Release of Lien by Posting of Surety Bond by Corporation or LLC Idaho Form

What is the Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho

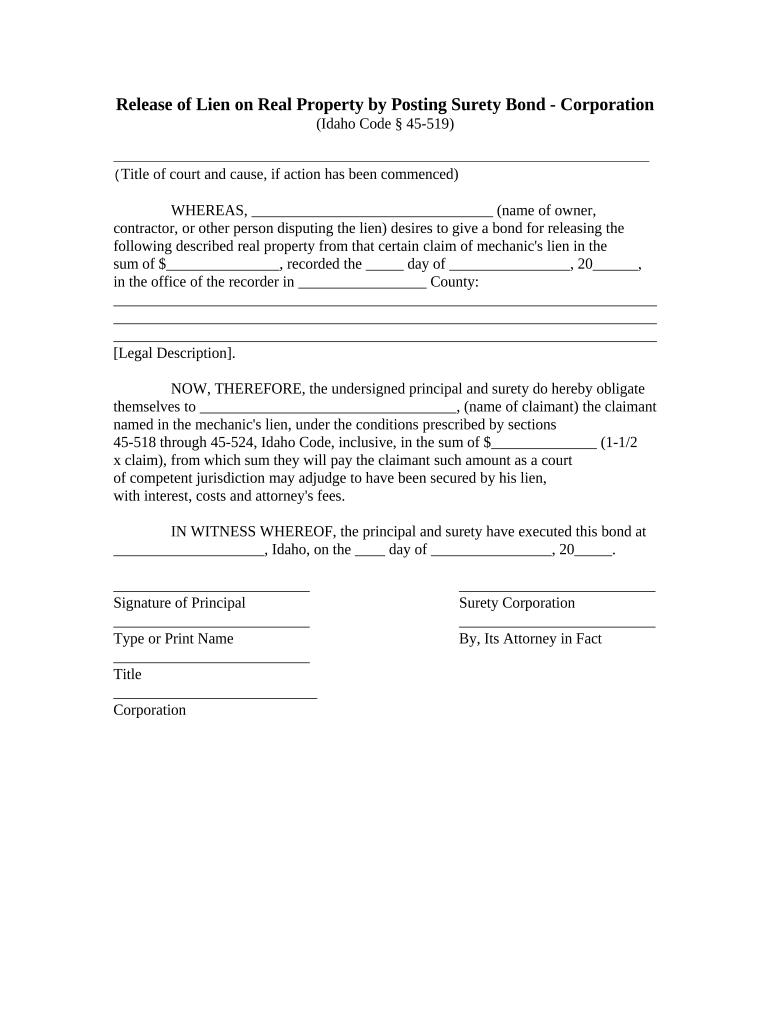

The release of lien by posting of surety bond by a corporation or LLC in Idaho is a legal process that allows a business entity to remove a lien placed against its property. A lien is a legal claim against an asset, typically used as security for a debt or obligation. By posting a surety bond, the corporation or LLC provides a financial guarantee that the lien will be satisfied, allowing for the release of the lien without the need for a lengthy court process. This mechanism is particularly useful in real estate and construction contexts, where liens can impede transactions and project progress.

Steps to Complete the Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho

Completing the release of lien by posting a surety bond involves several key steps:

- Identify the lien: Gather all relevant information about the lien, including the lienholder's details and the amount owed.

- Obtain a surety bond: Contact a surety company to acquire a bond that meets the requirements set by Idaho law.

- Prepare the release form: Fill out the necessary release of lien form, ensuring all details are accurate and complete.

- Submit the bond and form: File the surety bond and the release form with the appropriate county office where the lien was recorded.

- Confirm release: After submission, verify that the lien has been officially released from public records.

Legal Use of the Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho

The legal use of the release of lien by posting of surety bond is governed by Idaho state laws. This process is recognized as a valid method to clear liens, provided that all legal requirements are met. Corporations and LLCs must ensure that the surety bond is issued by a licensed surety company and that the bond amount covers the full value of the lien. Compliance with these legal stipulations is essential to avoid potential disputes or claims against the bond in the future.

State-Specific Rules for the Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho

Idaho has specific regulations regarding the release of liens through surety bonds. Key rules include:

- The surety bond must be filed in the same county where the lien was recorded.

- The bond amount typically needs to equal or exceed the amount of the lien.

- All parties involved must be notified of the bond posting to ensure transparency.

Understanding these state-specific rules is crucial for corporations and LLCs to navigate the process effectively.

Required Documents for the Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho

To successfully complete the release of lien by posting a surety bond, several documents are required:

- The original lien document that was recorded.

- A completed release of lien form, which can usually be obtained from the county recorder's office.

- The surety bond issued by a licensed surety company.

- Any additional documentation that may be required by the county, such as proof of payment or identification.

Examples of Using the Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho

There are various scenarios where a corporation or LLC might utilize the release of lien by posting a surety bond in Idaho:

- A construction company may face a mechanic's lien from a subcontractor. By posting a surety bond, they can continue work while resolving the payment dispute.

- A property owner may need to sell a property that has a lien for unpaid taxes. Posting a surety bond can facilitate the sale process by clearing the lien.

These examples illustrate how this process can be beneficial in maintaining business operations and property transactions.

Quick guide on how to complete release of lien by posting of surety bond by corporation or llc idaho

Finalize Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho easily on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the right template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Handle Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest method to edit and eSign Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho without hassle

- Obtain Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho and then click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize signNow sections of the documents or obscure sensitive content with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify all details and click the Done button to secure your modifications.

- Choose your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Leave behind the concerns of lost or misplaced documents, cumbersome form searching, or mistakes necessitating the printing of new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho to guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for achieving a Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho?

The process for obtaining a Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho typically involves identifying the lien, gathering necessary documents, and posting the surety bond with the appropriate authorities. This ensures that the lien is released legally, allowing for smoother business operations. With airSlate SignNow, you can easily manage document eSigning and streamline this process.

-

How does airSlate SignNow facilitate the Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho?

airSlate SignNow provides an easy-to-use platform that allows corporations and LLCs in Idaho to efficiently handle documentation required for the Release Of Lien By Posting Of Surety Bond. Our eSigning capabilities make it simple to obtain necessary signatures, and our templates help ensure all specific requirements are met.

-

What are the pricing options for using airSlate SignNow for lien releases?

airSlate SignNow offers competitive pricing plans designed to cater to the needs of businesses looking for a cost-effective solution for the Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho. Plans include varying features, allowing businesses to choose one that best suits their needs. For detailed pricing, visit our website to explore options.

-

What features does airSlate SignNow offer for lien release management?

AirSlate SignNow includes several features that enhance management for the Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho, such as document templates, automated workflows, and secure cloud storage. These features streamline the filing and signing process, ensuring that all necessary steps are completed promptly.

-

Can I integrate airSlate SignNow with other applications for better workflow?

Yes, airSlate SignNow offers integrations with a variety of applications to enhance your workflow, especially when dealing with the Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho. Whether you're using CRM systems, project management tools, or accounting software, our platform can help connect them seamlessly, saving time and minimizing errors.

-

What benefits do businesses gain from using airSlate SignNow for lien releases in Idaho?

Using airSlate SignNow for the Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho empowers businesses by simplifying the document flow and enhancing collaboration. The eSigning feature ensures documents are signed quickly, while our secure platform protects sensitive information, ultimately leading to faster lien resolution.

-

Is there customer support available for airSlate SignNow users?

Absolutely! airSlate SignNow provides customer support to help users navigate the process of achieving a Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho. Our support team is available via chat, email, or phone to assist with any questions or issues you may encounter.

Get more for Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho

Find out other Release Of Lien By Posting Of Surety Bond By Corporation Or LLC Idaho

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP