Schedule E Form 990 Schools 2023-2026

Understanding the Schedule E Form 990 for Schools

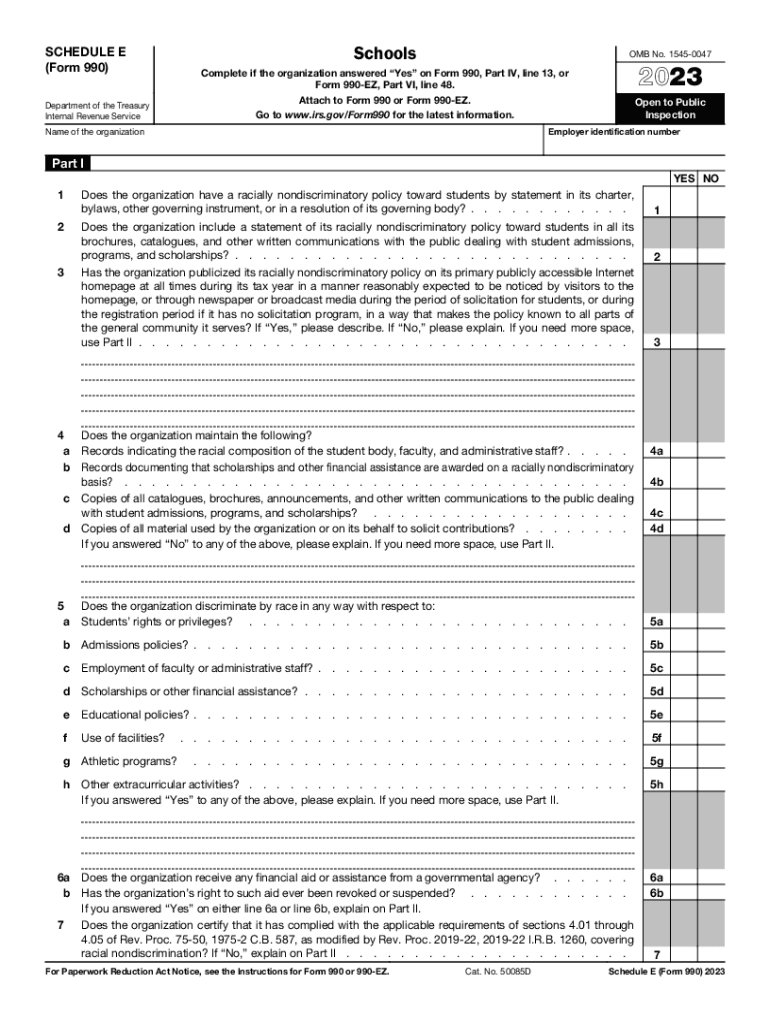

The Schedule E Form 990 is a crucial document for educational institutions in the United States. It is part of the IRS Form 990, which tax-exempt organizations must file annually. This specific schedule provides detailed information about the school’s activities, including the types of programs offered, the number of students served, and the sources of funding. Understanding this form is essential for compliance with federal regulations and for maintaining tax-exempt status.

How to Complete the Schedule E Form 990

Filling out the Schedule E Form 990 involves several steps. First, gather all necessary information about the school’s programs and financial data. This includes details on student enrollment, funding sources, and program expenses. Next, follow the IRS guidelines to accurately report this information on the form. It is important to ensure that all data is complete and accurate, as discrepancies can lead to penalties or issues with tax-exempt status.

Key Elements of the Schedule E Form 990

The Schedule E Form 990 includes several key components that must be addressed. These elements typically encompass:

- Program Information: A description of the educational programs offered.

- Enrollment Data: The number of students enrolled in each program.

- Funding Sources: Details on how the programs are financed, including grants and donations.

- Expenditures: A breakdown of costs associated with running the programs.

Accurate reporting of these elements is essential for transparency and compliance with IRS requirements.

Filing Deadlines for the Schedule E Form 990

Timely submission of the Schedule E Form 990 is critical to avoid penalties. The form is typically due on the 15th day of the fifth month after the end of the school’s fiscal year. For example, if the fiscal year ends on June 30, the form would be due on November 15. Schools can apply for an extension if necessary, but it is important to adhere to the deadlines to maintain compliance with IRS regulations.

Obtaining the Schedule E Form 990

The Schedule E Form 990 can be obtained directly from the IRS website or through tax preparation software that supports IRS forms. Schools should ensure they are using the most current version of the form to avoid any issues during filing. It is advisable to consult with a tax professional if there are any uncertainties regarding the form or the information required.

Legal Use of the Schedule E Form 990

Using the Schedule E Form 990 legally involves understanding its purpose and the requirements set forth by the IRS. This form is intended for tax-exempt educational organizations to report their financial activities and compliance with federal tax laws. Misuse of the form, such as providing false information or failing to file, can result in serious legal consequences, including loss of tax-exempt status.

Quick guide on how to complete schedule e form 990 schools

Accomplish Schedule E Form 990 Schools effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the features necessary to create, alter, and eSign your documents swiftly and without hurdles. Manage Schedule E Form 990 Schools on any device using airSlate SignNow apps for Android or iOS and enhance any document-centric task today.

The most efficient way to modify and eSign Schedule E Form 990 Schools with ease

- Find Schedule E Form 990 Schools and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Illuminate key sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule E Form 990 Schools to guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule e form 990 schools

Create this form in 5 minutes!

How to create an eSignature for the schedule e form 990 schools

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 990 Schedule E?

Form 990 Schedule E is a supplemental schedule used by tax-exempt organizations to report information about their professional fundraising services. This form helps organizations disclose the details surrounding the revenue generated through fundraising activities, ensuring transparency and compliance with IRS regulations.

-

How can airSlate SignNow help with submitting Form 990 Schedule E?

airSlate SignNow provides a streamlined process to eSign and submit Form 990 Schedule E quickly and securely. With its user-friendly interface, businesses can efficiently manage their documents and ensure that all necessary signatures are collected before filing.

-

Is there a cost associated with using airSlate SignNow for Form 990 Schedule E?

Yes, airSlate SignNow offers various pricing plans that cater to different organizational needs. These plans are designed to be cost-effective, allowing businesses to choose the package that best fits their budgeting requirements for handling forms like Form 990 Schedule E.

-

What features does airSlate SignNow offer for completing Form 990 Schedule E?

airSlate SignNow includes various features to assist in completing Form 990 Schedule E, such as template creation, document editing, and real-time collaboration. These tools enable organizations to work together efficiently and ensure that all information is correctly filled out before submission.

-

Can I integrate airSlate SignNow with other software for Form 990 Schedule E?

Absolutely! airSlate SignNow offers integrations with numerous software applications that can enhance your workflow for managing Form 990 Schedule E. This connectivity allows businesses to synchronize data and streamline their document processing experience seamlessly.

-

What are the benefits of using airSlate SignNow for Form 990 Schedule E?

Using airSlate SignNow for Form 990 Schedule E provides several advantages, including faster document turnaround, improved compliance, and enhanced security features. It allows organizations to manage their paperwork efficiently while minimizing the risk of errors during the filing process.

-

Is airSlate SignNow user-friendly for those unfamiliar with Form 990 Schedule E?

Yes, airSlate SignNow is designed to be user-friendly, even for individuals who are not familiar with Form 990 Schedule E. The platform offers intuitive navigation and helpful resources, ensuring that users can easily understand and complete their documentation.

Get more for Schedule E Form 990 Schools

Find out other Schedule E Form 990 Schools

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter