Nyc Parking Tax Exemption 2013-2026

What is the NYC Parking Tax Exemption?

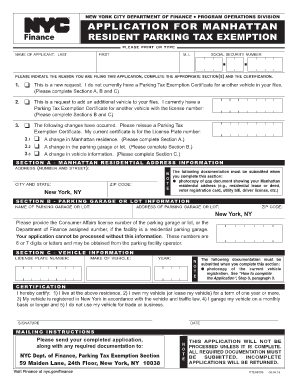

The NYC parking tax exemption is a benefit provided to certain residents of Manhattan, allowing them to avoid paying parking taxes on qualifying vehicles. This exemption is designed to ease the financial burden on residents who rely on their vehicles for daily activities. It applies to specific circumstances, such as when the vehicle is used for personal purposes, and is subject to eligibility criteria set forth by the New York City Department of Finance.

Eligibility Criteria for the NYC Parking Tax Exemption

To qualify for the Manhattan resident parking tax exemption, applicants must meet specific eligibility criteria. Generally, applicants must be residents of Manhattan and possess a valid driver’s license or state-issued identification. The vehicle in question must also be registered in the applicant's name and primarily used for personal purposes. Additional conditions may apply, so it is essential to review the guidelines provided by the NYC Department of Finance.

Steps to Complete the NYC Parking Tax Exemption Application

Completing the application for the NYC parking tax exemption involves several straightforward steps:

- Gather necessary documents, including proof of residency and vehicle registration.

- Access the NYC parking tax exemption application form, which can typically be found on the NYC Department of Finance website.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Submit the application either online, by mail, or in person, depending on your preference.

- Wait for confirmation of your application status from the NYC Department of Finance.

Required Documents for the NYC Parking Tax Exemption

When applying for the Manhattan resident parking tax exemption, applicants must provide several key documents to support their application. These typically include:

- A copy of the vehicle's registration.

- Proof of residency, such as a utility bill or lease agreement.

- A valid driver’s license or state-issued ID.

Having these documents ready will streamline the application process and help ensure compliance with all requirements.

Form Submission Methods for the NYC Parking Tax Exemption

Applicants can submit their NYC parking tax exemption applications through various methods, making it convenient to complete the process. The available submission options include:

- Online submission through the NYC Department of Finance eServices portal.

- Mailing the completed application form to the designated address provided on the form.

- In-person submission at a local NYC Department of Finance office.

Each method has its own processing times, so applicants should choose the one that best fits their needs.

Legal Use of the NYC Parking Tax Exemption

The NYC parking tax exemption is legally binding, provided that applicants adhere to the rules and regulations set forth by the city. It is crucial for residents to ensure that the exemption is used correctly, as misuse can lead to penalties or revocation of the exemption. Understanding the legal framework surrounding this exemption helps residents navigate their rights and responsibilities effectively.

Quick guide on how to complete nyc parking tax exemption

Manage Nyc Parking Tax Exemption effortlessly on any device

Virtual document administration has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and safely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and efficiently. Handle Nyc Parking Tax Exemption on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The simplest way to modify and eSign Nyc Parking Tax Exemption without hassle

- Locate Nyc Parking Tax Exemption and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to finalize your changes.

- Choose your preferred method to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Update and eSign Nyc Parking Tax Exemption and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc parking tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a resident parking tax exemption form?

A resident parking tax exemption form is an official document that allows eligible residents to apply for a tax exemption on parking fees in their area. This form is crucial for those who qualify, as it can lead to signNow savings. Understanding its requirements and process ensures that residents can benefit effectively.

-

How can I obtain the resident parking tax exemption form?

You can easily obtain the resident parking tax exemption form from your local municipality's website or office. Most municipalities provide downloadable versions of the form online for convenience. Additionally, airSlate SignNow allows you to manage and eSign these documents, streamlining the process.

-

What are the benefits of using airSlate SignNow for the resident parking tax exemption form?

Using airSlate SignNow to handle your resident parking tax exemption form offers numerous benefits, including a user-friendly interface and secure eSignature capabilities. This platform simplifies the signing process, reduces paperwork, and accelerates submission times. It's a cost-effective solution for managing essential documents.

-

Is there a fee to submit the resident parking tax exemption form?

Typically, submitting a resident parking tax exemption form itself does not incur a fee; however, some municipalities may charge a nominal application fee. It's important to check with your local government for specific details. Utilizing airSlate SignNow can help you avoid additional costs associated with paper-based submissions.

-

What features does airSlate SignNow offer for managing the resident parking tax exemption form?

airSlate SignNow offers features like customizable templates, real-time collaboration, and mobile access to manage your resident parking tax exemption form efficiently. These tools enhance accessibility and ensure that all parties can review and sign documents when needed. This results in a seamless experience for users.

-

Can I integrate airSlate SignNow with other applications for my resident parking tax exemption form?

Yes, airSlate SignNow offers integrations with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to streamline the process of handling your resident parking tax exemption form by connecting your existing workflow. Integration increases efficiency and can save you time.

-

How long does it take to process the resident parking tax exemption form?

The processing time for a resident parking tax exemption form can vary depending on the municipality, usually ranging from a few days to several weeks. By utilizing airSlate SignNow’s efficient eSignature capabilities, you can expedite your submission and potentially reduce waiting times for approval.

Get more for Nyc Parking Tax Exemption

Find out other Nyc Parking Tax Exemption

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure