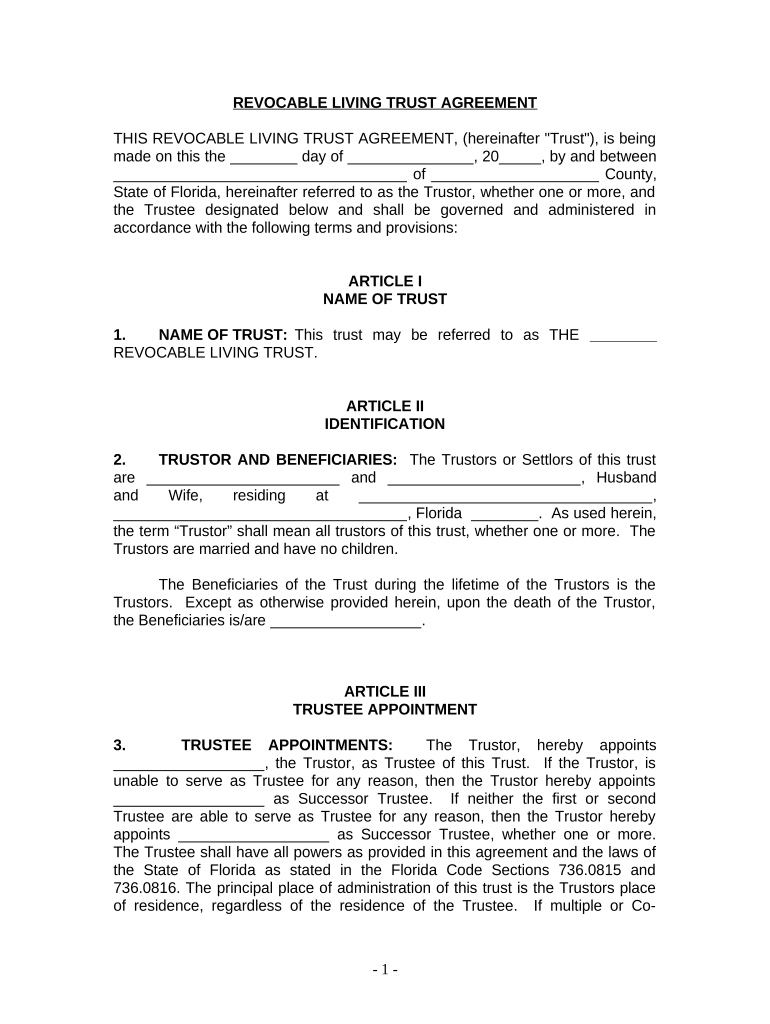

Living Trust Florida Form

What is the Living Trust Florida

A living trust in Florida is a legal document that allows individuals to manage their assets during their lifetime and dictate how those assets will be distributed after their death. It is designed to avoid the probate process, which can be time-consuming and costly. By establishing a living trust, the grantor retains control over their assets and can make changes as needed while they are alive. Upon their passing, the assets in the trust can be transferred to beneficiaries without the need for court intervention.

How to use the Living Trust Florida

To effectively use a living trust in Florida, individuals should first identify the assets they wish to include in the trust. This may include real estate, bank accounts, investments, and personal property. Once the assets are identified, the next step is to create the trust document, which outlines the terms of the trust, including the trustee, beneficiaries, and distribution instructions. After the trust is established, it is essential to transfer ownership of the identified assets into the trust. This process ensures that the assets are managed according to the grantor's wishes and are protected from probate.

Steps to complete the Living Trust Florida

Completing a living trust in Florida involves several key steps:

- Determine your assets: List all assets you want to include in the trust.

- Choose a trustee: Select a reliable individual or institution to manage the trust.

- Create the trust document: Draft the living trust document, detailing the terms and conditions.

- Transfer assets: Legally transfer ownership of your assets into the trust.

- Review and update: Regularly review the trust to ensure it reflects your current wishes and circumstances.

Key elements of the Living Trust Florida

Several key elements define a living trust in Florida:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust and its assets.

- Beneficiaries: Individuals or entities designated to receive the trust assets upon the grantor's death.

- Trust document: The formal document that outlines the terms and conditions of the trust.

- Revocability: Most living trusts are revocable, meaning the grantor can alter or dissolve the trust at any time during their lifetime.

State-specific rules for the Living Trust Florida

Florida has specific rules governing living trusts that individuals should be aware of. For instance, the trust must be in writing and signed by the grantor. Additionally, Florida law allows for both revocable and irrevocable trusts, with revocable trusts being more common due to their flexibility. It is also important to note that while living trusts can help avoid probate, they do not provide protection from creditors. Understanding these state-specific regulations is crucial for effective estate planning.

Legal use of the Living Trust Florida

The legal use of a living trust in Florida involves ensuring that the trust complies with state laws and serves its intended purpose. This includes properly drafting the trust document, transferring assets into the trust, and designating appropriate trustees and beneficiaries. A living trust can be an effective tool for managing assets, minimizing estate taxes, and ensuring a smooth transition of wealth to heirs. Consulting with an attorney experienced in estate planning can help ensure that the trust is legally sound and meets the grantor's objectives.

Quick guide on how to complete living trust florida

Effortlessly Prepare Living Trust Florida on Any Device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Manage Living Trust Florida on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign Living Trust Florida effortlessly

- Find Living Trust Florida and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form navigation, or errors that necessitate printing new document versions. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign Living Trust Florida and guarantee outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a living trust in Florida?

A living trust in Florida is a legal document that allows you to manage your assets during your lifetime and dictates how they will be distributed after your death. It offers flexibility and can help avoid probate, ensuring a smoother transition of assets to your beneficiaries.

-

How can a living trust benefit me in Florida?

Establishing a living trust in Florida provides several benefits, including asset management during incapacity, privacy for your estate, and avoidance of lengthy probate processes. It allows you to designate trustees to manage your assets, offering peace of mind for you and your family.

-

What are the costs associated with creating a living trust in Florida?

The costs for setting up a living trust in Florida can vary depending on the complexity of your estate and whether you choose to work with an attorney or use online services. Generally, you may expect to invest in legal fees, document preparation, and possible filing fees, but the investment can save you money in the long run by avoiding probate.

-

Can I modify or revoke my living trust in Florida?

Yes, one of the main advantages of a living trust in Florida is that it can be easily modified or revoked. As long as you are competent, you can change the terms of your trust or dissolve it altogether to adapt to any changes in your life circumstances.

-

What assets can I include in my living trust in Florida?

You can include various types of assets in your living trust in Florida, such as real estate, bank accounts, investments, and personal property. However, it's important to ensure that all assets are properly titled in the name of the trust to prevent them from going through probate.

-

Do I need an attorney to create a living trust in Florida?

While it's possible to create a living trust in Florida without an attorney using online platforms, having legal assistance can ensure that your trust meets all requirements and accurately reflects your wishes. A knowledgeable attorney can also provide valuable insights on asset management and tax implications.

-

What is the difference between a living trust and a will in Florida?

A living trust in Florida allows for the management of your assets during your lifetime and provides for their distribution after death, avoiding probate. In contrast, a will only takes effect after your death and typically requires probate, which can be a public process and may delay asset distribution.

Get more for Living Trust Florida

- Ipro fall tracking tool form

- Mass ltc change of address form

- Notarized statement of non ownership form

- Product classification form

- Defensive driving school workbook answers form

- Lymphedema measurement chart pdf form

- 120120 ccg 0613 anotice of filingin the circui form

- Construction company contract template form

Find out other Living Trust Florida

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation