Iowa Installments Fixed Rate Promissory Note Secured by Personal Property Iowa Form

What is the Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa

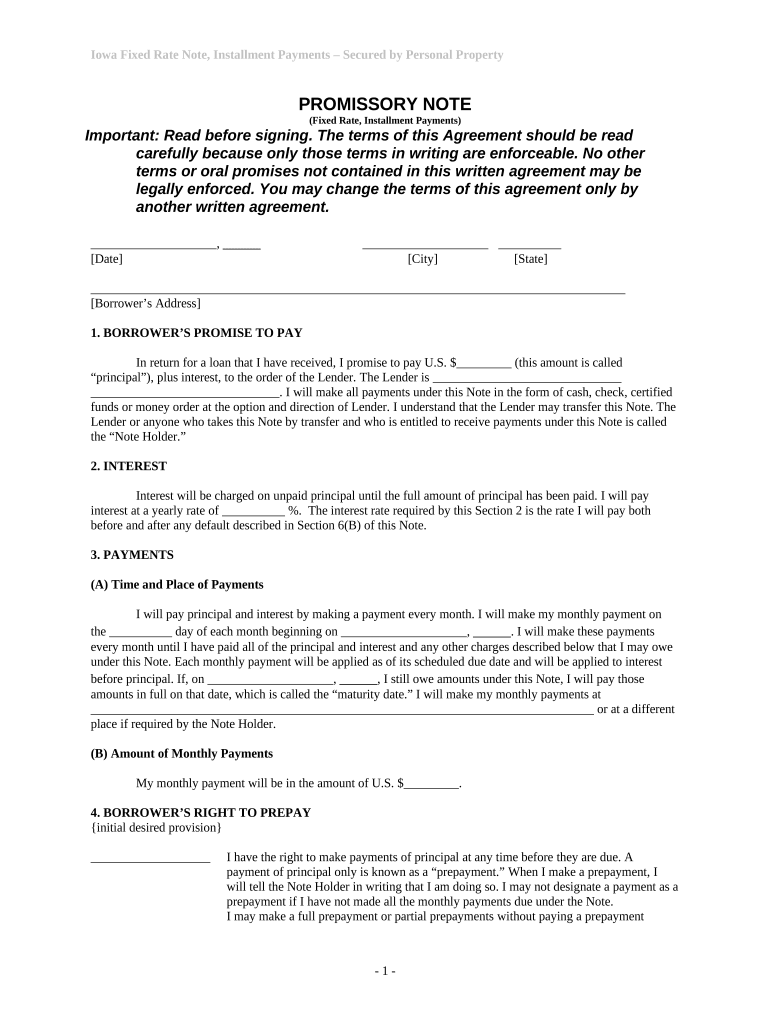

The Iowa Installments Fixed Rate Promissory Note Secured By Personal Property is a legal document used to formalize a loan agreement between a borrower and a lender. This note specifies that the loan will be repaid in fixed installments over a defined period, with interest applied at a predetermined rate. The term 'secured by personal property' indicates that the borrower offers personal property as collateral to ensure repayment. This means that if the borrower defaults on the loan, the lender has the right to seize the collateral to recover the owed amount.

Key Elements of the Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa

Several key elements must be included in the Iowa Installments Fixed Rate Promissory Note to ensure its validity and enforceability. These elements typically include:

- Borrower and Lender Information: Full names and addresses of both parties involved.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed interest rate applicable to the loan.

- Repayment Schedule: Detailed terms outlining the frequency and amount of each installment payment.

- Collateral Description: A clear description of the personal property securing the loan.

- Default Terms: Conditions under which the lender may declare the borrower in default.

Steps to Complete the Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa

Completing the Iowa Installments Fixed Rate Promissory Note involves several steps to ensure accuracy and compliance with legal standards. Follow these steps:

- Gather necessary information, including personal details of both parties and loan specifics.

- Clearly describe the collateral being used to secure the loan.

- Specify the loan amount and the fixed interest rate.

- Outline the repayment schedule, including payment amounts and due dates.

- Review the document for clarity and completeness.

- Both parties should sign the document in the presence of a notary public to ensure its legal standing.

Legal Use of the Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa

The legal use of the Iowa Installments Fixed Rate Promissory Note is crucial for protecting both the lender and the borrower. This document serves as a binding agreement that can be enforced in a court of law. To be legally binding, the note must comply with Iowa state laws regarding promissory notes and secured transactions. This includes ensuring that the terms are clear, that both parties understand their obligations, and that the collateral is properly documented.

How to Obtain the Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa

Obtaining the Iowa Installments Fixed Rate Promissory Note can be accomplished through various means. Many legal document services offer templates that can be customized to fit specific needs. Additionally, legal professionals can provide tailored assistance to ensure compliance with state laws. It is important to choose a reliable source to ensure the document meets all legal requirements and accurately reflects the agreement between the parties.

State-Specific Rules for the Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa

Each state has specific regulations governing promissory notes and secured transactions. In Iowa, it is essential to adhere to the Uniform Commercial Code (UCC) provisions regarding secured transactions. This includes proper documentation of the collateral and ensuring that the lender's security interest is perfected. Understanding these state-specific rules helps prevent legal disputes and ensures that the promissory note is enforceable in court.

Quick guide on how to complete iowa installments fixed rate promissory note secured by personal property iowa

Prepare Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to easily locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents promptly without interruptions. Manage Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centered workflow today.

The simplest way to alter and eSign Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa with ease

- Obtain Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Mark important sections of your documents or hide sensitive data using tools specifically designed for that by airSlate SignNow.

- Generate your signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select how you wish to send your form, be it via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Modify and eSign Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa to ensure seamless communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa?

An Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa is a legal document that outlines the terms of a loan where the borrower agrees to repay the loan in installments. This note is secured by personal property, providing peace of mind for lenders. Understanding its terms can help borrowers manage repayment effectively.

-

What are the benefits of using an Iowa Installments Fixed Rate Promissory Note?

Using an Iowa Installments Fixed Rate Promissory Note offers borrowers predictable monthly payments and helps in budgeting. It also secures the lender's investment, as the note is backed by personal property. This arrangement can lead to lower interest rates compared to unsecured loans.

-

How can I create an Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa?

Creating an Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa is straightforward with airSlate SignNow. You can easily customize templates to fit your needs and include essential terms, such as loan amount, interest rate, and payment schedule. Utilize our online tools for a hassle-free experience.

-

What are the costs associated with an Iowa Installments Fixed Rate Promissory Note?

The costs for an Iowa Installments Fixed Rate Promissory Note may vary depending on the lender's fees and interest rates. With airSlate SignNow, you can minimize costs by using our affordable eSigning solutions. Always review the total cost of borrowing to understand your financial commitment.

-

Is it necessary to have legal assistance for an Iowa Installments Fixed Rate Promissory Note?

While it is not legally required to have an attorney, seeking legal advice when drafting an Iowa Installments Fixed Rate Promissory Note can ensure all legalities are correctly followed. This is especially important to protect your interests and understand your obligations. AirSlate SignNow provides templates that can help streamline this process.

-

Can I customize my Iowa Installments Fixed Rate Promissory Note?

Absolutely! With airSlate SignNow, you can fully customize your Iowa Installments Fixed Rate Promissory Note to include specific terms that meet your financial needs. This allows for flexibility in payment schedules, interest rates, and other conditions. Personalization ensures the agreement is beneficial for both parties.

-

What integrations does airSlate SignNow offer for managing promissory notes?

airSlate SignNow integrates seamlessly with other business applications, allowing you to manage your Iowa Installments Fixed Rate Promissory Note within your existing workflow. Our platform connects with CRM systems, payment processors, and more, streamlining document management. This can enhance your overall business efficiency.

Get more for Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa

Find out other Iowa Installments Fixed Rate Promissory Note Secured By Personal Property Iowa

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now