requirements. Next, you will need to file a Certificate of Organization with the Connecticut Secretary of State. This document includes essential information such as the LLC's name, principal office address, and the name and address of the registered agent. There is a filing fee associated with this process, which must be paid at the time of submission.

Steps to Complete the CT LLC

Completing the CT LLC involves several key steps:

- Choose a name that meets state requirements and is not already in use.

- Select a registered agent who will receive legal documents on behalf of the LLC.

- Prepare and file the Certificate of Organization with the Secretary of State.

- Draft an Operating Agreement, which outlines the management structure and operating procedures of the LLC.

- Obtain any necessary permits or licenses required for your specific business type.

Legal Use of the CT LLC

The CT LLC can be used for various legal purposes, including operating a business, holding assets, and entering into contracts. It provides a formal structure that can enhance credibility with customers and suppliers. Additionally, the limited liability protection helps shield members from personal liability for the company's debts, making it a secure option for entrepreneurs.

State-Specific Rules for the CT LLC

Connecticut has specific rules governing the formation and operation of LLCs. These include requirements for filing annual reports, maintaining a registered agent, and adhering to state tax obligations. It is essential to stay informed about any changes in state laws that may affect your LLC, as compliance is critical to maintaining your business's legal standing.

Required Documents

To successfully form a CT LLC, you will need several key documents, including:

- Certificate of Organization: This is the primary document filed with the Secretary of State.

- Operating Agreement: While not mandatory, this document is highly recommended to outline the management and operational structure.

- Employer Identification Number (EIN): This is required for tax purposes and can be obtained from the IRS.

Quick guide on how to complete ct llc

Effortlessly prepare Ct Llc on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Ct Llc on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Ct Llc with ease

- Locate Ct Llc and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate the hassle of lost or displaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Ct Llc and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to form an LLC in the CT LLC state?

To form an LLC in the CT LLC state, you must file a Certificate of Organization with the Secretary of State. You'll also need to create an Operating Agreement to outline the management structure and operating procedures of your LLC. Additionally, obtain any necessary permits or licenses for your business activities in the state.

-

What are the benefits of forming an LLC in the CT LLC state?

Forming an LLC in the CT LLC state offers personal liability protection for its owners, protecting personal assets from business debts. It also provides tax flexibility, allowing members to report income on their personal tax returns. Moreover, it enhances credibility with customers and partners, making it easier to secure funding.

-

How much does it cost to set up an LLC in the CT LLC state?

The cost to set up an LLC in the CT LLC state typically includes a filing fee for the Certificate of Organization, which is around $120. Depending on your business needs, you may incur additional costs for an Operating Agreement and any required permits. It's important to budget for ongoing maintenance fees as well.

-

How long does it take to process an LLC application in the CT LLC state?

The processing time for an LLC application in the CT LLC state can vary, but it usually takes about 3-5 business days for online submissions. If filed by mail, it may take longer, potentially up to several weeks. Using expedited services can speed up the process if you need your LLC established quickly.

-

Can I use airSlate SignNow to sign documents for my CT LLC state?

Yes, airSlate SignNow provides a reliable platform for eSigning documents related to your CT LLC state. Whether it’s contracts, agreements, or legal documents, you can use our tools to streamline the signing process and keep everything securely organized. This ensures compliance and enhances efficiency in your business operations.

-

What features does airSlate SignNow offer that are beneficial for CT LLC state businesses?

airSlate SignNow offers various features beneficial for CT LLC state businesses, such as easy-to-use eSigning capabilities, templates for common documents, and integration with popular tools like Google Drive. Additionally, you can track the status of your documents and set reminders, making it simple to manage your workflow efficiently.

-

Is airSlate SignNow compliant with CT LLC state regulations?

Yes, airSlate SignNow is compliant with federal and state regulations, including those applicable to the CT LLC state. Our eSigning process adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). You can confidently use our platform for all your signing needs.

Get more for Ct Llc

Find out other Ct Llc

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT