Contractor Affidavit of Completion Form

What is the Contractor Affidavit of Completion

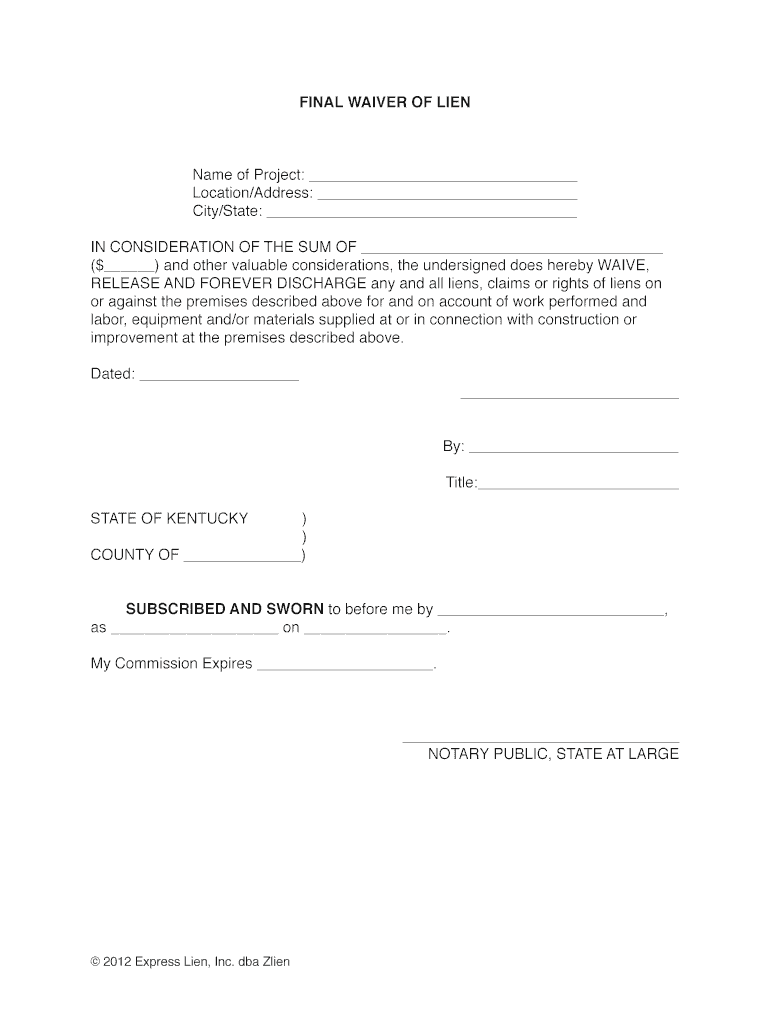

The Contractor Affidavit of Completion is a legal document that certifies the completion of work on a construction project. It serves as a formal declaration by the contractor that all contracted work has been finished in accordance with the terms of the contract. This affidavit is essential for ensuring that all parties involved are aware of the project's status and can proceed with any subsequent steps, such as final payments or inspections. It is particularly important in the context of construction law, as it may be required to release lien rights or to fulfill contractual obligations.

Key Elements of the Contractor Affidavit of Completion

A well-drafted Contractor Affidavit of Completion should include several key elements to ensure its legal validity and clarity. These elements typically encompass:

- Contractor Information: Name, address, and contact details of the contractor.

- Project Details: Description of the project, including location and scope of work completed.

- Completion Statement: A clear statement confirming that the work has been completed as per the contract.

- Signatures: Signatures of the contractor and any necessary witnesses or notaries to validate the document.

- Date: The date on which the affidavit is executed.

Steps to Complete the Contractor Affidavit of Completion

Completing the Contractor Affidavit of Completion involves several straightforward steps. Following these steps can help ensure that the affidavit is filled out correctly and meets all legal requirements:

- Gather Information: Collect all necessary details about the project, including the contract and any relevant documentation.

- Fill Out the Affidavit: Accurately complete the affidavit form, ensuring all required fields are filled in.

- Review for Accuracy: Double-check the information provided for any errors or omissions.

- Obtain Signatures: Have the contractor and any required witnesses or notaries sign the affidavit.

- Submit the Affidavit: File the completed affidavit with the appropriate parties, which may include the client or local government authorities.

Legal Use of the Contractor Affidavit of Completion

The legal use of the Contractor Affidavit of Completion is critical in protecting the rights of contractors and property owners. This affidavit can be used to:

- Establish proof of completion for payment purposes.

- Release any liens that may have been placed on the property during the construction process.

- Serve as a formal record that may be referenced in case of disputes regarding project completion.

- Facilitate the transfer of ownership or final acceptance of the project by the client.

State-Specific Rules for the Contractor Affidavit of Completion

Each state in the U.S. may have specific rules and regulations governing the use of the Contractor Affidavit of Completion. It is essential for contractors to be aware of these state-specific requirements to ensure compliance. Some common variations may include:

- Notarization Requirements: Some states may require the affidavit to be notarized to be legally binding.

- Filing Procedures: Different states may have unique procedures for submitting the affidavit, including deadlines and required forms.

- Content Specifications: Certain jurisdictions may mandate specific language or clauses to be included in the affidavit.

Examples of Using the Contractor Affidavit of Completion

Real-world examples can illustrate how the Contractor Affidavit of Completion is utilized in various scenarios:

- Residential Projects: A contractor completes a home renovation and submits the affidavit to the homeowner to finalize payment.

- Commercial Developments: A contractor finishes a commercial building and files the affidavit with local authorities to obtain occupancy permits.

- Public Works: For government contracts, the affidavit may be required to confirm that all work has been completed before final disbursement of funds.

Quick guide on how to complete contractor affidavit of completion form

Complete Contractor Affidavit Of Completion effortlessly on any device

Online document management has gained popularity with companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Contractor Affidavit Of Completion on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Contractor Affidavit Of Completion without hassle

- Obtain Contractor Affidavit Of Completion and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you choose. Edit and eSign Contractor Affidavit Of Completion and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

-

How do I fill out Form B under the Insolvency and Bankruptcy code? Does the affidavit require a stamp paper?

Affidavit is always on stamp paper

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

If someone gives the wrong date of birth while filling out the NDA form, can it be corrected at the time of SSB by an affidavit or something?

Yes bro it can be, but for that u have to request upsc for that. You have to send an email or you have to go personally there. But as per my experience they will not allow you to appear in sab.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

Which GST form should I fill out for filing a return as a building work contractor?

You need to file GSTR 3b and GSTR 1 ,if it government contract make sure to claim INPUT for TDS deducted amount.

Create this form in 5 minutes!

How to create an eSignature for the contractor affidavit of completion form

How to generate an electronic signature for your Contractor Affidavit Of Completion Form in the online mode

How to generate an electronic signature for the Contractor Affidavit Of Completion Form in Google Chrome

How to create an electronic signature for putting it on the Contractor Affidavit Of Completion Form in Gmail

How to make an eSignature for the Contractor Affidavit Of Completion Form straight from your smart phone

How to generate an electronic signature for the Contractor Affidavit Of Completion Form on iOS

How to generate an electronic signature for the Contractor Affidavit Of Completion Form on Android

People also ask

-

What is an affidavit of completion?

An affidavit of completion is a legal document that verifies the fulfillment of specific requirements or obligations. In the context of airSlate SignNow, it can be generated and signed electronically, ensuring a seamless and efficient process for businesses needing to complete their documentation.

-

How can I create an affidavit of completion using airSlate SignNow?

Creating an affidavit of completion with airSlate SignNow is straightforward. Simply upload your document template, customize it as needed, and utilize our electronic signature feature to collect signatures from all parties, ensuring your document is legally binding.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Each plan includes features like creating an affidavit of completion, electronic signatures, and document management tools, allowing you to choose the best fit for your operational needs.

-

Are there any specific features for managing affidavits of completion?

Yes, airSlate SignNow includes several features tailored to managing affidavits of completion efficiently. Users can track document status, set reminders for signatures, and utilize templates for quicker turnaround times, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for affidavits of completion?

Using airSlate SignNow for affidavits of completion streamlines the document signing process. It offers enhanced security, saves time with digital workflows, and reduces the need for physical paperwork, making it an eco-friendly option for your business.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to incorporate your affidavit of completion workflow into existing systems. This interconnectivity boosts productivity and helps maintain consistent business operations.

-

Is there a mobile app available for airSlate SignNow?

Yes, airSlate SignNow offers a mobile application that enables you to create, sign, and manage your affidavit of completion on the go. With the app, you have the flexibility to handle important documents anytime, anywhere, enhancing your efficiency.

Get more for Contractor Affidavit Of Completion

- Recorder of county wyoming on date the following described form

- New legislation center for agricultural law and taxation form

- What are your rights in joint tenant propertyus legal form

- Amendment for an effective financing statement wyoming form

- Ucc financing statement addendum form ucc1ad rev

- Wwwiacaorgwp contentuploadsucc11pdf form

- Ucc financing statement amendment addendum form ucc3ad rev

- Legal forms uslf are not a substitute for the advice of an

Find out other Contractor Affidavit Of Completion

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template