Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children Iowa

What is the Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa

The Legal Last Will and Testament Form for a widow or widower with adult and minor children in Iowa is a crucial legal document that outlines how a person's assets and responsibilities will be managed after their death. This form is specifically designed to address the unique needs of individuals who have lost a spouse and have children of varying ages. It ensures that the deceased's wishes are honored regarding the distribution of their estate, guardianship of minor children, and other important matters. This form serves as a legal declaration of intent, providing clarity and direction for surviving family members and the courts.

Key Elements of the Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa

Several key elements must be included in the Legal Last Will and Testament Form for a widow or widower with adult and minor children in Iowa:

- Testator Information: The full name and address of the individual creating the will.

- Executor Appointment: Designation of a trusted person to carry out the terms of the will.

- Asset Distribution: Clear instructions on how assets should be divided among beneficiaries.

- Guardianship Provisions: Designation of guardians for minor children, ensuring their care and upbringing.

- Witness Requirements: Signatures of witnesses to validate the will, as per Iowa state law.

- Revocation Clause: A statement that revokes any previous wills or codicils.

Steps to Complete the Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa

Completing the Legal Last Will and Testament Form for a widow or widower with adult and minor children in Iowa involves several important steps:

- Gather Information: Collect details about your assets, liabilities, and beneficiaries.

- Choose an Executor: Decide who will manage your estate and carry out your wishes.

- Draft the Will: Use the form to outline your wishes clearly, ensuring all key elements are included.

- Review and Revise: Carefully review the document for accuracy and completeness.

- Sign and Witness: Sign the will in the presence of at least two witnesses, who must also sign.

- Store Safely: Keep the original document in a secure location, such as a safe or with your attorney.

Legal Use of the Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa

The Legal Last Will and Testament Form for a widow or widower with adult and minor children in Iowa is legally binding when executed according to state laws. To ensure its validity, the document must be signed by the testator and witnessed by at least two individuals who are not beneficiaries. Additionally, the will should comply with Iowa's specific requirements regarding language, format, and content. This legal framework ensures that the testator's wishes are respected and upheld by the probate court, providing peace of mind to the surviving family members.

How to Use the Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa

Using the Legal Last Will and Testament Form for a widow or widower with adult and minor children in Iowa is a straightforward process. First, obtain the form from a reliable source, ensuring it is tailored to Iowa's legal requirements. Next, fill out the form with accurate information regarding your assets, beneficiaries, and any guardianship designations. Once completed, review the document for clarity and accuracy. Finally, sign the will in the presence of witnesses to validate it legally. This process will help ensure that your wishes are clearly communicated and legally enforceable.

State-Specific Rules for the Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa

In Iowa, specific rules govern the creation and execution of the Legal Last Will and Testament Form for a widow or widower with adult and minor children. The state requires that the will be in writing, signed by the testator, and witnessed by at least two individuals who are not named as beneficiaries. Additionally, Iowa recognizes holographic wills, which are handwritten and signed by the testator, but these must still meet certain criteria to be considered valid. Understanding these state-specific rules is essential for ensuring the will's enforceability and compliance with Iowa law.

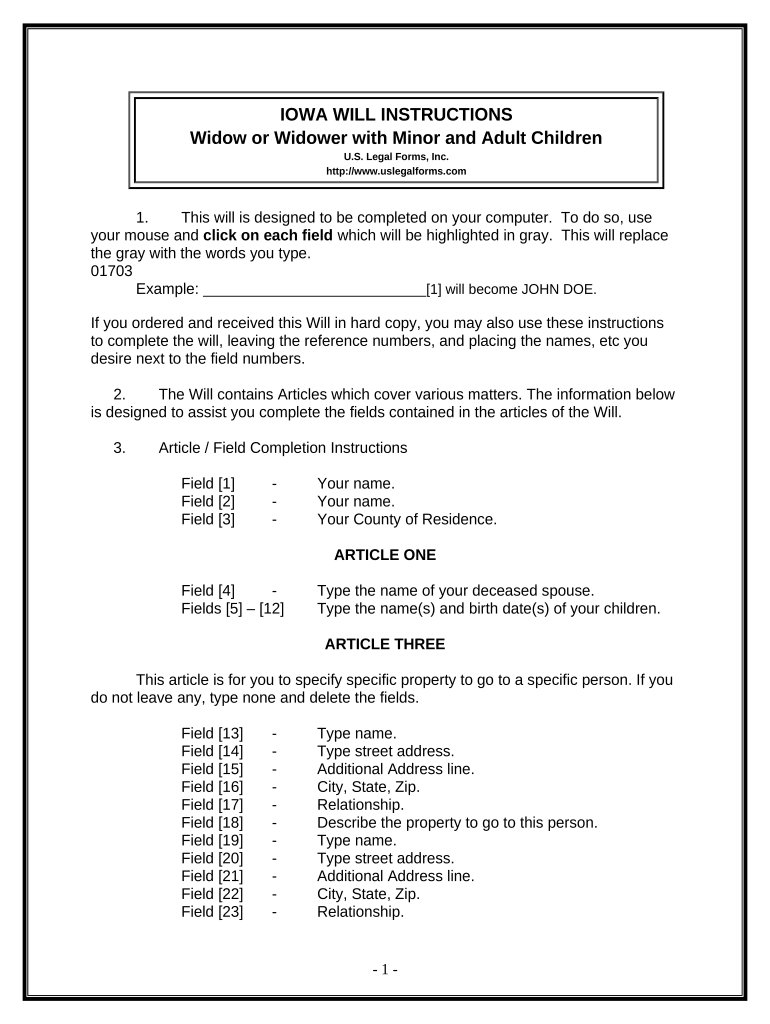

Quick guide on how to complete legal last will and testament form for a widow or widower with adult and minor children iowa

Complete Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa with ease

- Find Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal authority as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and electronically sign Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa?

A Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa is a legal document that outlines how a person's assets and responsibilities are to be managed after their passing. This form ensures that the wishes of the deceased regarding the distribution of their estate are honored, particularly catering to the needs of widows or widowers with both adult and minor children.

-

How can I create a Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa using airSlate SignNow?

Creating a Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa is simple with airSlate SignNow. You can use our intuitive interface to fill in the necessary details. Once completed, you can eSign the document and store it securely within our platform.

-

What are the benefits of using airSlate SignNow for a Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa?

Using airSlate SignNow for your Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa offers convenience, security, and cost effectiveness. You can complete the document from the comfort of your home, ensuring it is done correctly, and have it securely stored and easily accessible whenever you need it.

-

Is there a cost associated with the Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa on airSlate SignNow?

Yes, there is a nominal fee associated with accessing the Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa on airSlate SignNow. We offer various pricing plans suitable for individuals and families, ensuring that everyone can find a solution that fits their budget.

-

Can I customize my Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa?

Absolutely! airSlate SignNow allows you to customize your Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa to meet your specific needs. You can add unique provisions and instructions to reflect your wishes accurately.

-

What integrations does airSlate SignNow offer for managing my Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa?

airSlate SignNow seamlessly integrates with leading tools and platforms to help you manage your Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa effectively. Whether you need to share the document with family members or financial advisors, our integrations simplify the collaboration process.

-

How secure is my Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa with airSlate SignNow?

Security is a top priority at airSlate SignNow. Your Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa is stored using advanced encryption technologies to ensure that your sensitive information remains safe and confidential.

Get more for Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa

- South carolina disclosure of ownership form

- Great eastern direct credit facility form

- Clark county property records wa renew hardship form

- Verified petition for visitation grandparents and third parties form

- Proposed parental responsibility plan form

- Proof of school dental examination form 789088479

- Status notice form escrow agents39 fidelity corporation eafc

- Vaccine incident report and worksheet 776175662 form

Find out other Legal Last Will And Testament Form For A Widow Or Widower With Adult And Minor Children Iowa

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online