Delaware Installments Fixed Rate Promissory Note Secured by Commercial Real Estate Delaware Form

What is the Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware

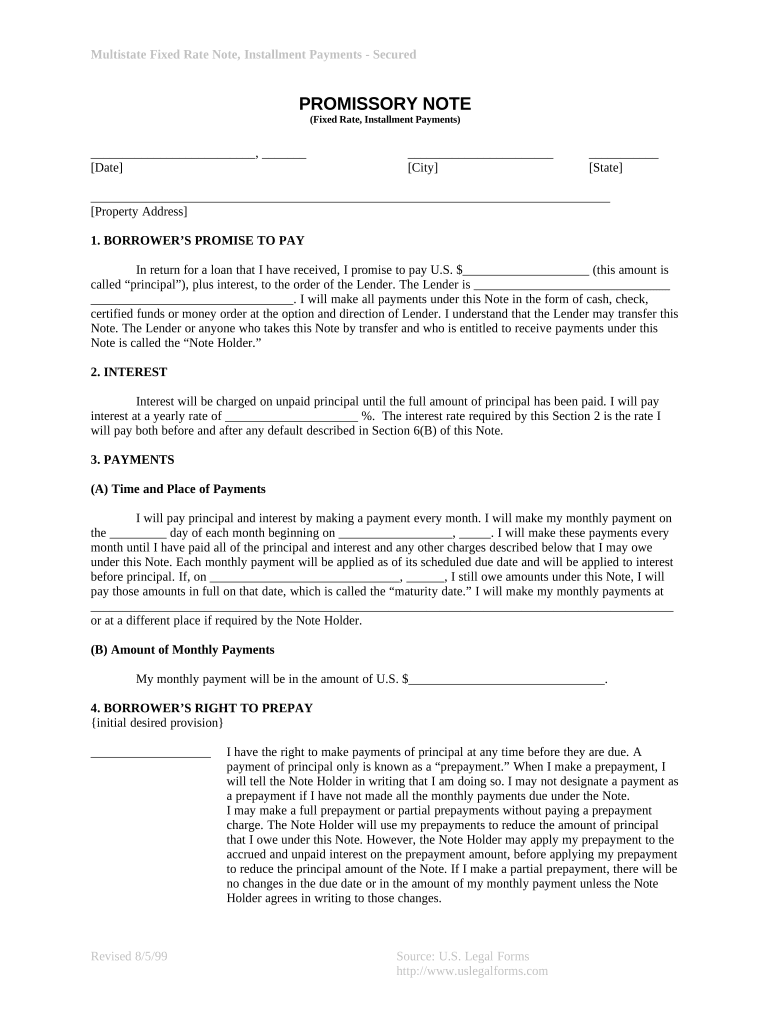

The Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate is a legal document that outlines the terms of a loan secured by commercial property. This note specifies the repayment schedule, interest rate, and the obligations of both the borrower and the lender. It is commonly used in real estate transactions where financing is required for property acquisition or development. The security provided by the commercial real estate ensures that the lender has a claim to the property in the event of default, making it a crucial instrument in real estate financing.

Steps to Complete the Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware

Completing the Delaware Installments Fixed Rate Promissory Note involves several important steps:

- Gather necessary information: Collect details about the borrower, lender, loan amount, interest rate, and repayment terms.

- Draft the document: Use a template or legal software to create the promissory note, ensuring all relevant terms are included.

- Review legal requirements: Ensure compliance with Delaware state laws regarding promissory notes and secured transactions.

- Obtain signatures: Both parties must sign the document, and it is advisable to have the signatures notarized for added legal protection.

- File or record the note: Depending on the transaction, you may need to file the note with the appropriate county office to protect the lender's interest.

Key Elements of the Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware

Several key elements must be included in the Delaware Installments Fixed Rate Promissory Note to ensure its effectiveness:

- Loan amount: Clearly state the principal amount being borrowed.

- Interest rate: Specify the fixed interest rate applicable to the loan.

- Repayment schedule: Outline the frequency of payments (monthly, quarterly, etc.) and the duration of the loan.

- Default provisions: Include terms that define what constitutes a default and the lender's rights in such cases.

- Security description: Provide details about the commercial real estate securing the loan, including its legal description.

Legal Use of the Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware

The legal use of this promissory note is governed by both state and federal laws. It serves as a binding agreement between the borrower and lender, ensuring that both parties understand their rights and obligations. To be legally enforceable, the note must comply with the Uniform Commercial Code (UCC) and any specific Delaware statutes related to secured transactions. Proper execution, including signatures and notarization, is essential for the document to hold up in court if disputes arise.

How to Use the Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware

Using the Delaware Installments Fixed Rate Promissory Note effectively involves understanding its purpose and following the correct procedures:

- Determine the need: Assess whether a promissory note is necessary for your real estate transaction.

- Consult legal advice: It is advisable to seek legal counsel to ensure that the note meets all legal requirements and adequately protects your interests.

- Complete the document: Fill in all required information accurately and clearly to avoid misunderstandings.

- Execute the note: Ensure both parties sign the document in the presence of a notary.

- Maintain records: Keep copies of the signed note and any related documents for your records.

Quick guide on how to complete delaware installments fixed rate promissory note secured by commercial real estate delaware

Complete Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware effortlessly on any device

Managing documents online has surged in popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and secure it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Process Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

The simplest way to modify and electronically sign Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware with ease

- Locate Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware and click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to mislaid or lost documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware?

A Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware is a legal financial document that outlines a borrower's promise to repay a specified amount over time, secured by commercial real estate. This type of note provides investors with fixed interest payments and security in the underlying real estate asset.

-

What are the benefits of using a Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware?

Using a Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware offers numerous benefits, including predictable cash flow and the security of tangible assets. It allows borrowers to access funds while providing lenders with a reliable investment option, potentially yielding higher returns compared to other financial instruments.

-

How is the interest rate determined for a Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware?

The interest rate for a Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware is typically determined based on various factors, including current market conditions, the risk level of the investment, and the financial health of the borrower. Lenders often consider comparable rates for similar notes to set a competitive yet fair interest rate.

-

What features should I look for in a Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware?

When evaluating a Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware, important features to consider include the terms of repayment, interest rate, payment frequency, and collateral details. Additionally, ensure the note includes a clear default clause to protect your investment in case of non-payment.

-

How can I integrate a Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware in my business?

Integrating a Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware into your business involves drafting the note in accordance with legal standards and ensuring proper documentation. You can also utilize platforms like airSlate SignNow for seamless eSigning and document management, making the process efficient and secure.

-

What are the potential risks associated with a Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware?

While a Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware can be a solid investment, there are potential risks involved, such as borrower default or fluctuations in property value. Conduct thorough due diligence on the borrower and the underlying property to mitigate these risks effectively.

-

Are there any specific regulations governing Delaware Installments Fixed Rate Promissory Notes?

Yes, Delaware Installments Fixed Rate Promissory Notes are subject to both federal and state regulations that govern lending practices, borrower rights, and disclosure requirements. It is essential to be aware of these regulations and consult with a legal professional to ensure compliance when creating such notes.

Get more for Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware

Find out other Delaware Installments Fixed Rate Promissory Note Secured By Commercial Real Estate Delaware

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter