Chart for Determining Amount of Wages Subject to Attachment Garnishment 7% Delaware Form

What is the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware

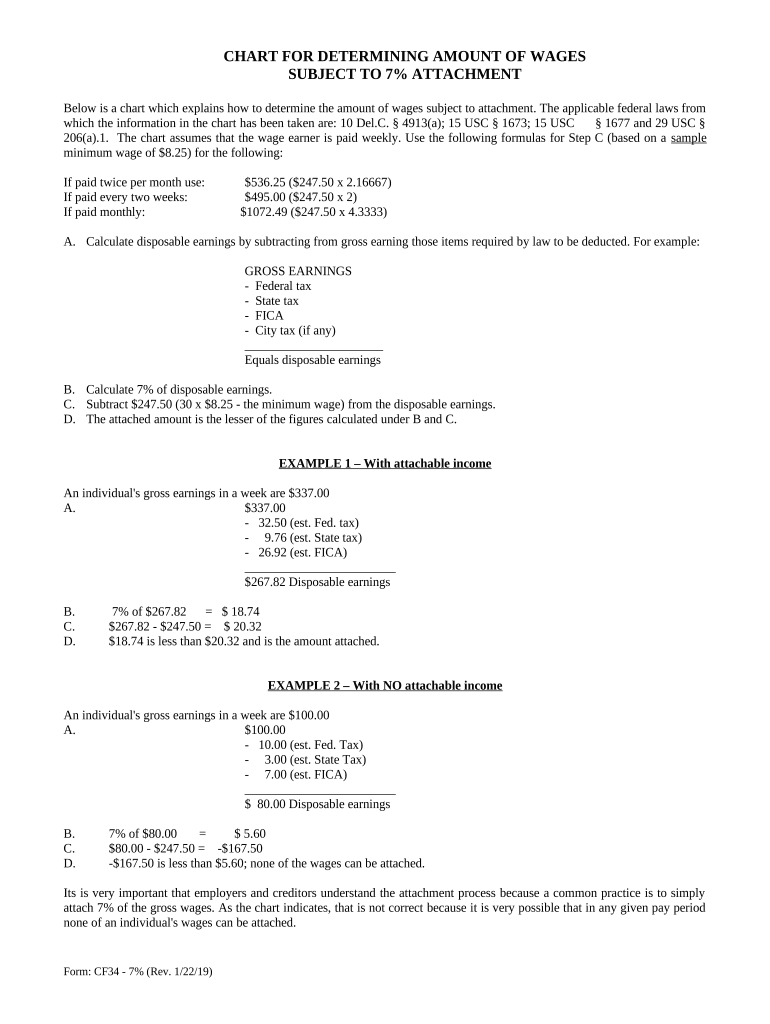

The Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware is a legal tool used to calculate the portion of an employee's wages that can be garnished for debt repayment. This chart is specifically designed for use in Delaware and adheres to state laws governing wage garnishment. It outlines the maximum percentage of disposable earnings that can be withheld, which is set at seven percent in this case. Understanding this chart is crucial for employers and employees alike, as it provides clarity on the limits of wage garnishment and helps ensure compliance with legal requirements.

How to use the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware

To effectively use the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware, follow these steps:

- Identify the employee's gross wages and calculate disposable earnings by subtracting mandatory deductions such as taxes and Social Security.

- Refer to the chart to determine the maximum allowable garnishment amount based on the disposable earnings calculated.

- Ensure that the garnishment does not exceed the seven percent limit established by Delaware law.

- Document the calculations and maintain records for compliance and future reference.

Steps to complete the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware

Completing the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware involves several key steps:

- Gather the necessary financial information, including the employee's gross wages and any applicable deductions.

- Calculate the disposable earnings by subtracting mandatory deductions from the gross wages.

- Locate the appropriate section of the chart that corresponds to the calculated disposable earnings.

- Determine the maximum garnishment amount based on the chart's guidelines.

- Record the findings and ensure compliance with the established limits.

Legal use of the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware

The legal use of the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware is essential for both employers and employees. Employers must adhere to the chart to ensure that any wage garnishments comply with state laws, preventing potential legal repercussions. Employees should understand their rights regarding wage garnishment, including the maximum amounts that can be withheld. This chart serves as a reference point to protect both parties' interests and ensure fair treatment under the law.

State-specific rules for the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware

Delaware has specific regulations regarding wage garnishment that are reflected in the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7%. These rules dictate the maximum percentage of wages that can be garnished, which is seven percent of disposable earnings. Additionally, state laws may outline the types of debts that can lead to garnishment and the procedures that must be followed by creditors. It is important for both employers and employees to be aware of these state-specific rules to ensure compliance and protect their rights.

Examples of using the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware

Understanding practical applications of the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware can provide clarity. For instance, if an employee earns $1,000 in gross wages and has $200 in mandatory deductions, their disposable earnings would be $800. According to the chart, the maximum garnishment amount would be seven percent of $800, which equals $56. This example illustrates how the chart can be applied to determine the appropriate garnishment amount while remaining compliant with Delaware law.

Quick guide on how to complete chart for determining amount of wages subject to attachment garnishment 7 delaware

Complete Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware without any hassle

- Find Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware?

The Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware is a guide that helps employers and employees understand the limits of wage garnishment in Delaware. This chart outlines how much of an employee's wages can be legally withheld to satisfy a debt, ensuring compliance with state laws.

-

How can airSlate SignNow assist with the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware?

airSlate SignNow provides businesses with secure eSignature solutions for agreements related to wage garnishments. By utilizing our platform, organizations can ensure that all documents relating to the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware are properly signed and stored for legal compliance.

-

Is airSlate SignNow affordable for small businesses needing to implement the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware?

Yes, airSlate SignNow offers cost-effective pricing plans designed to fit the budget of small businesses. By providing various tiers, including competitive rates, we ensure that companies can easily access tools needed to comply with the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware without breaking the bank.

-

What features does airSlate SignNow offer for managing wage garnishment documents?

airSlate SignNow offers features such as customizable templates, secure storage, and easy document tracking. These tools facilitate the efficient management of documents related to the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware, making the entire process smoother for businesses and employees.

-

Can I integrate airSlate SignNow with existing payroll systems to handle the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware?

Absolutely! airSlate SignNow provides integrations with various payroll systems, allowing for seamless management of garnishment processes. This integration ensures that calculations based on the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware are executed efficiently and accurately.

-

How does airSlate SignNow ensure compliance with Delaware wage garnishment laws?

airSlate SignNow prioritizes compliance by keeping its solutions updated with the latest state-specific regulations. Our platform includes guidelines that reference the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware, ensuring that users are always in line with legal requirements.

-

What benefits does airSlate SignNow offer for managing wage garnishments?

Using airSlate SignNow to manage wage garnishments streamlines the process, reduces paperwork, and enhances security. By automating document workflows related to the Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware, businesses can save time and resources, ultimately improving operational efficiency.

Get more for Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware

Find out other Chart For Determining Amount Of Wages Subject To Attachment Garnishment 7% Delaware

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now