Taxable Social Security Worksheet Fillable Form

What is the Taxable Social Security Worksheet Fillable Form

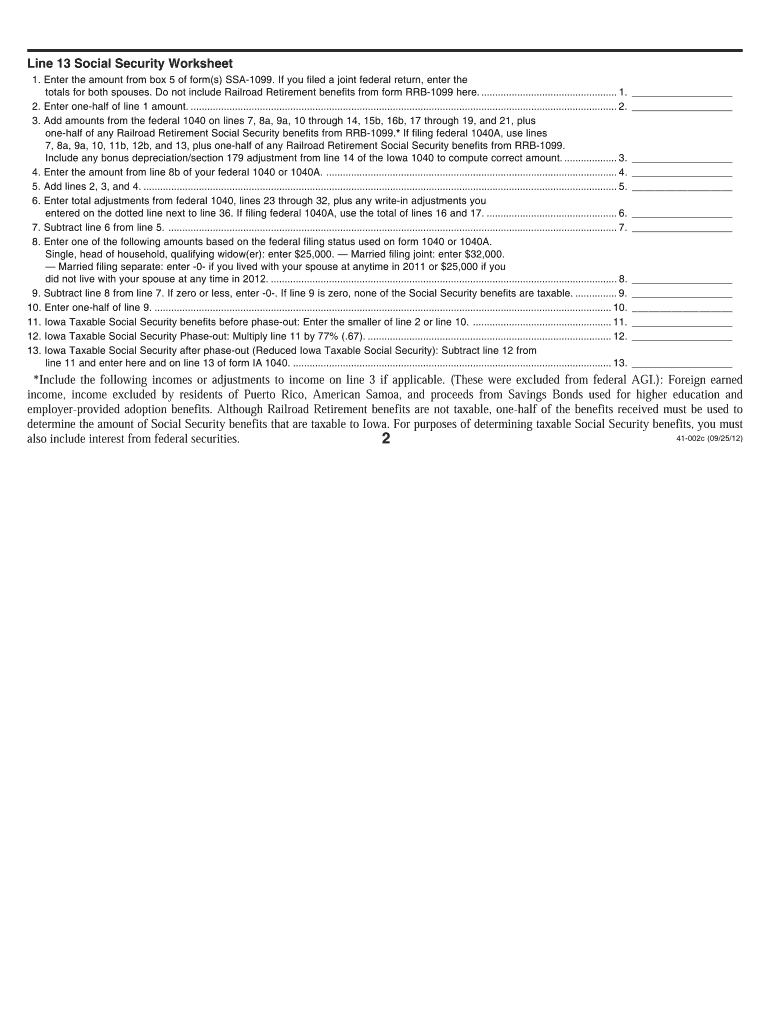

The Taxable Social Security Worksheet for 2023 is a crucial document used by taxpayers to determine the amount of their Social Security benefits that are subject to federal income tax. This worksheet helps individuals calculate their taxable benefits based on their total income and filing status. It is particularly important for retirees and individuals receiving Social Security benefits, as it ensures compliance with IRS regulations regarding taxable income. Understanding this form is essential for accurate tax reporting and can help prevent potential penalties associated with underreporting income.

How to use the Taxable Social Security Worksheet Fillable Form

Using the Taxable Social Security Worksheet for 2023 involves several steps. First, gather all necessary financial documents, including your total Social Security benefits and other income sources. Next, follow the instructions provided on the worksheet to input your information accurately. The form will guide you through calculating your combined income, which includes your adjusted gross income, tax-exempt interest, and half of your Social Security benefits. By completing this worksheet, you can determine how much of your Social Security benefits will be taxable and report this amount on your federal tax return.

Steps to complete the Taxable Social Security Worksheet Fillable Form

Completing the Taxable Social Security Worksheet involves a series of straightforward steps:

- Step One: Write down your total Social Security benefits received for the year.

- Step Two: Gather your other sources of income, including wages, pensions, and interest.

- Step Three: Calculate your combined income by adding your total income and half of your Social Security benefits.

- Step Four: Refer to the IRS guidelines to determine the taxability of your Social Security benefits based on your filing status and combined income.

- Step Five: Record the amount of taxable benefits on your tax return.

Legal use of the Taxable Social Security Worksheet Fillable Form

The Taxable Social Security Worksheet for 2023 must be used in accordance with IRS regulations to ensure legal compliance. It is important to fill out the form accurately and retain it for your records, as it may be required in case of an audit. The IRS mandates that taxpayers report their income correctly, including any taxable Social Security benefits. Failure to do so can result in penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of this worksheet is essential for every taxpayer receiving Social Security benefits.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of Social Security benefits and their taxability. According to IRS Publication 915, taxpayers must report their Social Security benefits if their combined income exceeds certain thresholds. The worksheet assists in determining these thresholds and calculating the correct taxable amount. It is advisable to refer to the latest IRS publications and updates to ensure compliance with current tax laws and regulations. Staying informed about IRS guidelines can help taxpayers avoid mistakes that could lead to financial penalties.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines when using the Taxable Social Security Worksheet for 2023. The federal tax return filing deadline is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers may need to consider deadlines for estimated tax payments if they expect to owe taxes on their Social Security benefits. Keeping track of these dates is vital to ensure timely filing and avoid penalties associated with late submissions.

Quick guide on how to complete taxable social security worksheet 2012 fillable form

Prepare Taxable Social Security Worksheet Fillable Form seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing easy access to the correct forms and secure online storage. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Taxable Social Security Worksheet Fillable Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Taxable Social Security Worksheet Fillable Form effortlessly

- Locate Taxable Social Security Worksheet Fillable Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive details using tools specifically designed for that by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Edit and electronically sign Taxable Social Security Worksheet Fillable Form and ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

Is there a way for you to outsource sensitive tasks securely? For instance, calling the bank, or filling out a loan application form that includes your social security number?

You might benefit from compartmentalizing your sensitive information. Realtors often use custom-purpose sticky notes to help people navigate paperwork, like a little yellow arrow that says “signNow” or a blue flag that says “review these options.” Perhaps your assistant could fill out the entire form for you, except where your SSN needs to be provided, and call those lines out to you with a little sticky arrow.When calling the bank, you may have to initiate the call and then allow your assistant to take over. That way, you’d provide the sensitive data to the bank and satisfy their identity verification, then you’d authorize your assistant to speak on your behalf about the account, and let them take it from there.If you have any tasks that require sensitive data to actually conduct the business - say, moving funds between several bank accounts, which would require constant access to account numbers and other info - then you’ll have to give that task to someone you trust with that info. If you’re the only one you trust, you’re the only one who can do the task.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

I am retired and living in the Czech Republic. My social security check is transferred to a local bank. They asked me to fill out a form W-9. I am not working, not having business or any kind of additional income. Do l need to file it?

Under FATCA, the Czech government has signed a treaty with the U.S. government where they agree to have financial institutions document whether or not U.S. citizens are account holders (and therefore, they pretty much have to document all account holders). So, if you do not fill out the W-9, the bank will have to close your account as you will not have provided sufficient evidence to document whether or not you are a U.S. citizen. Countries have been signing the treaties and starting to implement over the last couple of years - portions of the Czech treaty become effective in 2014.

-

Is it legal for doctors offices to charge special fees for filling out residual function forms and other questionnaires specifically used by lawyers and judges to determine a Social Security disability action?

I’m answering as though to a lawyer.Doctors are private professionals governed by their medical association ethical standards and state law, not social security law. They can charge. I’ve had doctors say their charges would be anywhere from $200 to $500. Then you have to make the decision whether to foot the bill. When I have done that my clients have not reimbursed me, with the exception of 1 or 2.On the other hand, if you are at the federal court level, you can pay and if you win, the Court will order expenses paid under EAJA. To set up for this, ask in writing for the ALJ to pay the cost of the opinion. State that it is necessary development and identify the undeveloped part of the record that could be completed with admission of the doctor’s opinion.On appeal, one of the issues is: was failure to develop error and - was it harmful error? To show harmful error, you submit the doctor’s opinion that you have now paid for, and argue this is what would have been in the record, had the ALJ properly developed the record as specifically requested by you, the lawyer.

-

Social Security is funded by money taken out of every paycheck for American's in the form of Federal withholding. So how can Mitch McConnell say Social Security is to expensive and needs to be cut when the government doesn't fund it the people do?

Social security benefits are funded both by payroll tax deductions and by the the Social Security Trust fund. When more money comes in through taxes than is paid out in benefits, the Fund grows. The Trust Fund (the combined OASDI Trust Funds total reserve is $2.89 trillion at the end of the year 2017) is invested in US Government securities that pay interest, a lot of interest. Social Security ran a surplus of $35 billion in 2017 and projects a surplus of $44 billion this year, 2018; however, long term projections based on the number of workers and the number of people signNowing retirement age, are that the surplus will turn to a deficit, relatively soon.If this drain went unchecked, eventually the Trust Fund would go to zero and there wouldn’t be enough money to pay social security benefits. SSA currently projects that depletion of the fund will occur in 2034.[1]Several small adjustments can be made now to fix the problem, such as raising the ceiling on income that is taxable, increasing the tax rate, lowering the social security cost of living adjustments, and raising the retirement age.The important thing in this discussion is that today the fix is easy because the Trust Fund is huge and earns lots of interest. If the Fund is starts to be depleted, that interest goes away and the amount of money to make up is vastly greater.Footnotes[1] Summary: Actuarial Status of the Social Security Trust Funds

-

When filling out an online job application, a question asks you to provide your social security number as part of the background investigation. Do you provide this number or how do you proceed?

My question exactly. Other similar posts overwhelmingly answer 'do NOT give out that number' until you are hired. Yet the majority of firms ask for it from the get-go nowadays. I think it should be illegal to seek your number. Companies can say 'we only use it for ....' but apparently they can verify when and where you worked, your wage, etc. There is a lot of 'fudging' going on out there but companies seem to hold all the card in my opinion.HR will always say they are doing everything by the book but of course they can do whatever they want to.

Create this form in 5 minutes!

How to create an eSignature for the taxable social security worksheet 2012 fillable form

How to make an electronic signature for your Taxable Social Security Worksheet 2012 Fillable Form in the online mode

How to generate an eSignature for your Taxable Social Security Worksheet 2012 Fillable Form in Chrome

How to create an eSignature for putting it on the Taxable Social Security Worksheet 2012 Fillable Form in Gmail

How to create an electronic signature for the Taxable Social Security Worksheet 2012 Fillable Form from your smartphone

How to generate an electronic signature for the Taxable Social Security Worksheet 2012 Fillable Form on iOS

How to generate an eSignature for the Taxable Social Security Worksheet 2012 Fillable Form on Android

People also ask

-

What is a taxable social security worksheet 2023 printable?

The taxable social security worksheet 2023 printable is a document designed to help individuals calculate their taxable social security benefits for the year 2023. This worksheet simplifies the process of determining how much of your social security income is subject to federal taxes, ensuring you stay compliant with tax regulations.

-

How can I obtain the taxable social security worksheet 2023 printable?

You can easily access the taxable social security worksheet 2023 printable through our website. Simply navigate to the resources section, and you can download the worksheet for free. This ensures you have the latest format and calculations at your fingertips.

-

Is the taxable social security worksheet 2023 printable easy to use?

Yes, the taxable social security worksheet 2023 printable is designed for user-friendliness. It features clear instructions and a straightforward layout, making it easy for anyone to fill out. Whether you’re a tax professional or an individual taxpayer, you will find it highly beneficial.

-

Are there any costs associated with the taxable social security worksheet 2023 printable?

No, the taxable social security worksheet 2023 printable is entirely free to download. We believe in providing accessible resources to help individuals manage their finances effectively without incurring any additional fees.

-

Can the taxable social security worksheet 2023 printable integrate with other tax software?

While the taxable social security worksheet 2023 printable is a standalone document, you can manually enter its results into your preferred tax software. This ensures a smooth transition of your calculations, enhancing your overall tax preparation experience.

-

What are the benefits of using the taxable social security worksheet 2023 printable?

Using the taxable social security worksheet 2023 printable can help you accurately calculate your taxable income from social security. This ensures you comply with IRS guidelines, potentially saving you from underpayment penalties and maximizing your tax refund.

-

Who should use the taxable social security worksheet 2023 printable?

The taxable social security worksheet 2023 printable is ideal for retirees, individuals receiving social security benefits, and tax professionals seeking a reliable method to calculate taxable income. It’s a useful tool for anyone looking to better understand their tax obligations.

Get more for Taxable Social Security Worksheet Fillable Form

Find out other Taxable Social Security Worksheet Fillable Form

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract