Living Trust for Husband and Wife with One Child Delaware Form

What is the Living Trust For Husband And Wife With One Child Delaware

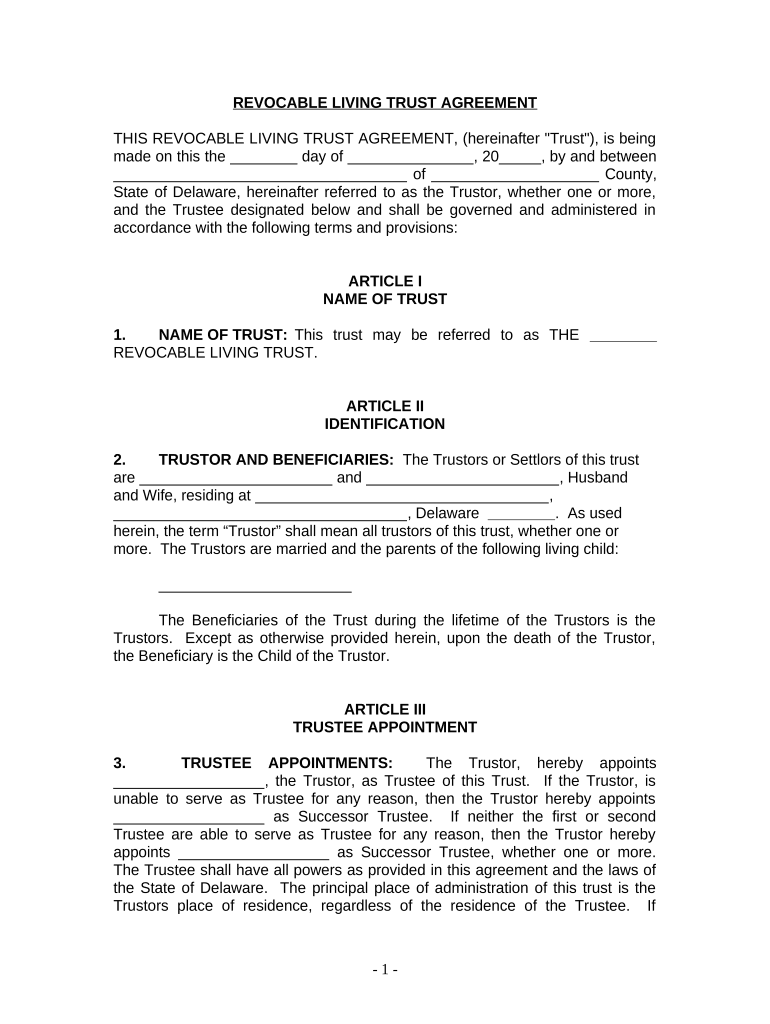

A living trust for husband and wife with one child in Delaware is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed after their passing. This type of trust can help avoid probate, ensuring a smoother transition of assets to the surviving spouse and child. It provides flexibility in managing property and can be amended or revoked as circumstances change. The trust typically includes provisions for the couple's child, ensuring that their needs are met and that assets are protected for future generations.

Key Elements of the Living Trust For Husband And Wife With One Child Delaware

Several key elements define a living trust for husband and wife with one child in Delaware:

- Trustee Designation: The couple usually serves as co-trustees, managing the trust assets while alive.

- Beneficiaries: The trust typically names the surviving spouse and child as beneficiaries, outlining how assets will be distributed upon the death of either spouse.

- Asset Management: The trust can hold various types of assets, including real estate, bank accounts, and investments, allowing for organized management.

- Distribution Instructions: Clear instructions on how and when the assets should be distributed to the child, potentially including provisions for education or other needs.

Steps to Complete the Living Trust For Husband And Wife With One Child Delaware

Creating a living trust in Delaware involves several important steps:

- Gather Information: Collect all relevant financial information, including assets, debts, and personal details.

- Choose a Trustee: Decide who will manage the trust, typically the couple themselves.

- Draft the Trust Document: Outline the terms of the trust, including beneficiaries and distribution plans.

- Sign the Document: Both spouses must sign the trust document in the presence of a notary public to ensure its legality.

- Fund the Trust: Transfer ownership of assets into the trust, which may include changing titles on property and accounts.

Legal Use of the Living Trust For Husband And Wife With One Child Delaware

The living trust serves several legal purposes in Delaware:

- Avoiding Probate: Assets held in the trust do not go through probate, allowing for quicker distribution to beneficiaries.

- Privacy: Unlike wills, which become public records, living trusts remain private, protecting family financial matters.

- Asset Protection: Trusts can provide a layer of protection against creditors and legal claims.

- Control Over Distribution: The trust can dictate specific terms for asset distribution, ensuring that the couple's wishes are honored.

State-Specific Rules for the Living Trust For Husband And Wife With One Child Delaware

Delaware has specific rules governing living trusts that couples should be aware of:

- Trust Creation: Trusts must be created in writing and signed by the grantors.

- Notarization: The trust document should be notarized to enhance its legal standing.

- Asset Transfer: Properly transferring assets into the trust is crucial for its effectiveness.

- State Laws: Familiarity with Delaware's trust laws is essential, as they may differ from other states.

How to Use the Living Trust For Husband And Wife With One Child Delaware

Using a living trust involves several ongoing responsibilities:

- Managing Assets: The trustees must manage the trust assets, ensuring they are maintained and grow in value.

- Updating the Trust: As life circumstances change, the trust may need to be updated to reflect new wishes or changes in family dynamics.

- Distributing Assets: Upon the death of a spouse, the surviving spouse must follow the trust's instructions for asset distribution to the child.

- Tax Considerations: Understanding any tax implications related to the trust is important for effective management.

Quick guide on how to complete living trust for husband and wife with one child delaware

Effortlessly Prepare Living Trust For Husband And Wife With One Child Delaware on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Living Trust For Husband And Wife With One Child Delaware on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Living Trust For Husband And Wife With One Child Delaware with Ease

- Obtain Living Trust For Husband And Wife With One Child Delaware and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant portions of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the information carefully and click the Done button to save your changes.

- Select how you wish to share your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Edit and electronically sign Living Trust For Husband And Wife With One Child Delaware to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child Delaware?

A Living Trust For Husband And Wife With One Child Delaware is a legal document that allows couples to manage their assets during their lifetime and specify how those assets will be distributed upon their death. This type of trust helps avoid probate, ensuring a smoother transition of assets to your child while minimizing legal hurdles.

-

How much does a Living Trust For Husband And Wife With One Child Delaware cost?

The cost of setting up a Living Trust For Husband And Wife With One Child Delaware can vary based on your needs and the complexity of your estate. Generally, prices range from several hundred to a few thousand dollars. It's best to consult with a legal expert who specializes in Delaware estate planning for a tailored quote.

-

What are the main benefits of establishing a Living Trust For Husband And Wife With One Child Delaware?

A Living Trust For Husband And Wife With One Child Delaware offers several benefits, including avoiding probate, reducing estate taxes, and maintaining privacy regarding your financial matters. Additionally, it provides a clear plan for asset distribution, ensuring that your child is taken care of according to your wishes.

-

Can I modify my Living Trust For Husband And Wife With One Child Delaware?

Yes, a Living Trust For Husband And Wife With One Child Delaware is revocable, meaning you can make changes to it during your lifetime. This flexibility allows you to update beneficiaries or asset allocations as your family situation or financial circumstances change.

-

How does a Living Trust For Husband And Wife With One Child Delaware integrate with e-signature tools?

airSlate SignNow can facilitate the creation and signing of your Living Trust For Husband And Wife With One Child Delaware by allowing you and your spouse to e-sign documents securely. This integration streamlines the process, reducing the time and effort needed to manage your estate planning documents.

-

Is a Living Trust For Husband And Wife With One Child Delaware necessary if I have a will?

While having a will is important, a Living Trust For Husband And Wife With One Child Delaware can provide additional protection and streamline the transfer of assets to your child. A trust helps bypass probate, ensuring quicker access to your estate and more privacy than a will typically provides.

-

What assets can I include in my Living Trust For Husband And Wife With One Child Delaware?

You can include various assets in your Living Trust For Husband And Wife With One Child Delaware, such as real estate, bank accounts, investments, and personal property. It’s essential to properly title these assets to ensure they are managed according to your trust's directives.

Get more for Living Trust For Husband And Wife With One Child Delaware

Find out other Living Trust For Husband And Wife With One Child Delaware

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure