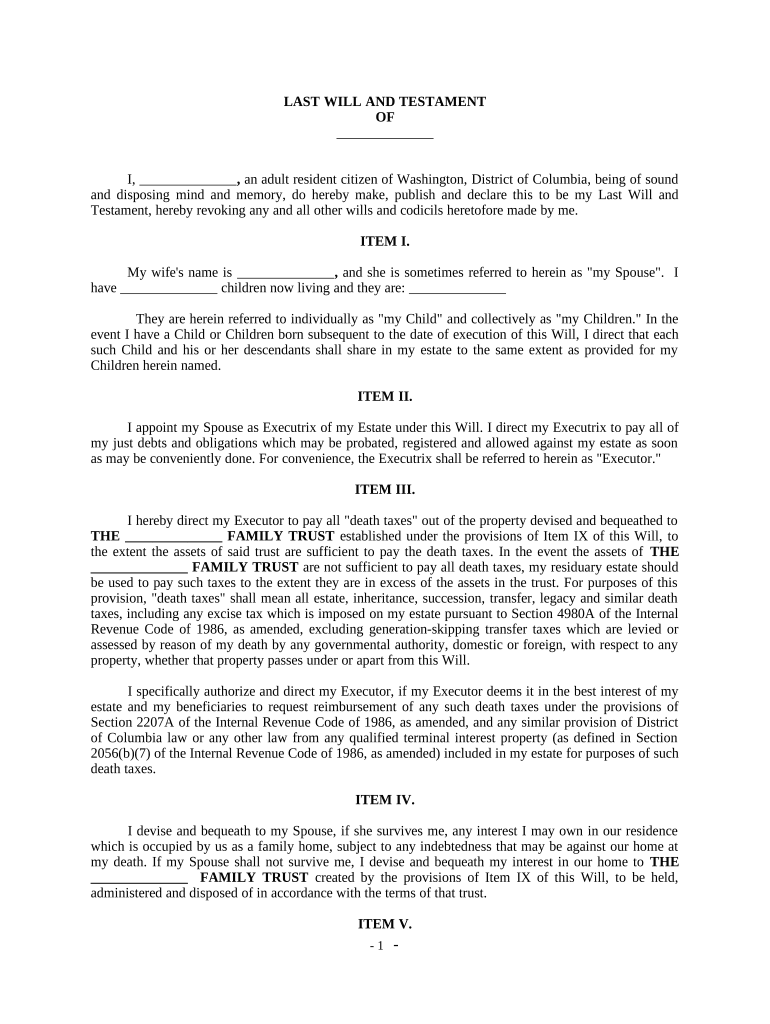

Complex Will with Credit Shelter Marital Trust for Large Estates District of Columbia Form

What is the Complex Will With Credit Shelter Marital Trust For Large Estates District Of Columbia

The Complex Will With Credit Shelter Marital Trust for Large Estates in the District of Columbia is a specialized estate planning tool designed to manage and preserve wealth for families with significant assets. This type of will incorporates a marital trust and a credit shelter trust, allowing for the strategic allocation of estate resources. The marital trust benefits the surviving spouse, while the credit shelter trust is designed to shield a portion of the estate from taxes, maximizing the inheritance for beneficiaries. This dual structure is particularly valuable for high-net-worth individuals aiming to minimize tax liabilities and ensure their estate is distributed according to their wishes.

How to Use the Complex Will With Credit Shelter Marital Trust For Large Estates District Of Columbia

Utilizing the Complex Will With Credit Shelter Marital Trust involves several key steps. First, individuals should consult with an estate planning attorney to assess their financial situation and determine the appropriate structure for their will. After drafting the will, it must be signed in accordance with District of Columbia laws, which typically require witnesses. Once executed, the will should be stored securely, and all relevant parties should be informed of its location. Regular reviews of the will are advisable to ensure it remains aligned with any changes in financial status or family dynamics.

Steps to Complete the Complex Will With Credit Shelter Marital Trust For Large Estates District Of Columbia

Completing the Complex Will With Credit Shelter Marital Trust involves a systematic approach:

- Assess your estate: Evaluate all assets, including real estate, investments, and personal property.

- Consult an attorney: Engage with a legal expert specializing in estate planning to draft the will.

- Draft the will: Include provisions for both the marital and credit shelter trusts, ensuring clarity in asset distribution.

- Sign the document: Follow legal requirements for execution, including witness signatures.

- Store the will: Keep the original document in a safe place and inform trusted individuals of its location.

- Review periodically: Reassess the will every few years or after major life events to ensure it remains relevant.

Legal Use of the Complex Will With Credit Shelter Marital Trust For Large Estates District Of Columbia

The legal use of the Complex Will With Credit Shelter Marital Trust in the District of Columbia is governed by state laws regarding wills and trusts. This form of estate planning must comply with the Uniform Probate Code and relevant tax regulations. Proper execution, including witnessing and notarization, is essential for the will to be deemed valid. Additionally, the structure must adhere to federal tax laws to ensure that the credit shelter trust effectively reduces estate tax liabilities. Legal guidance is crucial to navigate these complexities and ensure compliance.

Key Elements of the Complex Will With Credit Shelter Marital Trust For Large Estates District Of Columbia

Key elements of the Complex Will With Credit Shelter Marital Trust include:

- Marital Trust: This trust provides income and principal access to the surviving spouse, ensuring financial support.

- Credit Shelter Trust: This trust allows a portion of the estate to bypass estate taxes, benefiting heirs directly.

- Asset Allocation: Clear instructions on how assets are divided between the marital and credit shelter trusts.

- Beneficiary Designations: Specific naming of beneficiaries to avoid disputes and ensure clarity.

- Tax Considerations: Provisions that address potential tax implications to maximize the estate's value for heirs.

State-Specific Rules for the Complex Will With Credit Shelter Marital Trust For Large Estates District Of Columbia

In the District of Columbia, specific rules govern the execution and validity of the Complex Will With Credit Shelter Marital Trust. These include:

- Wills must be in writing and signed by the testator.

- At least two witnesses are required to sign the will, affirming they witnessed the signing.

- Holographic wills, or handwritten wills, are recognized if they meet certain criteria.

- Trust provisions must comply with the D.C. Uniform Trust Code.

- Regular updates are recommended to reflect changes in laws or personal circumstances.

Quick guide on how to complete complex will with credit shelter marital trust for large estates district of columbia

Complete Complex Will With Credit Shelter Marital Trust For Large Estates District Of Columbia effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally conscious substitute to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Complex Will With Credit Shelter Marital Trust For Large Estates District Of Columbia on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Complex Will With Credit Shelter Marital Trust For Large Estates District Of Columbia with ease

- Obtain Complex Will With Credit Shelter Marital Trust For Large Estates District Of Columbia and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive data using tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Complex Will With Credit Shelter Marital Trust For Large Estates District Of Columbia and guarantee excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Complex Will With Credit Shelter Marital Trust For Large Estates in the District Of Columbia?

A Complex Will With Credit Shelter Marital Trust For Large Estates in the District Of Columbia allows clients to plan their estate effectively, minimizing tax liabilities while providing for their heirs. This legal mechanism combines a will with a trust to protect substantial assets, offering a clear structure for distribution after death.

-

What are the benefits of using airSlate SignNow for drafting a Complex Will With Credit Shelter Marital Trust For Large Estates?

Using airSlate SignNow for creating a Complex Will With Credit Shelter Marital Trust For Large Estates simplifies the signing process with easy electronic signatures. The platform saves time and reduces costs while ensuring that your documents are legally binding and secure.

-

How much does it cost to create a Complex Will With Credit Shelter Marital Trust For Large Estates using airSlate SignNow?

The pricing for creating a Complex Will With Credit Shelter Marital Trust For Large Estates with airSlate SignNow is competitive and offers various subscription plans tailored for individual or business needs. Users can start with a free trial to explore the features before committing to a plan.

-

Is it easy to customize a Complex Will With Credit Shelter Marital Trust For Large Estates using airSlate SignNow?

Yes, airSlate SignNow offers user-friendly templates and drag-and-drop features that make it easy to customize your Complex Will With Credit Shelter Marital Trust For Large Estates. You can easily add or modify clauses to fit your specific wishes and requirements.

-

Can I integrate airSlate SignNow with other applications for creating a Complex Will With Credit Shelter Marital Trust For Large Estates?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your workflow for creating a Complex Will With Credit Shelter Marital Trust For Large Estates. This includes CRM systems, cloud storage solutions, and other legal software to simplify document management.

-

What security measures does airSlate SignNow provide for my Complex Will With Credit Shelter Marital Trust For Large Estates?

airSlate SignNow employs advanced security measures to protect your documents, including encryption and secure access controls. This ensures that your Complex Will With Credit Shelter Marital Trust For Large Estates is safe from unauthorized access and tampering.

-

How does airSlate SignNow help with legal compliance for a Complex Will With Credit Shelter Marital Trust For Large Estates?

airSlate SignNow provides users with legally compliant document templates and guidance, ensuring that your Complex Will With Credit Shelter Marital Trust For Large Estates adheres to local laws in the District Of Columbia. It simplifies the legal aspect of estate planning, giving you peace of mind.

Get more for Complex Will With Credit Shelter Marital Trust For Large Estates District Of Columbia

Find out other Complex Will With Credit Shelter Marital Trust For Large Estates District Of Columbia

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement