Wisconsin Tax Form P 521

What is the Wisconsin Tax Form P 521

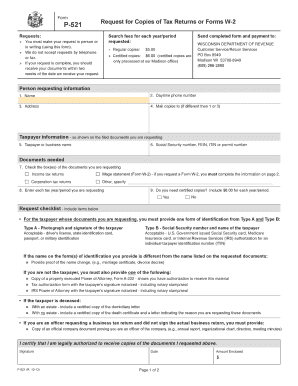

The Wisconsin Tax Form P 521 is a specific document utilized for tax purposes within the state of Wisconsin. This form is primarily designed for individuals and entities to report certain financial information to the Wisconsin Department of Revenue. It is essential for ensuring compliance with state tax regulations and for the accurate calculation of tax liabilities. Understanding the purpose and requirements of the P 521 form is crucial for taxpayers to avoid potential issues with their tax filings.

How to obtain the Wisconsin Tax Form P 521

To obtain the Wisconsin Tax Form P 521, taxpayers can visit the official website of the Wisconsin Department of Revenue. The form is typically available for download in a PDF format, which allows for easy printing and completion. Additionally, individuals may request a physical copy of the form by contacting the department directly. It is advisable to ensure that you are using the most current version of the form to comply with the latest tax regulations.

Steps to complete the Wisconsin Tax Form P 521

Completing the Wisconsin Tax Form P 521 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, such as income statements and expense records. Next, carefully fill out each section of the form, providing accurate information as required. Pay special attention to any calculations, ensuring that they are correct. Once completed, review the form for any errors or omissions before submitting it to the Wisconsin Department of Revenue.

Legal use of the Wisconsin Tax Form P 521

The Wisconsin Tax Form P 521 is legally binding when completed and submitted according to state regulations. It is important for taxpayers to understand that providing false information on the form can lead to penalties and legal repercussions. To ensure the legal validity of the form, it is recommended to use a reliable electronic signature solution that complies with eSignature laws. This ensures that the submission is secure and recognized by the state as a legitimate document.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin Tax Form P 521 are crucial for compliance. Typically, the form must be submitted by a specific date each year, often coinciding with the general tax filing deadline. Taxpayers should be aware of these dates to avoid late penalties. It is advisable to check the Wisconsin Department of Revenue's website for the most current deadlines and any changes that may occur annually.

Form Submission Methods (Online / Mail / In-Person)

The Wisconsin Tax Form P 521 can be submitted through various methods, providing flexibility for taxpayers. The form can be filed online through the Wisconsin Department of Revenue's electronic filing system, which offers a convenient and efficient way to submit documents. Alternatively, taxpayers can mail the completed form to the appropriate address provided by the department. In-person submissions may also be possible at designated offices, allowing for direct interaction with tax officials.

Quick guide on how to complete wisconsin tax form p 521

Prepare Wisconsin Tax Form P 521 effortlessly on any device

Digital document management has become prevalent among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the features you require to create, modify, and eSign your files swiftly without delays. Manage Wisconsin Tax Form P 521 on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Wisconsin Tax Form P 521 with ease

- Locate Wisconsin Tax Form P 521 and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow meets all your needs in document management in just a few clicks from any device you prefer. Modify and eSign Wisconsin Tax Form P 521 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin tax form p 521

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 521 form, and why is it important?

A 521 form is a document often used for various business and administrative purposes, serving as a record for transactions. Understanding the significance of the 521 form helps ensure compliance with regulations and streamlines processes within organizations.

-

How can airSlate SignNow help me with the 521 form?

airSlate SignNow simplifies the process of creating, signing, and managing your 521 form. With our platform, you can easily prepare and send this document for electronic signatures, ensuring a smooth and efficient workflow.

-

Is there a cost associated with using airSlate SignNow for the 521 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans provide access to features that support managing and signing the 521 form efficiently, making it a cost-effective solution.

-

What features does airSlate SignNow offer for the 521 form?

airSlate SignNow includes features like customizable templates, advanced document tracking, and secure e-signatures for your 521 form. These tools enhance user experience, ensuring that your documents are processed quickly and securely.

-

Can I integrate airSlate SignNow with other applications for managing the 521 form?

Yes, airSlate SignNow offers seamless integrations with various applications such as Google Drive, Salesforce, and Zapier. This enables users to streamline their workflows further while managing the 521 form and enhancing overall efficiency.

-

What benefits can I expect from using airSlate SignNow for the 521 form?

Using airSlate SignNow for your 521 form provides benefits such as reduced turnaround time for approvals, improved accuracy, and enhanced document security. These advantages help businesses operate more effectively and with less risk.

-

Is airSlate SignNow user-friendly for handling the 521 form?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, allowing users of all technical skill levels to manage the 521 form effortlessly. Its intuitive interface makes it easy to navigate and complete tasks quickly.

Get more for Wisconsin Tax Form P 521

- Contracts for deed and lease option agreements ghrist law form

- Fillable online texas sellers disclosure of financing terms form

- Uh oh does my purchase and sale agreement dla piper form

- Names of persons acknowledging form

- Form 201general information certificate of formationfor

- Form 204general information certificate of formation

- May be formed and governed only as a nonprofit corporation under the boc and not as a for profit

- Fillable online form 205 general information certificate of

Find out other Wisconsin Tax Form P 521

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure