Certificate of Origin from Portugal Form

What is the Certificate of Origin from Portugal?

The Certificate of Origin from Portugal is an official document that certifies the origin of goods being exported from Portugal. This document is crucial for international trade, as it verifies that the products meet the necessary regulations and standards for entry into foreign markets. It contains essential information such as the exporter’s details, a description of the goods, and the country of origin. The certificate is often required by customs authorities in the importing country to determine tariffs and ensure compliance with trade agreements.

How to use the Certificate of Origin from Portugal

Using the Certificate of Origin from Portugal involves several steps. First, ensure that you have the correct form, which can typically be obtained from the relevant trade authority or chamber of commerce. After filling out the necessary details about the goods and the exporter, the document must be signed and stamped by an authorized body. Once completed, this certificate should accompany the shipment and be presented to customs officials in the importing country to facilitate the clearance process.

Steps to complete the Certificate of Origin from Portugal

Completing the Certificate of Origin from Portugal involves a systematic approach:

- Gather all required information about the goods, including descriptions, quantities, and value.

- Obtain the official Certificate of Origin form from the appropriate authority.

- Fill in the exporter’s details and the specifics of the goods accurately.

- Have the document reviewed and signed by an authorized representative or chamber of commerce.

- Ensure that the certificate is stamped and dated before shipment.

Legal use of the Certificate of Origin from Portugal

The legal use of the Certificate of Origin from Portugal is governed by international trade laws and agreements. It serves as a declaration that the goods originate from Portugal, which can affect tariff rates and trade compliance. Misrepresentation of the origin can lead to penalties, including fines and seizure of goods. Therefore, it is essential to ensure that all information provided is accurate and truthful to avoid legal complications.

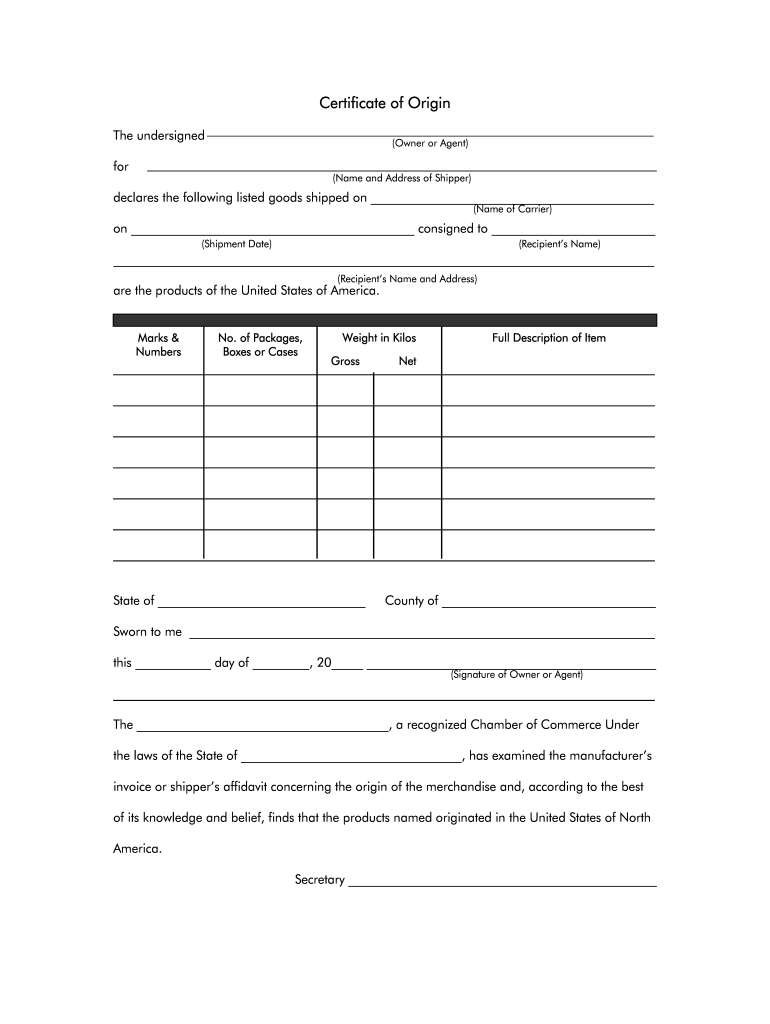

Key elements of the Certificate of Origin from Portugal

Key elements of the Certificate of Origin from Portugal include:

- Exporter Information: Name, address, and contact details of the exporter.

- Consignee Information: Name and address of the recipient in the importing country.

- Description of Goods: Detailed description, quantity, and value of the goods being exported.

- Country of Origin: Confirmation that the goods are produced in Portugal.

- Signature and Stamp: Authentication by an authorized body, confirming the validity of the certificate.

Who Issues the Form?

The Certificate of Origin from Portugal is typically issued by the local chamber of commerce or trade authority. These organizations are responsible for verifying the information provided by exporters and ensuring compliance with national and international trade regulations. Exporters should contact their local chamber for guidance on obtaining the certificate and any associated fees or requirements.

Quick guide on how to complete certificate of origin generic form for us made goods manhattan manhattancc

The optimal method to locate and authorize Certificate Of Origin From Portugal

For an entire organization, ineffective workflows associated with paper approvals can take up signNow amounts of working time. Approving documents such as Certificate Of Origin From Portugal is a fundamental aspect of operations in any enterprise, which is why the effectiveness of each agreement’s lifecycle holds such importance for the overall productivity of the company. With airSlate SignNow, authorizing your Certificate Of Origin From Portugal is as straightforward and rapid as possible. This platform provides you with the latest version of nearly any form. Even better, you can approve it instantly without requiring third-party software on your computer or printing any physical copies.

Steps to access and authorize your Certificate Of Origin From Portugal

- Browse through our collection by category or utilize the search function to locate the form you require.

- Examine the form preview by selecting Learn more to confirm it’s the correct one.

- Press Get form to start editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- Once finished, click on the Sign tool to authorize your Certificate Of Origin From Portugal.

- Choose the signature method that is easiest for you: Draw, Create initials, or upload an image of your written signature.

- Hit Done to complete editing and proceed to document-sharing options as required.

With airSlate SignNow, you have everything necessary to manage your documents efficiently. You can search for, complete, edit, and even distribute your Certificate Of Origin From Portugal all in one tab with no complications. Enhance your workflows by adopting a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How can I take my child (16yrs) to the U.S if my immigrant visa is approved? My husband, a US citizen, filled out form I 130 for me and mentioned this child as migrating in future.

Just petition using a I-130 yourself. Read the instructions very carefully. I am not sure but it’s possible that the affidavit of support will need to be filled by your husband since he is the citizen and he filled one for you - again, check the instructions very carefully. It should be a pretty clear, straightforward process.Your child is still well below the age limit and should be fine. If there are any problems, do the same thing you did with your own process - use the numbers you are given to check on the process and if you see it stuck call to make sure they have everything they need early.It is my understanding that the age limit of the child is based on the petition date, so go ahead and do it.You still have plenty of time at 16, just don’t delay.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

When I found out that there are U.S. universities that use requests for financial assistance to evaluate your chances of admission, it totally upset me. How do I accept that this is a good thing?

It is a good thing, because if you are admitted and you get no aid and just a large cost of $50,000 to $70,000 per year, it is likely even more upsetting. You got in, but now you can’t go. If they can’t give you funds, and decide they don’t admit you, you can just move on to other options —much easier mentally. Here are the scenarios:Most colleges will admit you regardless of need and just give you a bill and zero aid. Those are usually public universities. Some privates too.Only a handful of colleges will pay everything they think you need, after you pay your family portion. These are colleges with very low admit rates.A good deal of private colleges are ‘need aware’. Since they don’t have enough funds to give to everyone, they will give some people aid and admit them, but once the aid funds for that year are allocated, they can then only admit people who don’t need much or any aid. That is more practical than just admitting a bunch of extra students who are never likely to be able to come up with large amounts of funds to attend. They do have your financials, after all. So if you need a lot of aid you might get it if you are very desirable. Or you just may be admitted because you don’t need much aid, or you are a full payer. Of course they are going to want you to be a qualified student, but a lot of these colleges just have more qualified applicants than they can seat. Some don’t, some do.If a college practices ‘preferential packaging’, they don’t necessarily have to be ‘need aware’, but many are. To understand preferential packaging, read this excellent and frank article from Muhlenberg College.The Real Deal on Financial Aid.

Create this form in 5 minutes!

How to create an eSignature for the certificate of origin generic form for us made goods manhattan manhattancc

How to create an electronic signature for the Certificate Of Origin Generic Form For Us Made Goods Manhattan Manhattancc online

How to create an eSignature for the Certificate Of Origin Generic Form For Us Made Goods Manhattan Manhattancc in Chrome

How to create an electronic signature for putting it on the Certificate Of Origin Generic Form For Us Made Goods Manhattan Manhattancc in Gmail

How to generate an eSignature for the Certificate Of Origin Generic Form For Us Made Goods Manhattan Manhattancc from your smart phone

How to make an eSignature for the Certificate Of Origin Generic Form For Us Made Goods Manhattan Manhattancc on iOS devices

How to generate an eSignature for the Certificate Of Origin Generic Form For Us Made Goods Manhattan Manhattancc on Android OS

People also ask

-

What is a US certificate of origin template?

A US certificate of origin template is a standardized document used to signNow the origin of goods being exported. This template simplifies the process of declaring where the goods were manufactured, ensuring compliance with trade regulations. Using our template can accelerate your documentation process, enhancing business efficiency.

-

How can I customize the US certificate of origin template?

You can easily customize the US certificate of origin template in airSlate SignNow by adding your company logo, relevant details, and contact information. The platform provides a user-friendly interface that allows for quick edits and personalized content. This customization helps maintain your brand identity while adhering to trade documentation requirements.

-

What are the benefits of using the airSlate SignNow US certificate of origin template?

Using the airSlate SignNow US certificate of origin template offers several benefits, including streamlined eSigning processes and reduced paperwork. It helps ensure compliance with international shipping regulations, making export processes smoother. Furthermore, our template enhances collaboration by allowing multiple parties to sign securely and efficiently.

-

Is there a cost associated with the US certificate of origin template?

Yes, there is a cost associated with accessing the US certificate of origin template through airSlate SignNow. However, our pricing plans are designed to be cost-effective, providing great value for businesses looking to streamline their document signing and management processes. You can choose a plan that fits your budget and needs.

-

Can I integrate the US certificate of origin template with other software?

Absolutely! The US certificate of origin template can be seamlessly integrated with various software solutions including CRM systems and cloud storage services. This integration ensures a smooth flow of information and enhances overall workflow efficiency. AirSlate SignNow supports numerous integrations to help you manage your documents effectively.

-

How do I share the US certificate of origin template with my team?

Sharing the US certificate of origin template with your team is simple using airSlate SignNow. You can invite team members via email or share a secure link, allowing for easy access to the document. Collaborating in real-time helps keep everyone informed and speeds up the signing process.

-

Does the US certificate of origin template comply with legal standards?

Yes, the US certificate of origin template provided by airSlate SignNow is compliant with legal standards governing international trade documentation. We ensure that our templates meet all necessary regulatory requirements, helping you avoid potential legal issues. This compliance signNowly strengthens your documentation's reliability.

Get more for Certificate Of Origin From Portugal

Find out other Certificate Of Origin From Portugal

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free