Financial Account Transfer to Living Trust District of Columbia Form

What is the Financial Account Transfer To Living Trust District Of Columbia

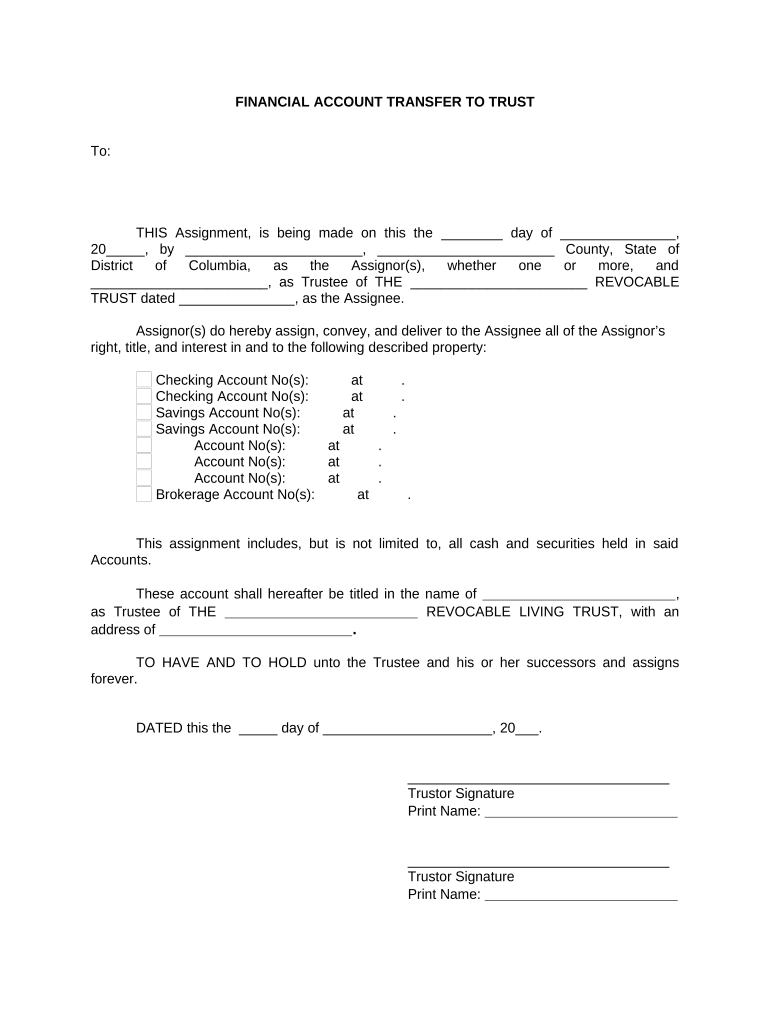

The Financial Account Transfer To Living Trust District Of Columbia is a legal document that facilitates the transfer of financial assets into a living trust. This process allows individuals to manage their assets during their lifetime and ensure a smooth transition to beneficiaries after death. By transferring accounts such as bank accounts, investment accounts, and other financial instruments into a trust, individuals can avoid probate, maintain privacy, and potentially reduce estate taxes.

Steps to complete the Financial Account Transfer To Living Trust District Of Columbia

Completing the Financial Account Transfer To Living Trust involves several important steps:

- Review your living trust document to ensure it is up-to-date and accurately reflects your wishes.

- Gather all relevant financial account information, including account numbers and financial institution details.

- Contact your financial institutions to inquire about their specific procedures for transferring accounts to a trust.

- Complete any required forms provided by the financial institutions, ensuring you specify the trust as the new account owner.

- Submit the completed forms and any necessary documentation, such as a copy of the trust document, to the financial institutions.

- Confirm the successful transfer of accounts by following up with the institutions to verify that the accounts are now held in the name of the trust.

Legal use of the Financial Account Transfer To Living Trust District Of Columbia

The legal use of the Financial Account Transfer To Living Trust is essential for ensuring that the transfer of assets complies with state and federal laws. In the District of Columbia, the trust must be properly established and executed to be valid. This includes having a clear declaration of trust, identifying the trustee and beneficiaries, and ensuring that the trust is funded correctly. Legal compliance is crucial to avoid any challenges to the trust's validity or the distribution of assets.

Required Documents

To complete the Financial Account Transfer To Living Trust, several documents are typically required:

- A copy of the living trust document.

- Identification documents, such as a driver's license or passport.

- Completed transfer forms from the financial institutions.

- Any additional documentation requested by the financial institutions, such as tax identification numbers for the trust.

State-specific rules for the Financial Account Transfer To Living Trust District Of Columbia

The District of Columbia has specific rules governing living trusts and the transfer of financial accounts. It is important to ensure that the trust complies with local laws, including the requirements for trust creation, funding, and management. Additionally, understanding the implications of D.C. estate tax laws can help in planning the transfer of assets effectively. Consulting with a legal professional familiar with D.C. trust law can provide valuable guidance.

Examples of using the Financial Account Transfer To Living Trust District Of Columbia

There are various scenarios in which individuals may utilize the Financial Account Transfer To Living Trust. For example:

- A married couple may transfer their joint bank accounts into a living trust to ensure that the surviving spouse has immediate access to funds without probate delays.

- A parent may transfer custodial accounts for their children into a trust to manage the funds until the children reach adulthood.

- An individual with multiple investment accounts may consolidate them into a trust to simplify management and provide clear instructions for distribution upon their passing.

Quick guide on how to complete financial account transfer to living trust district of columbia

Complete Financial Account Transfer To Living Trust District Of Columbia effortlessly on any device

Web-based document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Financial Account Transfer To Living Trust District Of Columbia across any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and electronically sign Financial Account Transfer To Living Trust District Of Columbia without hassle

- Locate Financial Account Transfer To Living Trust District Of Columbia and click on Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of the documents or redact sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal authority as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Financial Account Transfer To Living Trust District Of Columbia and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for Financial Account Transfer To Living Trust in District Of Columbia?

The process for Financial Account Transfer To Living Trust in District Of Columbia typically involves creating a living trust document, retitling your financial accounts into the name of the trust, and notifying your financial institution. It’s crucial to ensure all legal requirements are met to make the transfer smooth and effective. Consulting a legal expert may help clarify the steps tailored to your situation.

-

What are the benefits of transferring financial accounts to a living trust in District Of Columbia?

Transferring financial accounts to a living trust in District Of Columbia offers several benefits including avoiding probate, ensuring privacy, and providing better control over asset distribution. Moreover, it simplifies the management of your assets should you become incapacitated, as your chosen trustee can step in seamlessly.

-

How much does it cost to complete a Financial Account Transfer To Living Trust in District Of Columbia?

The cost of completing a Financial Account Transfer To Living Trust in District Of Columbia can vary based on the complexity of your financial situation and whether you hire a legal professional. Commonly, fees may include attorney fees, filing fees, and potential costs associated with retitling assets, which can total a few hundred to several thousand dollars.

-

Are there any tax implications when transferring financial accounts to a living trust in District Of Columbia?

Generally, transferring financial accounts to a living trust in District Of Columbia does not incur immediate tax implications, as the transfer does not change ownership for tax purposes. However, it’s advisable to consult with a tax professional to understand any long-term implications or consider how your trust may affect taxes in the future.

-

Can I transfer all types of financial accounts to a living trust in District Of Columbia?

Yes, you can transfer various types of financial accounts to a living trust in District Of Columbia, including bank accounts, investment accounts, and even some retirement accounts. However, certain specific accounts may have additional regulations or restrictions, so it's wise to check with your financial institution and legal advisor for guidance.

-

How does airSlate SignNow assist in the Financial Account Transfer To Living Trust process in District Of Columbia?

airSlate SignNow simplifies the Financial Account Transfer To Living Trust process in District Of Columbia by allowing users to eSign necessary documents securely and efficiently. Our platform ensures that your documents are legally binding and stored safely, providing peace of mind throughout the transfer process.

-

What features of airSlate SignNow can enhance my Financial Account Transfer To Living Trust in District Of Columbia?

airSlate SignNow offers a range of features that enhance the Financial Account Transfer To Living Trust process, including customizable templates, secure eSigning, and status tracking for documents. These features streamline your experience, ensuring that your transactions are efficient and compliant with legal standards.

Get more for Financial Account Transfer To Living Trust District Of Columbia

Find out other Financial Account Transfer To Living Trust District Of Columbia

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now