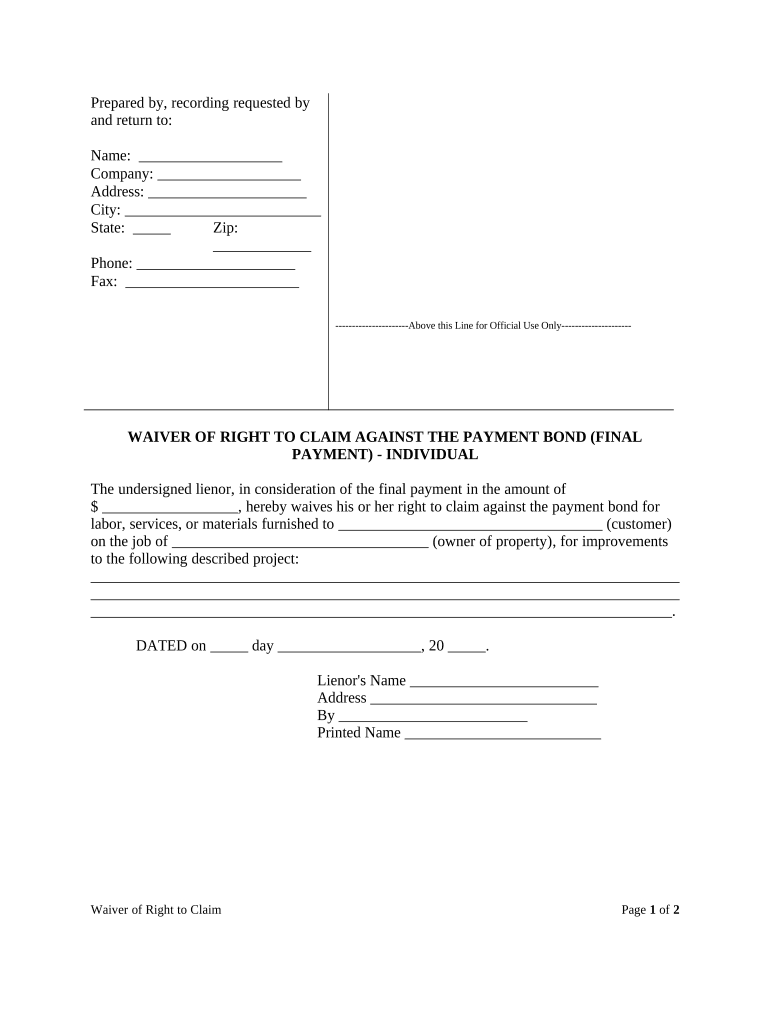

Claim Payment Bond Form

What is the Claim Payment Bond

A claim payment bond is a type of surety bond that guarantees payment to subcontractors, suppliers, and laborers in the event that a contractor fails to fulfill their financial obligations on a project. This bond serves as a financial safety net, ensuring that all parties involved in a construction contract are protected against non-payment. The bond is typically required for public construction projects, providing assurance to project owners that funds will be available to cover costs associated with claims made by unpaid parties.

How to Use the Claim Payment Bond

Using a claim payment bond involves several steps. First, the contractor must obtain the bond from a surety company, which evaluates the contractor's creditworthiness and business history. Once secured, the bond is submitted to the project owner or relevant authority as part of the contract documentation. If a claim arises, the affected party can file a claim against the bond, seeking compensation for unpaid amounts. The surety company then investigates the claim and, if valid, pays the claimant, ensuring that the contractor is held accountable for their obligations.

Steps to Complete the Claim Payment Bond

Completing a claim payment bond requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including the project details, contractor's business information, and the names of all parties involved.

- Contact a surety company to initiate the bonding process and provide the required documentation.

- Complete the bond application, ensuring all information is accurate and up-to-date.

- Review the bond terms and conditions before signing to ensure understanding of obligations and rights.

- Submit the completed bond to the project owner or relevant authority as part of the contract requirements.

Legal Use of the Claim Payment Bond

The legal use of a claim payment bond is governed by state laws and regulations. In the United States, each state has specific requirements regarding the bonding process, including the amount of the bond and the types of projects that require it. It is essential for contractors to understand these legalities to ensure compliance. Failure to secure a claim payment bond when required can result in penalties, including disqualification from bidding on public projects.

Key Elements of the Claim Payment Bond

Several key elements define a claim payment bond, including:

- Principal: The contractor who purchases the bond and is responsible for fulfilling the contract.

- Obligee: The project owner or authority requiring the bond as a guarantee of payment.

- Surety: The company that issues the bond and guarantees payment to the obligee in case of a claim.

- Bond Amount: The total amount of coverage provided by the bond, which is typically a percentage of the contract value.

Examples of Using the Claim Payment Bond

Claim payment bonds are commonly used in various construction scenarios. For instance, a general contractor working on a public school project may be required to secure a bond to protect subcontractors and suppliers. If a subcontractor is not paid for their work, they can file a claim against the bond. Another example includes a contractor working on a government infrastructure project, where the bond ensures that all laborers and material suppliers receive payment, safeguarding the interests of all parties involved.

Quick guide on how to complete claim payment bond

Easily Prepare Claim Payment Bond on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your files promptly, without any delays. Manage Claim Payment Bond on any device with airSlate SignNow's Android or iOS applications, and enhance your document-driven processes today.

How to Modify and Electronically Sign Claim Payment Bond with Ease

- Obtain Claim Payment Bond and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight relevant sections of your documents or obscure sensitive information using the tools specifically designed for that purpose provided by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Claim Payment Bond and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a claim payment bond?

A claim payment bond is a type of surety bond that ensures that a contractor will fulfill its obligations to pay for labor and materials used in a construction project. In case of a claim, this bond protects the project owner from financial loss. Understanding how to manage and claim your payment bond can save you signNow costs in the long run.

-

How can airSlate SignNow help with claim payment bond documentation?

airSlate SignNow simplifies the process of managing and signing crucial documents related to claim payment bonds. With our eSigning solution, you can quickly send, sign, and store all necessary paperwork securely and efficiently. This helps to streamline your workflow and reduce the risks associated with paperwork errors.

-

What are the benefits of using airSlate SignNow for claim payment bond agreements?

Using airSlate SignNow for your claim payment bond agreements provides numerous benefits, including faster document turnaround times and reduced administrative overhead. Our user-friendly platform ensures that all parties can easily understand and sign documents, minimizing delays in the bonding process. You'll also enjoy enhanced security features that protect your sensitive information.

-

What features does airSlate SignNow offer for claim payment bond management?

airSlate SignNow offers various features tailored for claim payment bond management, such as customizable templates, real-time tracking, and audit trails. These functionalities ensure that you can quickly access and manage your bond documents, keeping you organized throughout your project lifecycle. The platform also allows seamless collaboration among stakeholders.

-

Is airSlate SignNow cost-effective for managing claim payment bonds?

Yes, airSlate SignNow is a cost-effective solution for managing claim payment bonds. Our competitive pricing models allow businesses of all sizes to take advantage of our premium eSigning services without breaking the bank. By streamlining document management, you can ultimately reduce your overhead costs and improve your bottom line.

-

Can airSlate SignNow integrate with other tools for claim payment bond processing?

Absolutely! airSlate SignNow can integrate with various tools and platforms to streamline your claim payment bond processing. From CRM systems to project management software, these integrations enhance your workflow and ensure a smooth transition between different processes. You can easily connect your existing tools with our platform for maximum efficiency.

-

How does eSigning a claim payment bond reduce the risk of disputes?

eSigning a claim payment bond through airSlate SignNow minimizes the risk of disputes by providing a clear, verifiable record of all signatures and actions taken on the document. This transparency ensures that all parties are held accountable, reducing misunderstandings or disagreements. Our platform also includes features like timestamps and audit trails to further enhance document integrity.

Get more for Claim Payment Bond

Find out other Claim Payment Bond

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document