Connecticut Partner Form

What is the Connecticut Partner

The Connecticut Partner form is a legal document used by partnerships operating in the state of Connecticut. This form is essential for reporting income, deductions, and credits for partnerships, ensuring compliance with state tax regulations. It serves as a means for the partnership to communicate financial information to the Connecticut Department of Revenue Services and is crucial for accurate tax filing.

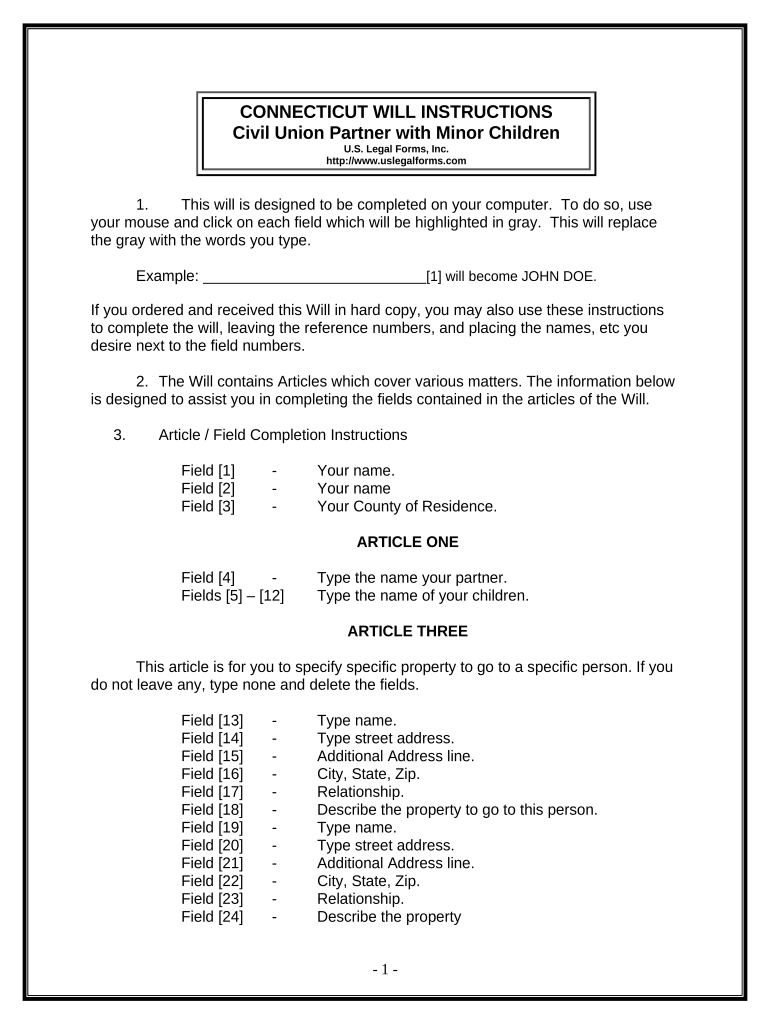

How to use the Connecticut Partner

To effectively use the Connecticut Partner form, a partnership must first gather all necessary financial data, including income and expenses. Once the data is compiled, the partnership can fill out the form, ensuring all sections are completed accurately. After completing the form, it must be submitted to the state by the designated deadline, typically aligned with federal tax filing dates. Utilizing electronic tools can streamline this process, making it easier to fill out and submit the form securely.

Steps to complete the Connecticut Partner

Completing the Connecticut Partner form involves several key steps:

- Gather financial records, including profit and loss statements and balance sheets.

- Fill out the form with accurate information regarding income, deductions, and credits.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, following the specific submission guidelines provided by the state.

Legal use of the Connecticut Partner

The Connecticut Partner form must be used in compliance with state laws and regulations. This includes ensuring that all information reported is truthful and complete. Failure to comply with these legal requirements can result in penalties or audits. It is important for partnerships to understand their obligations under Connecticut law to avoid any legal issues.

Key elements of the Connecticut Partner

Several key elements are crucial when completing the Connecticut Partner form:

- Partnership Information: This includes the name, address, and federal employer identification number (EIN) of the partnership.

- Income Reporting: Accurate reporting of all income earned by the partnership during the tax year.

- Deductions and Credits: Detailed information on any deductions or credits the partnership is eligible to claim.

- Signatures: The form must be signed by authorized individuals within the partnership to validate its authenticity.

State-specific rules for the Connecticut Partner

Connecticut has specific rules governing the use of the Partner form, including filing deadlines and eligibility criteria. Partnerships must adhere to these state-specific regulations to ensure compliance. It is advisable to consult the Connecticut Department of Revenue Services for the most current guidelines and requirements related to the form.

Quick guide on how to complete connecticut partner

Complete Connecticut Partner easily on any device

Web-based document management has become favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Connecticut Partner on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Connecticut Partner effortlessly

- Locate Connecticut Partner and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only a few seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Connecticut Partner and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can a Connecticut partner benefit from it?

airSlate SignNow is a powerful solution that empowers businesses to send and eSign documents efficiently. A Connecticut partner can leverage this tool to enhance document workflow, increase productivity, and improve customer satisfaction by streamlining the signing process.

-

What pricing plans are available for Connecticut partners using airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to meet the needs of businesses in Connecticut. These plans range from basic to advanced features, allowing partners to choose the best fit for their budget and requirements, ensuring cost-effectiveness.

-

What key features does airSlate SignNow offer to Connecticut partners?

airSlate SignNow comes equipped with features such as document templates, real-time tracking, and advanced security measures. Connecticut partners can utilize these functionalities to improve their document management processes and ensure their information is secure.

-

Can airSlate SignNow integrate with other tools for Connecticut partners?

Yes, airSlate SignNow allows for seamless integration with various popular business tools and platforms. Connecticut partners can connect it with applications like Google Workspace, Salesforce, and more, thus enhancing their operational efficiency.

-

How does airSlate SignNow ensure security for Connecticut partners’ documents?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance with industry standards. For Connecticut partners, this means their sensitive documents remain protected throughout the signing process, providing peace of mind.

-

What are the benefits of using airSlate SignNow for a Connecticut partner's business?

Using airSlate SignNow, a Connecticut partner can improve operational efficiency, reduce turnaround times, and enhance client relationships. The cost-effective solution also helps businesses save on printing and mailing expenses while providing a modern signing experience.

-

Is there support available for Connecticut partners using airSlate SignNow?

Absolutely! airSlate SignNow offers dedicated customer support for Connecticut partners, including online resources and live assistance. This ensures that businesses can quickly resolve any questions or issues they may encounter while using the platform.

Get more for Connecticut Partner

Find out other Connecticut Partner

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer