Non Foreign Affidavit under IRC 1445 Georgia Form

What is the Non Foreign Affidavit Under IRC 1445 Georgia

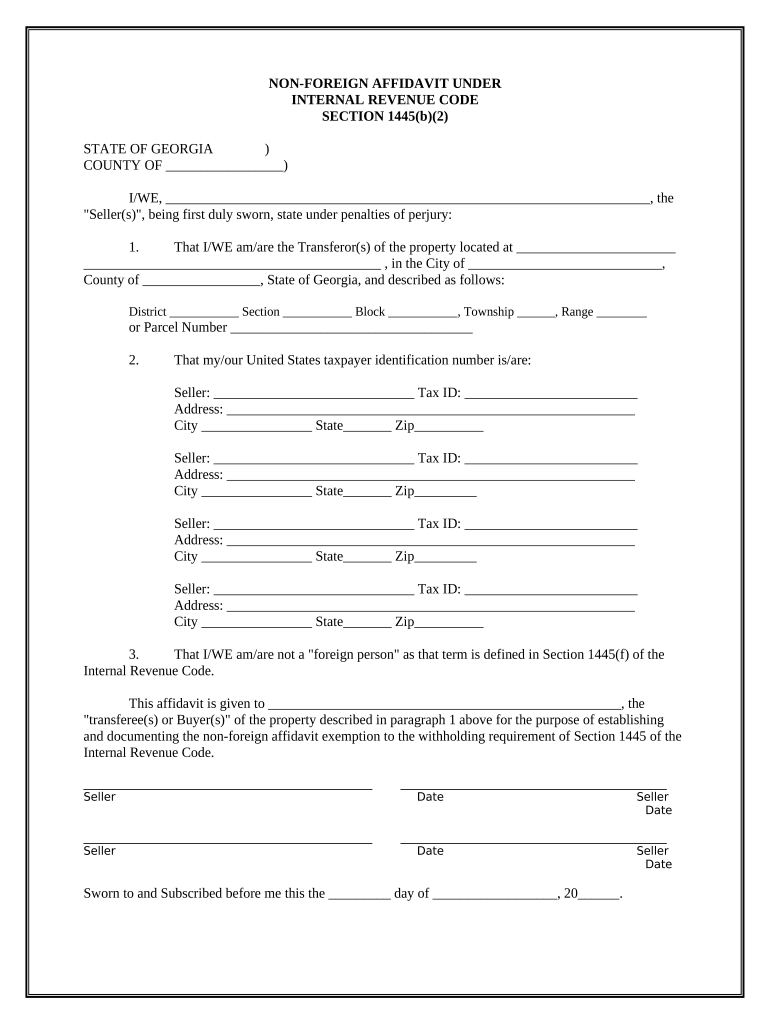

The Non Foreign Affidavit Under IRC 1445 is a legal document used in Georgia that certifies a transferor's status as a non-foreign person. This affidavit is crucial for real estate transactions to ensure that the buyer does not incur withholding taxes on the sale of property. Under the Internal Revenue Code Section 1445, foreign persons are subject to a withholding tax on the sale of U.S. real property interests, making this affidavit essential for compliance and tax avoidance for non-foreign sellers.

Steps to Complete the Non Foreign Affidavit Under IRC 1445 Georgia

Completing the Non Foreign Affidavit involves several key steps:

- Gather necessary information, including the seller's name, address, and taxpayer identification number.

- Complete the affidavit form, ensuring all sections are filled out accurately.

- Sign and date the affidavit in the presence of a notary public to validate the document.

- Provide the completed affidavit to the buyer or their representative as part of the closing documents.

Legal Use of the Non Foreign Affidavit Under IRC 1445 Georgia

The Non Foreign Affidavit serves a legal purpose in real estate transactions by confirming the seller's non-foreign status. This declaration protects the buyer from potential withholding tax liabilities. It is important to ensure that the affidavit is executed properly, as any inaccuracies or omissions may lead to legal complications or tax penalties for the buyer.

Key Elements of the Non Foreign Affidavit Under IRC 1445 Georgia

Key elements of the Non Foreign Affidavit include:

- The seller's full legal name and address.

- The seller's taxpayer identification number or Social Security number.

- A statement confirming the seller is not a foreign person as defined by the IRC.

- The seller's signature and date of execution.

How to Obtain the Non Foreign Affidavit Under IRC 1445 Georgia

The Non Foreign Affidavit can typically be obtained through real estate professionals, such as attorneys or title companies, involved in the transaction. Additionally, templates for the affidavit may be available online, but it is advisable to use a version that complies with Georgia state laws to ensure validity.

Filing Deadlines / Important Dates

While the Non Foreign Affidavit itself does not have a specific filing deadline, it must be completed and provided at the time of closing the real estate transaction. Timely submission is crucial to avoid any withholding tax implications. Buyers should ensure they receive the affidavit before finalizing the transaction.

Quick guide on how to complete non foreign affidavit under irc 1445 georgia

Effortlessly Prepare Non Foreign Affidavit Under IRC 1445 Georgia on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and eSign your files without delays. Manage Non Foreign Affidavit Under IRC 1445 Georgia on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Modify and eSign Non Foreign Affidavit Under IRC 1445 Georgia with Ease

- Obtain Non Foreign Affidavit Under IRC 1445 Georgia and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Non Foreign Affidavit Under IRC 1445 Georgia to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 Georgia?

A Non Foreign Affidavit Under IRC 1445 Georgia is a legal document required when a non-U.S. citizen sells real estate in the state. This affidavit certifies that the seller is not a foreign person, which helps avoid withholding taxes on the sale. Understanding this process is crucial for both buyers and sellers involved in real estate transactions.

-

How does airSlate SignNow assist with Non Foreign Affidavit Under IRC 1445 Georgia?

airSlate SignNow offers a seamless solution for creating, sending, and eSigning Non Foreign Affidavit Under IRC 1445 Georgia documents. With user-friendly features, it simplifies the paperwork process by providing customizable templates and secure storage options. This ensures that your important documents are handled efficiently and accurately.

-

Is there a cost associated with using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Georgia?

Yes, airSlate SignNow offers flexible pricing plans that vary based on individual needs and usage. Depending on the features you choose, pricing is designed to be cost-effective, giving you full access to create and manage Non Foreign Affidavit Under IRC 1445 Georgia documents efficiently. A free trial is also available to explore the platform before committing.

-

What features does airSlate SignNow provide for Non Foreign Affidavit Under IRC 1445 Georgia?

airSlate SignNow provides numerous features for handling Non Foreign Affidavit Under IRC 1445 Georgia, including real-time collaboration, advanced eSigning options, and comprehensive document management. You can track the status of your documents, set reminders, and automate workflows to streamline the signing process. All these features contribute to a faster and smarter way of handling your legal documents.

-

Can I store my Non Foreign Affidavit Under IRC 1445 Georgia securely with airSlate SignNow?

Absolutely! airSlate SignNow ensures that all your Non Foreign Affidavit Under IRC 1445 Georgia documents are stored securely with bank-level encryption. You can access your documents anytime and anywhere, providing peace of mind knowing that your sensitive information is protected against unauthorized access.

-

Does airSlate SignNow integrate with other tools for managing Non Foreign Affidavit Under IRC 1445 Georgia?

Yes, airSlate SignNow boasts seamless integrations with various productivity and document management tools, such as Google Drive, Dropbox, and Microsoft Office. This allows you to enhance your workflow while dealing with Non Foreign Affidavit Under IRC 1445 Georgia documents. Integration capabilities make it easy to sync your documents and manage everything from one central location.

-

What are the benefits of using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Georgia?

Utilizing airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Georgia can signNowly speed up your document processes, reduce operational costs, and enhance collaboration among all parties involved. The platform is intuitive, which means less training time and faster adoption. Overall, it simplifies complex legal transactions, saving both time and resources.

Get more for Non Foreign Affidavit Under IRC 1445 Georgia

- Tidal prediction form

- Form 6 driving license download

- Alumni registration form

- Affidavit of good moral character form

- Police codes texas form

- Puppy application form 15423

- Physical examination record for foreigner name sex form

- For presentation to the export control authorities of the federal republic of germany form

Find out other Non Foreign Affidavit Under IRC 1445 Georgia

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free

- Sign Tennessee Joint Venture Agreement Template Free