Form Profit and Loss Form for Self Employed Earnings PDF South Norfolk Gov

Understanding the Profit and Loss Form for Self Employed

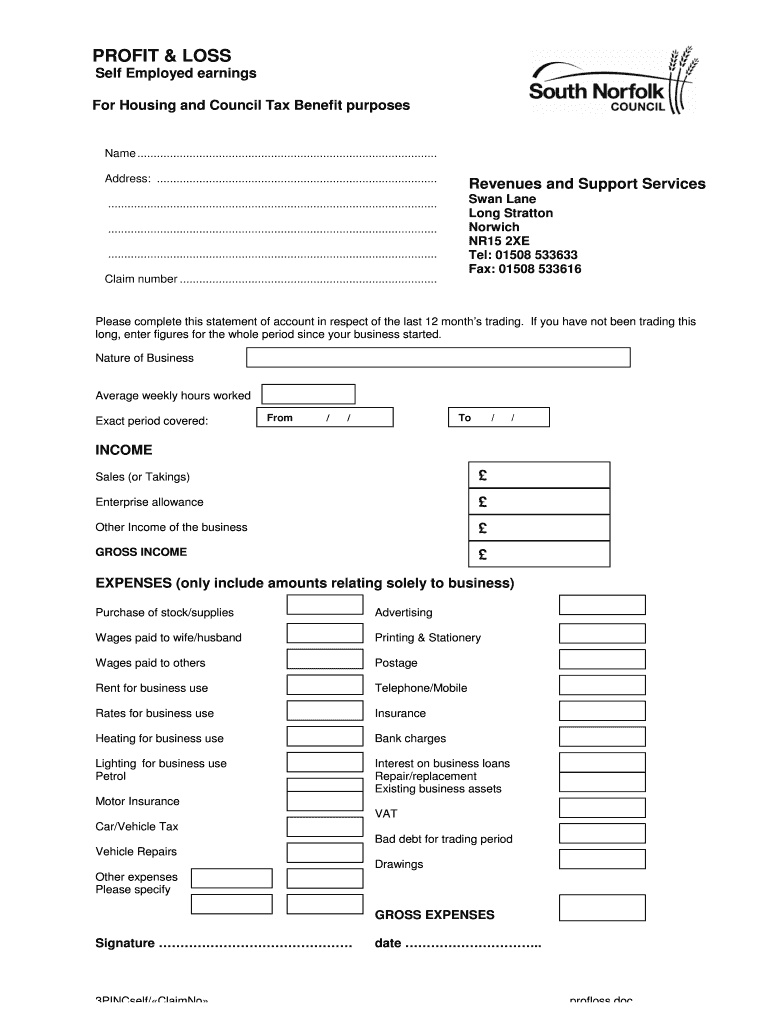

The profit and loss form for self employed is a crucial document that helps individuals track their income and expenses over a specific period. This form is essential for self-employed individuals, as it provides a comprehensive overview of their financial performance, which is necessary for tax reporting and financial analysis. By accurately completing this form, self-employed individuals can determine their net profit or loss, which directly impacts their tax obligations.

Key Elements of the Profit and Loss Form for Self Employed

When filling out the profit and loss form for self employed, there are several key elements to include:

- Income: This section should list all sources of income, including sales, services rendered, and any other revenue streams.

- Expenses: Here, self-employed individuals should detail all business-related expenses, including operational costs, supplies, and any other expenditures necessary for running their business.

- Net Profit or Loss: This is calculated by subtracting total expenses from total income. It is a critical figure for tax reporting.

Steps to Complete the Profit and Loss Form for Self Employed

Completing the profit and loss form for self employed involves several steps:

- Gather all financial records, including invoices, receipts, and bank statements.

- Organize income and expenses into appropriate categories.

- Fill in the income section with all revenue sources.

- Detail all business expenses in the expenses section.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Review the form for accuracy before submission.

Legal Use of the Profit and Loss Form for Self Employed

The profit and loss form for self employed is legally recognized as a valid document for tax purposes in the United States. It is important to ensure that the information provided is accurate and complete, as discrepancies can lead to audits or penalties. The form serves not only as a financial record but also as a tool for demonstrating income to lenders or during legal proceedings.

IRS Guidelines for the Profit and Loss Form for Self Employed

The Internal Revenue Service (IRS) provides specific guidelines for self-employed individuals regarding the profit and loss form. It is recommended to use this form to report income on Schedule C when filing taxes. The IRS emphasizes the importance of maintaining accurate records and retaining documentation that supports the figures reported on the form. This adherence to IRS guidelines ensures compliance and helps avoid potential issues during tax filing.

Examples of Using the Profit and Loss Form for Self Employed

Self-employed individuals can use the profit and loss form for various purposes, such as:

- Preparing annual tax returns to report income and expenses.

- Applying for loans or credit by providing financial statements to lenders.

- Evaluating business performance over time to make informed financial decisions.

Quick guide on how to complete form profit and loss form for self employed earnings pdf south norfolk gov

Complete Form Profit And Loss Form For Self Employed Earnings PDF South norfolk Gov seamlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely archive it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your files swiftly without delays. Manage Form Profit And Loss Form For Self Employed Earnings PDF South norfolk Gov on any device with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to adjust and electronically sign Form Profit And Loss Form For Self Employed Earnings PDF South norfolk Gov effortlessly

- Find Form Profit And Loss Form For Self Employed Earnings PDF South norfolk Gov and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a traditional ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form Profit And Loss Form For Self Employed Earnings PDF South norfolk Gov and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I earn a small profit from the free digital magazine I distribute? It is out in HTML and PDF form. It is a professionally designed digital publication. I need the money to support hosting etc.

Get a larger audience base.Show ad networks you have what they want, or better still sell ads directly.In the HTML format of the magazine, you'll earn in two waysCPM. Cost per miles. 1 mile is equivalent to $1 per ad unit.CTR. Click-through-rate. Approx.-$2 per click.AdSense and adsterra are my recommended third party ads network.You can as well include a “donate” call to action button for people that want to support the magazine. You can also extend the support service to the PDF format.

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

If you work for yourself doing government contracts and American Express asks for you to show them a current pay stub, how would you provide that? Is there a form that has an earnings statement that you can fill out yourself?

It seems to me you should just ask American Express if they have form you can fill out. It seems odd they would want to see an earnings statement, but if you need to show some sort of proof of income, typically in the absence of a pay stub, your most recently-filed tax return should suffice.I'd really ask them first before automatically sending them your tax returns though.

-

I'm filling out the employment verification form online for KPMG and realized that it's not asking me for phone numbers to my previous employers. Just curious as to how they verify employment without me providing a contact number to call?

Many US employers today won’t allow individuals (coworkers, supervisors) at a company respond to any questions or write recommendations. Everything must go through HR and they will often only confirm dates of employment.I know this, so I’m not going to waste time contacting phone numbers/email lists of supposed former coworkers or managers. Fact is, if anyone answered and started responding to my questions, I’d be very suspicious. Instead, I just ask for the main number of the company — which I can look up on line and verify to be the actual number of the claimed company.Same deal with academic credentials. I’m not going to use your address for “Harvard” … the one with a PO Box in Laurel, KS. I’m going to look up the address for the registrar myself.Sorry to say, there’s far too much lying on resumes today, combined with the liability possible for a company to say anything about you. A common tactic is to lie about academic back ground while giving friends as your “former supervisor at XYZ.”

Create this form in 5 minutes!

How to create an eSignature for the form profit and loss form for self employed earnings pdf south norfolk gov

How to generate an electronic signature for your Form Profit And Loss Form For Self Employed Earnings Pdf South Norfolk Gov online

How to create an electronic signature for your Form Profit And Loss Form For Self Employed Earnings Pdf South Norfolk Gov in Google Chrome

How to make an electronic signature for putting it on the Form Profit And Loss Form For Self Employed Earnings Pdf South Norfolk Gov in Gmail

How to generate an electronic signature for the Form Profit And Loss Form For Self Employed Earnings Pdf South Norfolk Gov right from your smart phone

How to create an electronic signature for the Form Profit And Loss Form For Self Employed Earnings Pdf South Norfolk Gov on iOS devices

How to create an eSignature for the Form Profit And Loss Form For Self Employed Earnings Pdf South Norfolk Gov on Android devices

People also ask

-

What is a profit and loss form for self employed?

A profit and loss form for self employed is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period. This form helps self-employed individuals track their income and expenses accurately, enabling them to understand their profitability. Using this form is essential for tax preparation and financial forecasting.

-

How can airSlate SignNow help me with my profit and loss form for self employed?

airSlate SignNow provides an efficient platform to create, send, and eSign your profit and loss form for self employed electronically. The user-friendly interface simplifies document management and ensures that your financial documentation is securely signed and stored. This streamlines the process and saves time, giving you more focus on growing your business.

-

Is there a free trial available for the profit and loss form for self employed in airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, including the creation and management of your profit and loss form for self employed. This trial provides you with the opportunity to assess the platform’s capabilities before committing to a paid plan. Experience firsthand how easy it is to handle your financial documents.

-

What features does airSlate SignNow offer for handling profit and loss forms?

AirSlate SignNow includes a range of features tailored for managing profit and loss forms for self employed, such as customizable templates, secure eSigning, and document tracking. You can easily create templates that meet your specific needs and monitor the signing process in real-time. This enhances efficiency and helps ensure that your financial documents are always in order.

-

Can I integrate airSlate SignNow with other accounting software for my profit and loss form for self employed?

Absolutely! airSlate SignNow offers integrations with popular accounting and financial software, allowing you to streamline the workflow for your profit and loss form for self employed. By connecting your accounting tools, you can ensure that all your financial data is easily accessible and keep your documents organized without any hassle.

-

How does airSlate SignNow ensure the security of my profit and loss form for self employed?

AirSlate SignNow prioritizes security and employs industry-leading encryption protocols to protect your profit and loss form for self employed. The platform also features advanced authentication options, ensuring that only authorized users can access and eSign your documents. This guarantees that your financial information remains confidential and secure.

-

What are the pricing options for using airSlate SignNow to manage profit and loss forms?

AirSlate SignNow offers flexible pricing plans tailored to different business needs, including those focused on managing profit and loss forms for self employed. Depending on your requirements, you can choose from various tiers that provide different features and functionalities at competitive rates. Evaluate the options to find the best plan that suits your financial documentation needs.

Get more for Form Profit And Loss Form For Self Employed Earnings PDF South norfolk Gov

Find out other Form Profit And Loss Form For Self Employed Earnings PDF South norfolk Gov

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure