Quitclaim Deed for Trustee to Beneficiary Florida Form

What is the Quitclaim Deed For Trustee To Beneficiary Florida

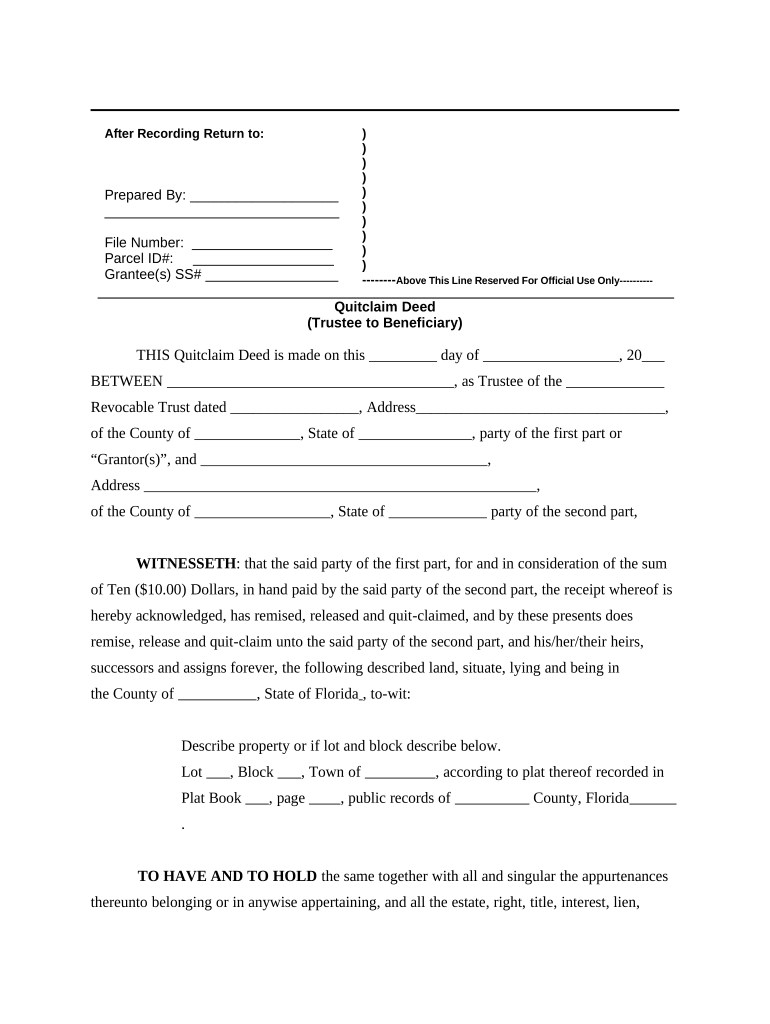

A quitclaim deed for trustee to beneficiary in Florida is a legal document that transfers ownership of property from a trustee to a beneficiary without any warranties or guarantees regarding the title. This type of deed is often used in estate planning and trust administration, allowing the trustee to convey property interests directly to beneficiaries as specified in the trust agreement. It is important to understand that a quitclaim deed does not guarantee that the property is free from liens or other claims, making it essential for beneficiaries to conduct due diligence before accepting the transfer.

Steps to Complete the Quitclaim Deed For Trustee To Beneficiary Florida

Completing a quitclaim deed for trustee to beneficiary involves several key steps:

- Gather necessary information: Collect details about the property, including the legal description, the names of the trustee and beneficiary, and any relevant trust information.

- Draft the deed: Prepare the quitclaim deed, ensuring it includes all required elements, such as the names of the parties, a clear description of the property, and the date of the transfer.

- Sign the deed: The trustee must sign the deed in the presence of a notary public to ensure its validity.

- Record the deed: Submit the signed and notarized quitclaim deed to the appropriate county clerk or recorder’s office to make the transfer official.

Key Elements of the Quitclaim Deed For Trustee To Beneficiary Florida

Several critical elements must be included in a quitclaim deed for it to be legally binding in Florida:

- Grantor and grantee information: Clearly state the names and addresses of the trustee (grantor) and the beneficiary (grantee).

- Property description: Provide a complete legal description of the property being transferred, which can typically be found in the property’s title or deed.

- Consideration: While not always required, it is common to include a statement of consideration, which can be a nominal amount or indicate that the transfer is a gift.

- Notarization: The signature of the trustee must be notarized to confirm the authenticity of the document.

Legal Use of the Quitclaim Deed For Trustee To Beneficiary Florida

The quitclaim deed for trustee to beneficiary is legally recognized in Florida and serves specific purposes in property transfers. It is particularly useful in situations where the trustee is acting on behalf of a trust, allowing for a straightforward transfer of property without the complexities associated with warranty deeds. This type of deed is often employed in estate planning to facilitate the distribution of assets to beneficiaries, ensuring that the trustee can efficiently manage and transfer property as outlined in the trust agreement.

State-Specific Rules for the Quitclaim Deed For Trustee To Beneficiary Florida

Florida has specific rules governing the use of quitclaim deeds. These include:

- Recording requirements: The quitclaim deed must be recorded in the county where the property is located to provide public notice of the transfer.

- Notarization: The deed must be signed by the trustee in the presence of a notary public to be valid.

- Documentary stamp tax: Depending on the circumstances of the transfer, a documentary stamp tax may apply, which is calculated based on the consideration or value of the property.

How to Use the Quitclaim Deed For Trustee To Beneficiary Florida

Using a quitclaim deed for trustee to beneficiary involves preparing the document correctly and ensuring compliance with state regulations. Once the deed is completed and signed, it should be recorded with the county clerk’s office to finalize the transfer of property. Beneficiaries should also verify that the deed has been recorded and that they have received a copy for their records. This process ensures that the transfer is legally recognized and protects the interests of all parties involved.

Quick guide on how to complete quitclaim deed for trustee to beneficiary florida

Prepare Quitclaim Deed For Trustee To Beneficiary Florida seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Quitclaim Deed For Trustee To Beneficiary Florida on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process now.

The easiest way to alter and eSign Quitclaim Deed For Trustee To Beneficiary Florida effortlessly

- Locate Quitclaim Deed For Trustee To Beneficiary Florida and click Get Form to begin.

- Use the tools we provide to complete your document.

- Select important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Quitclaim Deed For Trustee To Beneficiary Florida to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed For Trustee To Beneficiary Florida?

A Quitclaim Deed For Trustee To Beneficiary Florida is a legal document that allows a trustee to transfer property rights to a beneficiary without guaranteeing that the title is clear. This type of deed is commonly used in estate planning and trust management in Florida, providing a straightforward method to transfer property rights.

-

How do I create a Quitclaim Deed For Trustee To Beneficiary Florida using airSlate SignNow?

Creating a Quitclaim Deed For Trustee To Beneficiary Florida with airSlate SignNow is easy. Simply use our user-friendly interface to fill out the necessary template, customize it to your requirements, and eSign the document securely. Our platform simplifies the process and ensures compliance with Florida’s legal standards.

-

What are the benefits of using airSlate SignNow for a Quitclaim Deed For Trustee To Beneficiary Florida?

Using airSlate SignNow for a Quitclaim Deed For Trustee To Beneficiary Florida offers numerous benefits, such as time savings, reduced paperwork, and enhanced security. Our electronic signature solution allows for quick execution of documents, making the process efficient for both trustees and beneficiaries.

-

Are there any costs associated with obtaining a Quitclaim Deed For Trustee To Beneficiary Florida through airSlate SignNow?

Yes, there are costs associated with eSigning a Quitclaim Deed For Trustee To Beneficiary Florida through airSlate SignNow, but they are competitively priced. Our subscription plans offer flexible pricing options tailored to your needs, ensuring you receive a cost-effective solution without compromising on quality.

-

Can I integrate airSlate SignNow with other tools for managing a Quitclaim Deed For Trustee To Beneficiary Florida?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, enhancing your workflow when managing a Quitclaim Deed For Trustee To Beneficiary Florida. This allows you to synchronize data, streamline processes, and improve productivity across different platforms.

-

Is a Quitclaim Deed For Trustee To Beneficiary Florida valid without notarization?

In Florida, a Quitclaim Deed For Trustee To Beneficiary requires notarization to be considered valid. Proper notarization ensures that the document is legally binding and protects the rights of both the trustee and the beneficiary. airSlate SignNow allows you to obtain the required notarization easily.

-

How quickly can I finalize a Quitclaim Deed For Trustee To Beneficiary Florida using airSlate SignNow?

You can finalize a Quitclaim Deed For Trustee To Beneficiary Florida in minutes with airSlate SignNow. Our eSignature technology speeds up the process, allowing you and other parties involved to sign and complete the document without delays, so you can move forward with the property transfer swiftly.

Get more for Quitclaim Deed For Trustee To Beneficiary Florida

- International financial questionnaire form

- Rewards check up after lesson 4 voyager sopris learning form

- Quadrilateral quiz answer key form

- Lra 39 form

- Ukg syllabus month wise form

- Community christian school planned absence form no

- Prince william county public schools bemergencyb permission bformb

- Project compliance certificate division of fire safety firesafety vermont form

Find out other Quitclaim Deed For Trustee To Beneficiary Florida

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself