Florida Financing Statement Form

What is the Florida Financing Statement

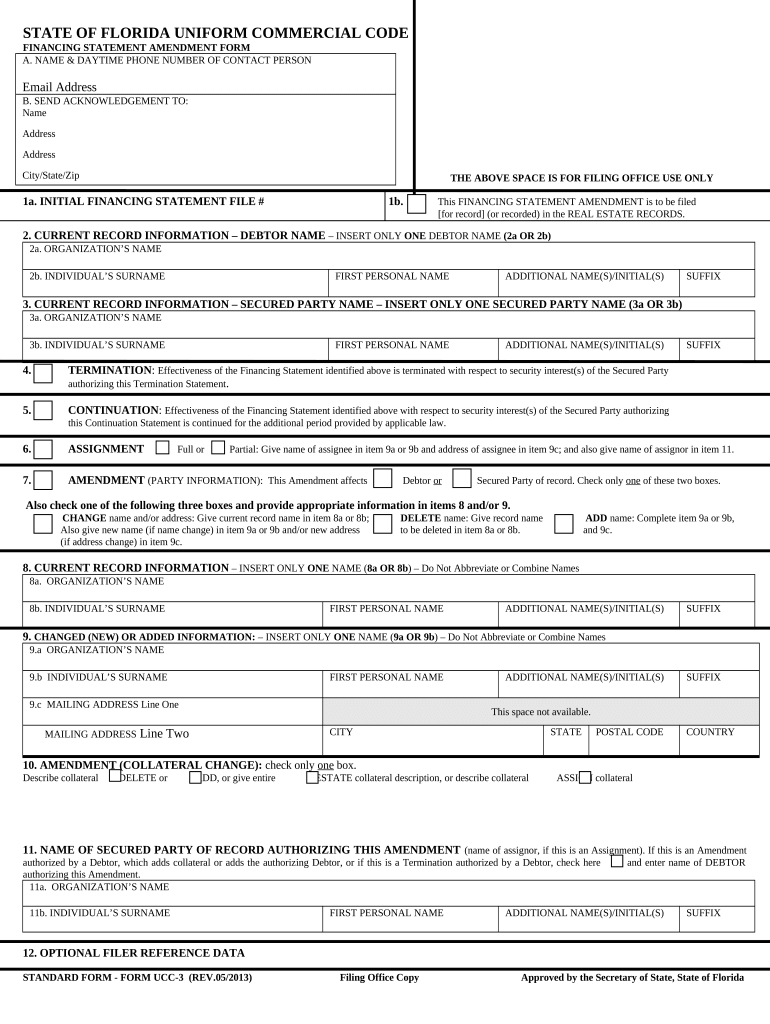

The Florida financing statement is a legal document used to secure a creditor's interest in a debtor's personal property. This form is essential in transactions involving loans or credit, as it provides public notice of the secured party's claim. By filing this statement, creditors can protect their rights to specific assets in case of default by the debtor. The Florida financing statement is particularly important for businesses and individuals who wish to establish a security interest in collateral, ensuring that their claims are recognized under Florida law.

How to use the Florida Financing Statement

Using the Florida financing statement involves several key steps. First, gather the necessary information about the debtor and the collateral. This includes the debtor's name, address, and a description of the collateral being secured. Next, fill out the financing statement accurately, ensuring all details are correct to avoid complications. Once completed, the form must be filed with the appropriate state office, typically the Florida Department of State. After filing, it is crucial to keep a copy for your records, as it serves as proof of the secured interest.

Steps to complete the Florida Financing Statement

Completing the Florida financing statement requires careful attention to detail. Follow these steps:

- Obtain the Florida financing statement form from the appropriate state office or online resource.

- Provide the debtor's legal name and address, ensuring accuracy to avoid rejection.

- Describe the collateral in detail, including any identification numbers or specific characteristics.

- Sign the form, certifying that the information provided is true and correct.

- Submit the form to the Florida Department of State, either online, by mail, or in person.

Key elements of the Florida Financing Statement

The Florida financing statement includes several key elements that must be completed for it to be valid. These elements include:

- Debtor Information: Full legal name and address of the debtor.

- Secured Party Information: Name and address of the creditor or secured party.

- Collateral Description: A clear and specific description of the collateral being secured.

- Signature: The signature of the secured party or an authorized representative.

Legal use of the Florida Financing Statement

The legal use of the Florida financing statement is governed by the Uniform Commercial Code (UCC) and Florida state law. This document serves as a public record of the secured interest, which is crucial in establishing priority over other creditors. Proper filing ensures that the secured party's rights are enforceable in case of default. It is important to adhere to all legal requirements to maintain the validity of the financing statement, as any errors could jeopardize the secured party's claim.

Form Submission Methods

The Florida financing statement can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Many users prefer to file electronically through the Florida Department of State's online portal.

- Mail: Completed forms can be sent via postal service to the designated state office.

- In-Person: Individuals may also choose to file the form in person at the local office.

Quick guide on how to complete florida financing statement

Complete Florida Financing Statement effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage Florida Financing Statement on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to alter and electronically sign Florida Financing Statement with ease

- Obtain Florida Financing Statement and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Alter and electronically sign Florida Financing Statement and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Florida financing statement?

A Florida financing statement is a legal document used to secure a creditor's interest in a debtor's personal property. It is filed under the Uniform Commercial Code (UCC) in Florida and provides public notice of the secured party’s interest. Understanding how to properly use and file a Florida financing statement can be crucial for businesses seeking to protect their assets.

-

How does airSlate SignNow facilitate filing a Florida financing statement?

airSlate SignNow simplifies the process of filing a Florida financing statement by enabling users to electronically sign and send documents directly through the platform. This user-friendly solution ensures that you can quickly prepare your financing statements without any complicated paperwork or delays. Additionally, the platform allows for easy tracking and management of your filed documents.

-

What are the costs associated with using airSlate SignNow for a Florida financing statement?

airSlate SignNow offers competitive pricing plans designed to fit various business needs, making the process of handling a Florida financing statement affordable. Pricing plans typically include access to features that streamline document management and e-signatures, ensuring that your financing statements can be efficiently processed. You can choose a plan that best suits your desired features and usage frequency.

-

Can I integrate airSlate SignNow with other applications for managing Florida financing statements?

Yes, airSlate SignNow offers integration with various applications, allowing you to streamline the management of your Florida financing statements. Integrations with popular tools ensure that your financial workflows remain seamless and efficient. This capability simplifies how you track and organize your financing statements while enhancing collaboration within your team.

-

What are the benefits of using airSlate SignNow for electronic signatures on Florida financing statements?

Using airSlate SignNow for electronic signatures on your Florida financing statements offers numerous benefits, including faster turnaround times and enhanced security. The platform ensures that your documents are signed and securely stored, minimizing the risk of lost paperwork. Additionally, it allows multiple parties to sign electronically, promoting efficiency in your financial dealings.

-

Is airSlate SignNow compliant with Florida's legal requirements for financing statements?

Yes, airSlate SignNow adheres to Florida's legal requirements for filing financing statements, ensuring that your documents are compliant with state laws. This compliance is vital when dealing with secured transactions and helps protect your interests. When you use our platform, you can have confidence that your financing statements are prepared accurately and legally.

-

How can I track the status of my Florida financing statement with airSlate SignNow?

You can easily track the status of your Florida financing statement through airSlate SignNow’s user-friendly dashboard. The platform provides real-time updates and notifications regarding your document's status, so you are always informed. This feature enhances your ability to manage multiple financing statements and their progress efficiently.

Get more for Florida Financing Statement

- Sample letter to beneficiaries distribution of funds 203965299 form

- Rg active half ironman training plan form

- Lees sandwiches rowland heights form

- Continental drift worksheet pdf form

- Fa8 financial services notification form

- Building notice examples 622474352 form

- Animal friends pet claim form

- How to create a contact form in wordpress step by step

Find out other Florida Financing Statement

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself