Individual Credit Application Hawaii Form

What is the Individual Credit Application Hawaii

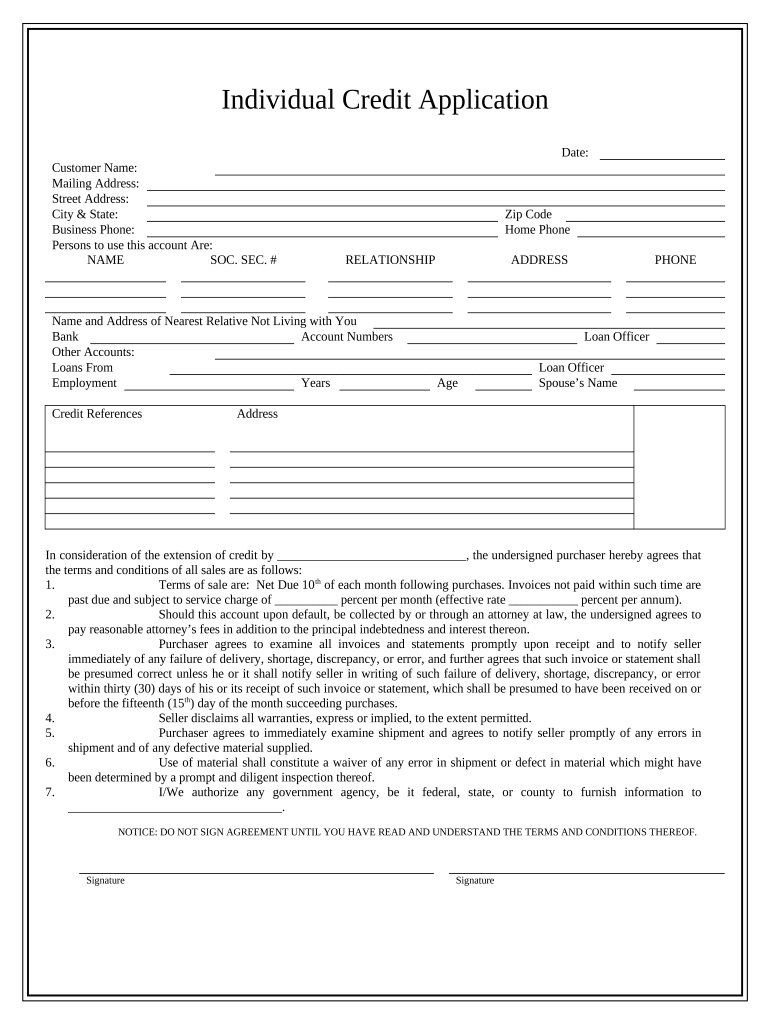

The Individual Credit Application Hawaii is a formal document used by individuals seeking credit from financial institutions or lenders in Hawaii. This application collects essential personal and financial information to assess the applicant's creditworthiness. It typically includes details such as the applicant's name, address, social security number, income, employment history, and existing debts. Understanding the purpose and components of this application is crucial for individuals looking to secure loans or credit lines in Hawaii.

Steps to complete the Individual Credit Application Hawaii

Completing the Individual Credit Application Hawaii involves several key steps to ensure accuracy and completeness. Follow these steps for a smooth application process:

- Gather necessary documents: Collect personal identification, proof of income, and details of existing debts.

- Fill out personal information: Provide your full name, address, and contact information accurately.

- Detail your financial information: Include your income sources, monthly expenses, and any outstanding loans or credit cards.

- Review the application: Double-check all entries for accuracy and completeness before submission.

- Submit the application: Depending on the lender, you may submit the application online, via mail, or in person.

Legal use of the Individual Credit Application Hawaii

The legal use of the Individual Credit Application Hawaii is governed by federal and state regulations. It is essential that the application is filled out truthfully and accurately, as providing false information can lead to legal consequences, including denial of credit or potential fraud charges. Additionally, lenders must comply with the Fair Credit Reporting Act (FCRA), ensuring that they handle applicants' personal information responsibly and securely.

Key elements of the Individual Credit Application Hawaii

Several key elements are essential to the Individual Credit Application Hawaii. These include:

- Personal Information: Name, address, and social security number.

- Employment Details: Current employer, position, and length of employment.

- Financial Information: Monthly income, expenses, and existing debts.

- Credit History: Information about previous loans, credit cards, and payment history.

Eligibility Criteria

Eligibility for the Individual Credit Application Hawaii typically depends on several factors, including:

- Age: Applicants must be at least eighteen years old.

- Residency: Applicants should reside in Hawaii or have a permanent address in the state.

- Income: Proof of stable income is usually required to demonstrate the ability to repay borrowed funds.

- Credit History: A good credit history may enhance the chances of approval.

Form Submission Methods

The Individual Credit Application Hawaii can be submitted through various methods, depending on the lender's preferences. Common submission methods include:

- Online Submission: Many lenders offer online portals for quick and secure application submissions.

- Mail: Applicants can print the completed application and send it via postal service.

- In-Person: Some lenders may require or allow applicants to submit the form in person at their offices.

Quick guide on how to complete individual credit application hawaii

Effortlessly Prepare Individual Credit Application Hawaii on Any Device

Digital document management has gained popularity among businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly and without interruptions. Manage Individual Credit Application Hawaii on any device using airSlate SignNow's Android or iOS applications and enhance your document-oriented processes today.

Efficiently Modify and Electronically Sign Individual Credit Application Hawaii with Ease

- Find Individual Credit Application Hawaii and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to preserve your updates.

- Select your preferred method to send your form, whether by email, SMS, invite link, or by downloading it to your computer.

Eliminate the hassles of lost or disorganized files, tedious form hunting, and mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device you prefer. Modify and eSign Individual Credit Application Hawaii and ensure clear communication throughout every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Individual Credit Application Hawaii and how does it work?

The Individual Credit Application Hawaii is a streamlined document used for assessing creditworthiness in Hawaii. With airSlate SignNow, you can easily fill out this application online, ensuring all necessary information is captured efficiently and effectively. Our platform enables you to eSign the document securely and smoothly, making the credit application process a breeze.

-

What are the key benefits of using airSlate SignNow for the Individual Credit Application Hawaii?

Using airSlate SignNow for the Individual Credit Application Hawaii offers numerous benefits, including enhanced security and quicker processing times. Our platform allows for easy collaboration, letting all parties involved access and sign the application from any device. Additionally, you can track the status of your documents in real-time, ensuring nothing falls through the cracks.

-

Is there a cost associated with using the Individual Credit Application Hawaii through airSlate SignNow?

Yes, there is a subscription fee for using airSlate SignNow, which varies based on the features you select. However, we believe our pricing is competitive because of the efficiency and time savings you gain when processing the Individual Credit Application Hawaii. Our plans are designed to fit different budgets, making it accessible for businesses of all sizes.

-

Can I integrate airSlate SignNow with other applications for the Individual Credit Application Hawaii?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, enhancing the functionality of the Individual Credit Application Hawaii. Whether you use CRM systems, project management tools, or cloud storage services, our integration options ensure you can work efficiently within your existing workflow.

-

What features does airSlate SignNow offer for the Individual Credit Application Hawaii?

airSlate SignNow provides an array of features for the Individual Credit Application Hawaii, including eSigning, document templates, and advanced security measures. You can customize your applications with specific fields, and our user-friendly interface ensures that all parties can navigate the process easily. Plus, our audit logs provide you with a detailed history of each transaction.

-

How secure is the Individual Credit Application Hawaii when using airSlate SignNow?

Security is our top priority when it comes to the Individual Credit Application Hawaii. airSlate SignNow employs bank-level encryption and complies with data protection regulations, ensuring your sensitive information is safeguarded. Additionally, our platform offers features such as two-factor authentication and secure document storage for added peace of mind.

-

How can I get started with the Individual Credit Application Hawaii on airSlate SignNow?

Getting started with the Individual Credit Application Hawaii on airSlate SignNow is simple! You can sign up for an account on our website, choose a pricing plan that suits your needs, and start creating your applications immediately. Our user-friendly interface and helpful resources make it easy to navigate the platform.

Get more for Individual Credit Application Hawaii

- The least you should know about english 13th edition pdf form

- Non federal direct deposit enrollment request form 100051005

- Wapda dpe past papers form

- Job offer letter format sample template for employment in doc and pdf

- Holt doctors time sheet form

- Homer vet form

- Band parent volunteer form

- Sts application form

Find out other Individual Credit Application Hawaii

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast