Quitclaim Deed from Corporation to Individual Idaho Form

What is the Quitclaim Deed From Corporation To Individual Idaho

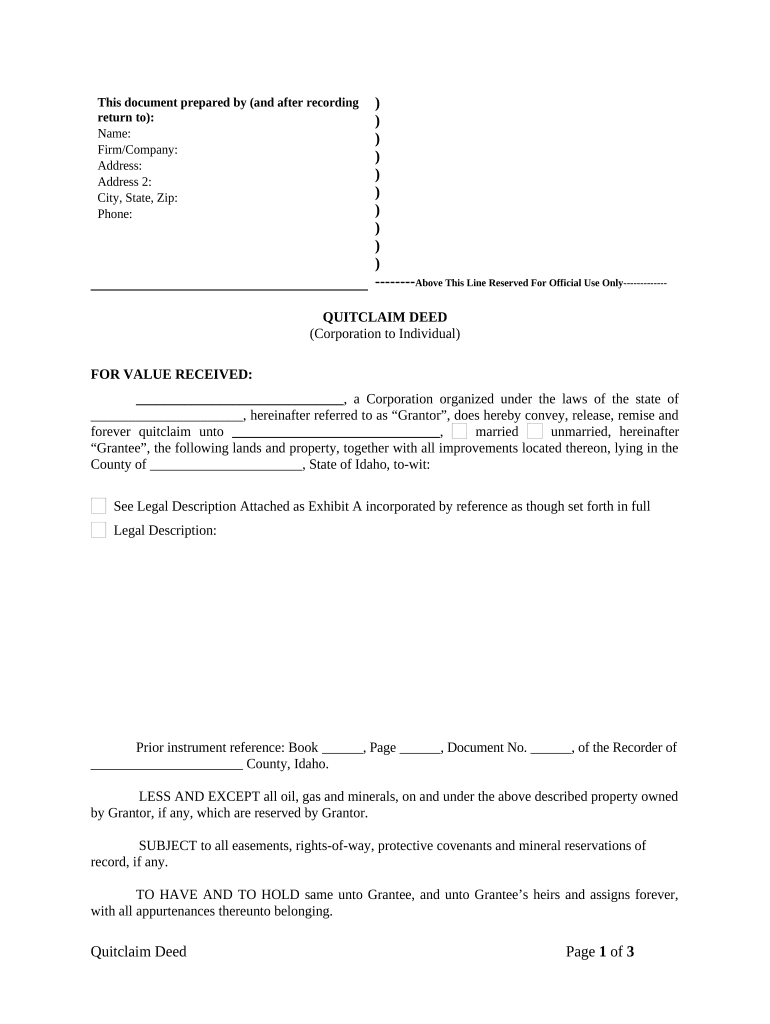

A quitclaim deed from a corporation to an individual in Idaho is a legal document that allows a corporation to transfer its interest in a property to an individual without making any warranties regarding the title. This type of deed is often used in situations where the transferring party does not wish to guarantee that the title is clear or free of encumbrances. It is commonly utilized in real estate transactions, particularly when the transfer is between related parties or for nominal consideration.

How to use the Quitclaim Deed From Corporation To Individual Idaho

To use a quitclaim deed from a corporation to an individual in Idaho, the corporation must first complete the deed form accurately. This includes identifying the property being transferred, the parties involved, and any relevant legal descriptions. Once the form is filled out, it must be signed by an authorized representative of the corporation. The individual receiving the property should also sign the deed. After signing, the deed must be recorded with the county recorder’s office to ensure the transfer is legally recognized.

Steps to complete the Quitclaim Deed From Corporation To Individual Idaho

Completing a quitclaim deed from a corporation to an individual in Idaho involves several key steps:

- Obtain the appropriate quitclaim deed form, which can often be found online or through legal resources.

- Fill in the names of the corporation and the individual, along with the legal description of the property.

- Have the authorized representative of the corporation sign the deed in the presence of a notary public.

- Ensure the individual also signs the deed, if required.

- Record the completed deed with the local county recorder’s office to finalize the transfer.

Key elements of the Quitclaim Deed From Corporation To Individual Idaho

Key elements of a quitclaim deed from a corporation to an individual in Idaho include:

- Parties Involved: Clearly identify the corporation and the individual receiving the property.

- Property Description: Provide a detailed legal description of the property being transferred.

- Consideration: State any consideration being exchanged, even if it is nominal.

- Signatures: Ensure that all necessary signatures are obtained, including those of the corporation's authorized representative.

- Notarization: The deed must be notarized to be valid.

State-specific rules for the Quitclaim Deed From Corporation To Individual Idaho

In Idaho, specific rules govern the use of quitclaim deeds. The deed must meet the state's legal requirements, including proper execution and recording. It should be signed by an authorized officer of the corporation, and the signature must be notarized. Additionally, the deed must be recorded in the county where the property is located to provide public notice of the transfer. Failure to comply with these rules may result in challenges to the validity of the deed.

Legal use of the Quitclaim Deed From Corporation To Individual Idaho

The legal use of a quitclaim deed from a corporation to an individual in Idaho is primarily for transferring property rights without warranties. This type of deed is often used in situations such as transferring property among family members, settling estate matters, or simplifying transactions where the parties know each other well. It is important to understand that a quitclaim deed does not protect the individual from claims against the property, so it is advisable to conduct a title search before accepting the deed.

Quick guide on how to complete quitclaim deed from corporation to individual idaho

Easily prepare Quitclaim Deed From Corporation To Individual Idaho on any device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your paperwork swiftly without delays. Handle Quitclaim Deed From Corporation To Individual Idaho on any device using the airSlate SignNow applications for Android or iOS and enhance any document-based workflow today.

How to edit and electronically sign Quitclaim Deed From Corporation To Individual Idaho effortlessly

- Obtain Quitclaim Deed From Corporation To Individual Idaho and select Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically supplies for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Quitclaim Deed From Corporation To Individual Idaho and ensure effective communication at any step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To Individual Idaho?

A Quitclaim Deed From Corporation To Individual Idaho is a legal document that allows a corporation to transfer its interest in a property to an individual without providing any warranties about the title. It is commonly used in real estate transactions to ensure a clean transfer of ownership. This deed effectively relinquishes any claims the corporation may have over the property.

-

How do I prepare a Quitclaim Deed From Corporation To Individual Idaho?

To prepare a Quitclaim Deed From Corporation To Individual Idaho, you'll need to gather essential information such as the legal description of the property, the names of the parties involved, and the signature of an authorized representative from the corporation. Utilizing airSlate SignNow can simplify this process, making it easy to create and eSign your document promptly.

-

What costs are involved in creating a Quitclaim Deed From Corporation To Individual Idaho?

The costs associated with creating a Quitclaim Deed From Corporation To Individual Idaho may include filing fees, notary fees, and any charges for legal assistance if needed. Using airSlate SignNow can help minimize these expenses as it is a cost-effective solution for document creation and eSigning, allowing users to manage their paperwork efficiently.

-

What are the benefits of using airSlate SignNow for a Quitclaim Deed From Corporation To Individual Idaho?

Using airSlate SignNow for a Quitclaim Deed From Corporation To Individual Idaho offers several benefits, including streamlined document preparation, user-friendly templates, and the ability to eSign securely. Additionally, the platform ensures compliance with Idaho's legal requirements, providing peace of mind during the transaction.

-

Can I eSign a Quitclaim Deed From Corporation To Individual Idaho?

Yes, you can eSign a Quitclaim Deed From Corporation To Individual Idaho using airSlate SignNow. The platform allows for secure electronic signatures, which are legally recognized in Idaho, ensuring that your document is valid and accepted by courts and other institutions.

-

Is it necessary to signNow my Quitclaim Deed From Corporation To Individual Idaho?

Yes, notarization is typically required for a Quitclaim Deed From Corporation To Individual Idaho to be legally binding. This step helps to verify the identity of the signatory and can prevent potential disputes. Using airSlate SignNow, you can easily connect with notary services to get your document signNowd remotely.

-

What integrations does airSlate SignNow offer for handling a Quitclaim Deed From Corporation To Individual Idaho?

airSlate SignNow offers various integrations with popular tools like Google Drive, Salesforce, and Microsoft Office. This allows users to manage their Quitclaim Deed From Corporation To Individual Idaho along with other documents seamlessly, enhancing productivity and collaboration in a single platform.

Get more for Quitclaim Deed From Corporation To Individual Idaho

Find out other Quitclaim Deed From Corporation To Individual Idaho

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy