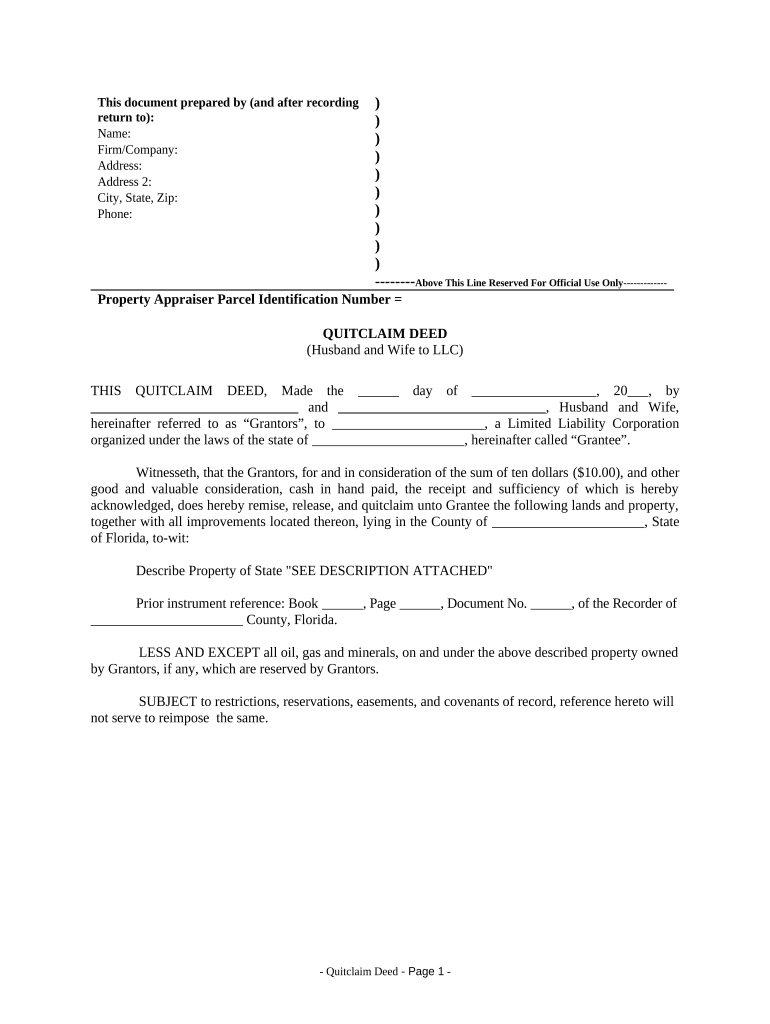

Florida Husband Llc Form

What is the Florida Husband LLC?

The Florida Husband LLC is a specific type of limited liability company designed to provide legal protection and operational flexibility for business owners in Florida. This entity structure allows husbands to manage business activities while limiting personal liability. By forming an LLC, individuals can separate their personal assets from business debts and obligations, which is essential for financial security. The Florida Husband LLC is particularly beneficial for couples who wish to collaborate in business ventures while ensuring legal protection.

How to use the Florida Husband LLC

Utilizing the Florida Husband LLC involves several key steps that ensure compliance with state regulations. First, it is essential to choose a unique name for the LLC that adheres to Florida naming guidelines. Next, the Articles of Organization must be filed with the Florida Division of Corporations, which formalizes the creation of the LLC. Once established, the owners can operate the business, manage finances, and enter contracts while enjoying limited liability protection. It is advisable to maintain proper records and follow best practices for managing the LLC to ensure ongoing compliance.

Steps to complete the Florida Husband LLC

Completing the Florida Husband LLC involves a systematic approach:

- Choose a unique name that complies with Florida regulations.

- Designate a registered agent responsible for receiving legal documents.

- File the Articles of Organization with the Florida Division of Corporations.

- Create an operating agreement outlining the management structure and operational procedures.

- Obtain any necessary licenses or permits required for your specific business activities.

Legal use of the Florida Husband LLC

The legal use of the Florida Husband LLC is governed by state laws that dictate how LLCs must operate. This includes adhering to the requirements for filing annual reports and maintaining good standing with the state. Additionally, the LLC must comply with federal tax regulations and any applicable local laws. Proper legal use ensures that the LLC maintains its limited liability status, protecting personal assets from business liabilities.

Key elements of the Florida Husband LLC

Key elements of the Florida Husband LLC include:

- Limited Liability Protection: Owners are not personally liable for business debts.

- Pass-Through Taxation: Income is reported on the owners' personal tax returns, avoiding double taxation.

- Flexible Management Structure: Owners can choose how to manage the LLC, whether by themselves or appointing managers.

- Compliance Requirements: Regular filings and adherence to state regulations are necessary to maintain the LLC's status.

State-specific rules for the Florida Husband LLC

Florida has specific rules that govern the formation and operation of LLCs. These include the requirement to file Articles of Organization, pay a filing fee, and submit an annual report to the state. Additionally, Florida law mandates that the LLC must maintain a registered agent with a physical address in the state. Understanding these rules is crucial for ensuring that the Florida Husband LLC operates legally and efficiently.

Quick guide on how to complete florida husband llc

Complete Florida Husband Llc effortlessly on any device

Managing documents online has become a favorite among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Florida Husband Llc on any platform with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to edit and eSign Florida Husband Llc effortlessly

- Obtain Florida Husband Llc and select Get Form to begin.

- Use the tools we provide to finalize your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your desktop.

Eliminate concerns over missing or lost documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Florida Husband Llc and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Florida husband LLC and how does it work?

A Florida husband LLC, or Limited Liability Company, is a business structure that protects personal assets from business liabilities. This type of LLC is specifically beneficial for married couples looking to operate a joint business venture. By forming a Florida husband LLC, couples can enjoy flexibility in management and favorable tax treatment.

-

What are the benefits of forming a Florida husband LLC?

The benefits of establishing a Florida husband LLC include personal liability protection, tax advantages, and enhanced credibility with clients. This structure allows spouses to combine their resources and efforts, leading to a more streamlined business operation. Efficient management and ease of decision-making are additional advantages of opting for this model.

-

How much does it cost to set up a Florida husband LLC?

The cost to set up a Florida husband LLC varies, ranging from state fees to additional expenses for legal assistance if needed. Basic state filing fees generally start around $125, but you should factor in costs like name reservations and operating agreements. Overall, it's a cost-effective method compared to other business structures.

-

What documents are required to register a Florida husband LLC?

To register a Florida husband LLC, you typically need to file Articles of Organization with the Florida Division of Corporations. Additionally, an operating agreement is highly recommended to outline the management and financial arrangements between spouses. Ensuring you have all necessary documents will streamline the registration process.

-

Are there any tax implications for a Florida husband LLC?

Yes, a Florida husband LLC benefits from pass-through taxation, meaning the business's profits are reported on the owners' personal tax returns, avoiding double taxation. This structure allows for more manageable tax obligations, especially for married couples. Consulting with a tax professional can provide tailored advice on maximizing your tax benefits.

-

Can I use airSlate SignNow with my Florida husband LLC?

Absolutely! airSlate SignNow is fully compatible for use with your Florida husband LLC, making it easy to send and eSign documents online. Our platform streamlines the document signing process, enhancing operational efficiency for your business. Integrating airSlate SignNow into your LLC's workflow will simplify communication and contract management.

-

What features does airSlate SignNow offer for Florida husband LLCs?

airSlate SignNow offers a variety of features tailored for Florida husband LLCs, including document templates, reminders, and customizable workflows. These tools help you manage signatures and documentation more effectively. Additionally, our robust analytics will allow you to track document status in real-time.

Get more for Florida Husband Llc

- Pearls of wisdom oregon public health association form

- Uline application form pdf

- Motivation assessment scale 395300766 form

- Human form human function essentials of anatomy physiology pdf

- Frankenstein philip pullman read online form

- Certificate of embracing islam form

- Roofing invoice for insurance form

- Gmac atpi form

Find out other Florida Husband Llc

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer