Hawaii Lien Form

What is the Hawaii Lien

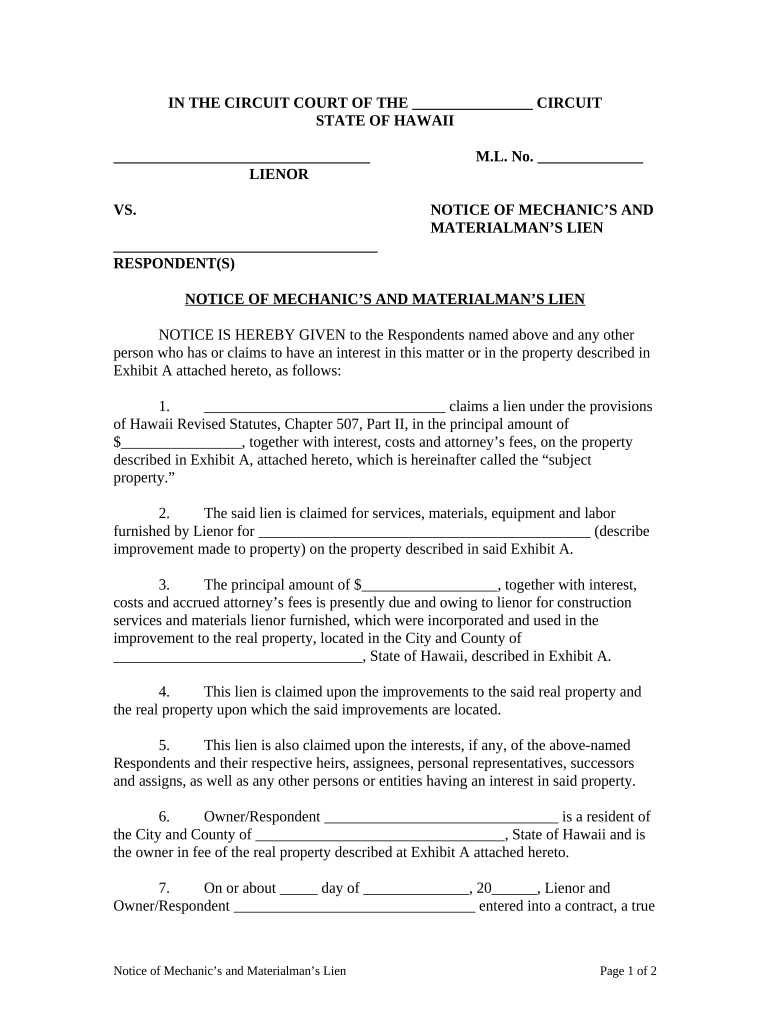

The Hawaii lien is a legal claim against a property or asset, typically used to secure the payment of a debt or obligation. This lien serves as a public notice that the property is encumbered, which can affect the owner's ability to sell or refinance the property. In Hawaii, liens can arise from various situations, including unpaid taxes, contractor services, or other financial obligations. Understanding the nature of this lien is essential for property owners and creditors alike, as it establishes the rights and responsibilities associated with the property in question.

How to use the Hawaii Lien

To utilize the Hawaii lien effectively, a creditor must first ensure that the lien is properly filed with the appropriate county office. This involves preparing the necessary documentation that outlines the debt and the property involved. Once filed, the lien acts as a legal claim, allowing the creditor to pursue collection efforts if the debt remains unpaid. It is crucial for creditors to follow the legal procedures outlined by Hawaii law to maintain the validity of the lien and to protect their rights in any potential disputes.

Steps to complete the Hawaii Lien

Completing the Hawaii lien involves several key steps:

- Gather Information: Collect all relevant details about the debt, including the debtor's information and the amount owed.

- Prepare Documentation: Draft the lien document, ensuring it includes all necessary information, such as the description of the property and the nature of the debt.

- File the Lien: Submit the completed lien form to the appropriate county office where the property is located.

- Notify the Debtor: Inform the debtor about the lien filing, which is a legal requirement in many cases.

- Maintain Records: Keep copies of all documents related to the lien for future reference and potential legal proceedings.

Legal use of the Hawaii Lien

The legal use of the Hawaii lien is governed by state laws that outline how liens can be established and enforced. Creditors must adhere to these laws to ensure that their liens are valid and enforceable. This includes proper filing procedures, notification requirements, and compliance with any applicable statutes of limitations. Failure to follow legal guidelines may result in the lien being deemed invalid, which can jeopardize the creditor's ability to collect the owed amount.

Key elements of the Hawaii Lien

Several key elements define the Hawaii lien:

- Debtor Information: The name and address of the individual or entity responsible for the debt.

- Property Description: A detailed description of the property subject to the lien, including its location and legal boundaries.

- Amount Owed: The total amount of the debt that the lien secures.

- Filing Date: The date the lien is filed, which can impact the priority of the lien in relation to other claims.

- Creditor Information: The name and contact details of the creditor or entity filing the lien.

Filing Deadlines / Important Dates

Understanding filing deadlines and important dates is crucial for maintaining the effectiveness of the Hawaii lien. Typically, liens must be filed within a specific timeframe after the debt becomes due. Additionally, creditors should be aware of any deadlines for renewing or enforcing the lien to avoid losing their rights. Keeping track of these dates ensures that creditors can act promptly and protect their interests in the property.

Quick guide on how to complete hawaii lien 497304308

Complete Hawaii Lien seamlessly on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the right form and securely save it online. airSlate SignNow provides you with all the features necessary to create, modify, and eSign your documents quickly without delays. Handle Hawaii Lien on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Hawaii Lien effortlessly

- Obtain Hawaii Lien and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misfiled documents, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you choose. Edit and eSign Hawaii Lien to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a hawaii lien and how does it work with airSlate SignNow?

A hawaii lien is a legal claim against a property to secure payment of a debt or obligation. With airSlate SignNow, you can efficiently eSign documents related to hawaii liens, ensuring that all parties have a seamless experience throughout the process.

-

How can airSlate SignNow help me manage hawaii liens?

airSlate SignNow offers features that enable you to create, send, and sign hawaii lien documents quickly. Its user-friendly interface simplifies the management of liens, helping you maintain compliance and reducing the time spent on paperwork.

-

What are the pricing plans for using airSlate SignNow for hawaii lien documentation?

airSlate SignNow offers a variety of pricing plans tailored to meet different business needs, including those focusing on hawaii lien documentation. You can choose a plan that suits your usage, with options ranging from individual to enterprise solutions, ensuring cost-effectiveness for managing your liens.

-

Are there any specific features in airSlate SignNow for hawaii lien processing?

Yes, airSlate SignNow includes specific features for hawaii lien processing, such as customizable templates, real-time tracking, and automated reminders. These tools enhance your ability to manage liens effectively while minimizing the risk of errors in documentation.

-

Can I integrate airSlate SignNow with other tools to handle hawaii liens?

Absolutely! airSlate SignNow integrates seamlessly with various platforms like Google Drive and Salesforce, which can be particularly beneficial for handling hawaii liens. These integrations streamline your workflow, making document management easier and more efficient.

-

What benefits does airSlate SignNow provide for businesses dealing with hawaii liens?

Using airSlate SignNow for hawaii liens provides signNow benefits, including reduced processing time and improved accuracy in documentation. Additionally, the secure eSigning process helps ensure that your agreements are legally binding and easily auditable.

-

Is airSlate SignNow secure for handling sensitive hawaii lien documents?

Yes, airSlate SignNow prioritizes the security of your documents, including sensitive hawaii lien files. With advanced encryption and compliance with industry standards, you can trust that your eSigned documents are protected against unauthorized access.

Get more for Hawaii Lien

Find out other Hawaii Lien

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form