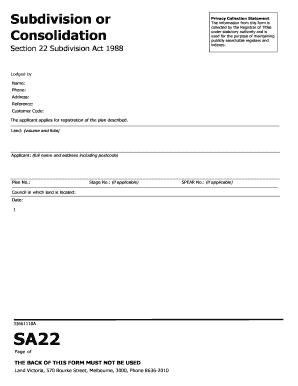

Sa22 Form 2008

What is the SA22 Form

The SA22 form is a document used primarily for tax purposes in the United States. It serves as a declaration of certain financial information required by the Internal Revenue Service (IRS) or state tax authorities. This form is essential for individuals or businesses to report income, deductions, and other relevant financial data accurately. Understanding the purpose and requirements of the SA22 form is crucial for compliance with tax regulations.

How to Use the SA22 Form

Using the SA22 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial records, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is advisable to review the form for any errors before submission. Once completed, the SA22 form can be submitted electronically or by mail, depending on the specific requirements of the tax authority.

Steps to Complete the SA22 Form

Completing the SA22 form requires attention to detail. Follow these steps for successful completion:

- Gather all required documentation, such as W-2s, 1099s, and receipts.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- List any deductions or credits you are eligible for.

- Review the completed form for accuracy.

- Submit the form according to the guidelines provided by the IRS or state tax authority.

Legal Use of the SA22 Form

The SA22 form must be used in compliance with applicable tax laws to ensure its legal standing. When filled out correctly, it serves as a legally binding document that reflects your financial situation to tax authorities. It is important to understand the legal implications of the information provided on the form, as inaccuracies can lead to penalties or audits. Ensure that all data is truthful and substantiated by your financial records.

Required Documents

To complete the SA22 form accurately, several documents are typically required:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses.

- Bank statements for income verification.

- Any previous tax returns for reference.

Form Submission Methods

The SA22 form can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online submission through the IRS website or authorized e-filing services.

- Mailing a paper copy of the form to the appropriate tax authority.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete sa22 form

Complete Sa22 Form effortlessly on any device

Digital document management has become widely embraced by organizations and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without holdups. Manage Sa22 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and eSign Sa22 Form with minimal effort

- Locate Sa22 Form and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you would like to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Sa22 Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sa22 form

Create this form in 5 minutes!

How to create an eSignature for the sa22 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form sa22 and how does it work?

The form sa22 is a specialized document designed for streamlined business transactions. With airSlate SignNow, users can easily fill out, sign, and send the form sa22 electronically, ensuring a quick and efficient workflow.

-

How much does it cost to use the form sa22 feature on airSlate SignNow?

Pricing for using the form sa22 on airSlate SignNow varies based on the subscription plan selected. We offer flexible pricing options that cater to different business sizes, ensuring that you get the best value for your use of the form sa22.

-

What features does airSlate SignNow offer for the form sa22?

airSlate SignNow provides a range of features for the form sa22, including customizable templates, secure eSigning capabilities, and advanced tracking options. These features enhance productivity and ensure that your documents are handled with care.

-

Are there any benefits to using airSlate SignNow for the form sa22?

Using airSlate SignNow for the form sa22 offers numerous benefits, such as reduced turnaround time for documents, enhanced security, and improved overall efficiency. This allows businesses to focus on their core activities while minimizing paperwork delays.

-

Can the form sa22 be integrated with other software?

Yes, the form sa22 can be seamlessly integrated with various business applications through airSlate SignNow’s API. This makes it easy to enhance your workflows and streamline the document management process across different platforms.

-

Is the form sa22 legally binding when signed electronically?

Absolutely! The form sa22 signed through airSlate SignNow is legally binding and compliant with eSignature laws. This ensures that your electronic agreements hold the same legal weight as traditional paper documents.

-

How can I access the form sa22 on airSlate SignNow?

You can easily access the form sa22 by signing up for an account on airSlate SignNow. Once registered, you can create, customize, and manage the form sa22 directly within the platform.

Get more for Sa22 Form

- Courtesy appointment form and procedures faculty

- Effective presentation in medical education and research form

- Faculty handbook for short term faculty led programs form

- 2019 2020 high school completion verification form

- Arnold 5 form

- Lbcc change form

- Homestay families manual chemeketa community college form

- Asu diploma request form

Find out other Sa22 Form

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online