Form 9465 Installment Agreement Request

What is the Form 9465 Installment Agreement Request

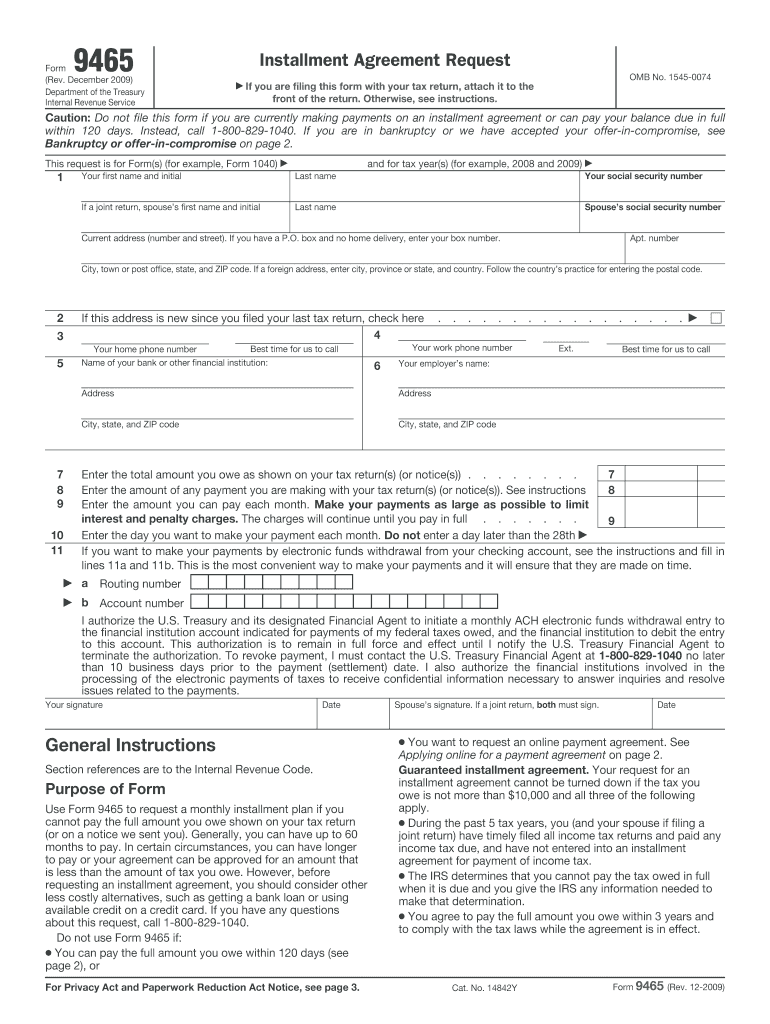

The Form 9465, officially known as the Installment Agreement Request, is a document used by taxpayers in the United States to request a monthly payment plan with the IRS for unpaid tax liabilities. This form is essential for individuals who cannot pay their tax debt in full at the time of filing. By submitting this form, taxpayers can propose a manageable payment schedule that allows them to settle their debts over time while avoiding more severe penalties and interest charges.

Steps to Complete the Form 9465 Installment Agreement Request

Completing the Form 9465 involves several straightforward steps:

- Begin by providing your personal information, including your name, address, and Social Security number.

- Indicate the amount you owe to the IRS and the proposed monthly payment you can afford.

- Specify the day of the month you would like the IRS to debit your bank account for the payment.

- Sign and date the form to confirm your request.

- Review the completed form for accuracy before submission.

How to Obtain the Form 9465 Installment Agreement Request

The Form 9465 can be easily obtained from the IRS website. It is available as a downloadable PDF, which allows you to print and fill it out manually. Additionally, you can request a physical copy by contacting the IRS directly or visiting a local IRS office. Ensure you have the most current version of the form to avoid any processing delays.

Eligibility Criteria for the Form 9465 Installment Agreement Request

To qualify for an installment agreement using Form 9465, taxpayers must meet specific criteria:

- The total tax debt must not exceed $50,000.

- Taxpayers must be current with all filing requirements.

- Individuals must not have previously defaulted on an installment agreement.

Meeting these criteria is essential for the IRS to approve the payment plan request.

Form Submission Methods

The completed Form 9465 can be submitted to the IRS in several ways:

- Online through the IRS website if you are eligible for online payment agreements.

- By mail to the address specified in the form instructions, typically based on your location.

- In-person at a local IRS office, where you can receive assistance if needed.

IRS Guidelines for Payment Plans

The IRS provides specific guidelines regarding payment plans that taxpayers must adhere to when submitting Form 9465. These guidelines include maintaining timely payments, keeping the IRS updated on any changes in contact information, and ensuring that all future tax returns are filed on time. Failure to comply with these guidelines may result in the cancellation of the payment plan.

Quick guide on how to complete form 9465 installment agreement request

Prepare Form 9465 Installment Agreement Request effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary template and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly without interruptions. Manage Form 9465 Installment Agreement Request on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to revise and eSign Form 9465 Installment Agreement Request without any hassle

- Locate Form 9465 Installment Agreement Request and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with the tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow satisfies all your document management requirements in just a few clicks from any device you prefer. Revise and eSign Form 9465 Installment Agreement Request and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is the best course of action if I owe back taxes I cannot afford to pay?

See http://www.irs.gov/taxtopics/tc2.... If you owe less than $25,000, you probably should fill out and submit Form 9465, Request for Installment Agreement, see http://www.irs.gov/pub/irs-pdf/f.... You can make this request online as well, http://www.irs.gov/individuals/a.... If you owe more than $25,000, you will probably have to provide the IRS with a Collection Information Statement, Form 433-A, http://www.irs.gov/pub/irs-pdf/f..., so that the IRS can assess how much you can actually pay.I would also urge you to seek out an enrolled agent or a CPA who specializes in tax matters in your area; he/she can advise you on your best course of action and can represent you before the IRS should that become necessary.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

Do military personnel need money to fill out a leave request form?

It’s great that you asked. The answer is NO. Also, whatever you are doing with this person, STOP!Bloody hell, how many of these “I need your money to see you sweetheart” scammers are there? It’s probably that or someone totally misunderstood something.All military paperwork is free! However, whether their commander or other sort of boss will let them return or not depends on the nature of duty, deployment terms, and other conditions. They can’t just leave on a whim, that would be desertion and it’s (sorry I don’t know how it works in America) probably punishable by firing (as in termination of job) or FIRING (as in execution)!!!Soldiers are generally paid enough to fly commercial back to home country.Do not give these people any money or any contact information! If you pay him, you’ll probably get a receipt from Nigeria and nothing else.

-

Does a girlfriend have to fill out a leave request form for a US Army Soldier in Special Operations in Africa?

Let me guess, you've been contacted via email by somebody you’ve never met. they've told you a story about being a deployed soldier. At some stage in the dialogue they’ve told you about some kind of emotional drama, sick relative/kid etc. They tell you that because they are in a dangerous part of the world with no facilities they need you to fill in a leave application for them. Some part of this process will inevitably involve you having to pay some money on their behalf. The money will need to be paid via ‘Western Union’. Since you havent had much involvement with the military in the past you dont understand and are tempted to help out this poor soldier. they promise to pay you back once they get back from war.if this sounds familiar you are being scammed. There is no soldier just an online criminal trying to steal your money. If you send any money via Western Union it is gone, straight into the pockets of the scammer. you cant get it back, it is not traceable, this is why scammers love Western Union. They aernt going to pay you back, once they have your money you will only hear from them again if they think they can double down and squeeze more money out of you.Leave applications need to be completed by soldiers themselves. They are normally approved by their unit chain of command. If there is a problem the soldier’s commander will summon them internally to resolve the issue. This is all part of the fun of being a unit commander!! If the leave is not urgent they will wait for a convenient time during a rotation etc to work out the problems, if the leave is urgent (dying parent/spouse/kid etc) they will literally get that soldier out of an operational area ASAP. Operational requirements come first but it would need to be something unthinkable to prevent the Army giving immediate emergency leave to somebody to visit their dying kid in hospital etc.The process used by the scammers is known as ‘Advance fee fraud’ and if you want to read about the funny things people do to scam the scammers have a read over on The largest scambaiting community on the planet!

Create this form in 5 minutes!

How to create an eSignature for the form 9465 installment agreement request

How to generate an eSignature for the Form 9465 Installment Agreement Request in the online mode

How to generate an electronic signature for the Form 9465 Installment Agreement Request in Google Chrome

How to generate an eSignature for signing the Form 9465 Installment Agreement Request in Gmail

How to create an eSignature for the Form 9465 Installment Agreement Request from your smart phone

How to create an eSignature for the Form 9465 Installment Agreement Request on iOS devices

How to generate an eSignature for the Form 9465 Installment Agreement Request on Android OS

People also ask

-

What is the Form 9465 Installment Agreement Request?

The Form 9465 Installment Agreement Request is a tax form used to request an installment agreement with the IRS for paying off tax liabilities over time. This form allows taxpayers to propose a monthly payment plan, making it easier to manage tax debts without facing immediate financial strain.

-

How can I fill out the Form 9465 Installment Agreement Request using airSlate SignNow?

With airSlate SignNow, you can easily fill out the Form 9465 Installment Agreement Request online. Our user-friendly interface allows you to complete the form efficiently, and you can eSign and send it directly to the IRS, streamlining the entire process.

-

Is there a cost associated with using airSlate SignNow for the Form 9465 Installment Agreement Request?

Yes, while airSlate SignNow offers a range of pricing plans, we provide a cost-effective solution for managing documents, including the Form 9465 Installment Agreement Request. You can choose a plan that fits your needs, ensuring you get the best value for your eSigning and document management requirements.

-

What features does airSlate SignNow offer for managing the Form 9465 Installment Agreement Request?

airSlate SignNow provides several features to enhance your experience with the Form 9465 Installment Agreement Request, including customizable templates, real-time tracking, and secure cloud storage. These features ensure that your document is handled efficiently and securely throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for the Form 9465 Installment Agreement Request?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enhancing your workflow when dealing with the Form 9465 Installment Agreement Request. Whether you use CRM systems or project management tools, you can connect your accounts for a streamlined experience.

-

What are the benefits of using airSlate SignNow for the Form 9465 Installment Agreement Request?

Using airSlate SignNow for the Form 9465 Installment Agreement Request provides numerous benefits, including quick eSigning, improved document security, and easy access from any device. This ensures you can manage your tax agreements efficiently and with confidence.

-

How long does it take to process the Form 9465 Installment Agreement Request with airSlate SignNow?

The processing time for the Form 9465 Installment Agreement Request largely depends on the IRS's workload. However, using airSlate SignNow can expedite the submission process, allowing you to send your request electronically and securely, which may lead to quicker responses.

Get more for Form 9465 Installment Agreement Request

Find out other Form 9465 Installment Agreement Request

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy