Credit Application Form

Understanding the Credit Application

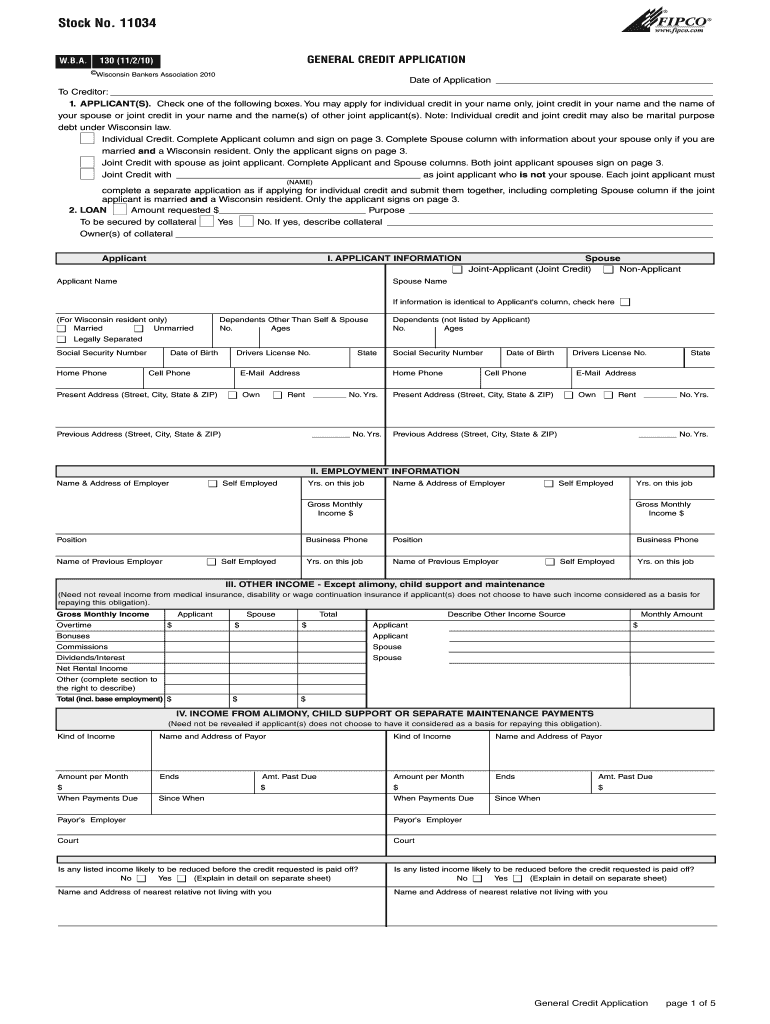

A credit application is a formal document used by individuals or businesses to request credit from a lender or financial institution. This document collects essential information about the applicant's financial history, income, and creditworthiness. By providing detailed information, the applicant allows the lender to assess their ability to repay the borrowed amount. A typical credit application includes personal identification details, employment information, and financial statements, which help the lender make an informed decision regarding the credit request.

Steps to Complete the Credit Application

Completing a credit application involves several key steps to ensure accuracy and completeness. First, gather all necessary information, including personal identification, employment details, and financial documents. Next, fill out the application form carefully, ensuring that all fields are completed accurately. Review the application for any errors or omissions before submission. Once verified, submit the application either online or in person, depending on the lender's requirements. Lastly, keep a copy of the submitted application for your records, as it may be needed for future reference.

Legal Use of the Credit Application

The legal use of a credit application is governed by various regulations that ensure the protection of both the lender and the applicant. In the United States, the Fair Credit Reporting Act (FCRA) mandates that lenders must obtain consent before accessing an applicant's credit report. Additionally, the Equal Credit Opportunity Act (ECOA) prohibits discrimination in lending practices. It is essential for applicants to understand their rights and the legal implications of submitting a credit application, as this knowledge can help protect them from potential issues during the approval process.

Key Elements of the Credit Application

A well-structured credit application includes several key elements that provide lenders with a comprehensive view of the applicant's financial situation. These elements typically consist of:

- Personal Information: Name, address, Social Security number, and contact details.

- Employment Details: Current employer, job title, and length of employment.

- Financial Information: Income, expenses, and existing debts.

- Credit History: Previous loans, credit cards, and payment history.

Each of these elements plays a crucial role in determining the applicant's creditworthiness and ability to repay the loan.

Required Documents for the Credit Application

When filling out a credit application, certain documents are typically required to support the information provided. Commonly requested documents include:

- Proof of Identity: Government-issued identification, such as a driver's license or passport.

- Income Verification: Recent pay stubs, tax returns, or bank statements that demonstrate financial stability.

- Credit History: A recent credit report may be requested to evaluate the applicant's creditworthiness.

Having these documents ready can streamline the application process and improve the chances of approval.

Application Process & Approval Time

The application process for a credit application typically involves several stages. After submission, the lender reviews the application and conducts a credit check to assess the applicant's financial background. This review process can take anywhere from a few minutes to several days, depending on the lender's policies and the complexity of the application. Once the review is complete, the lender will notify the applicant of the decision, whether it is approval, denial, or a request for additional information. Understanding this timeline can help applicants manage their expectations during the credit application process.

Quick guide on how to complete credit application 5527123

Complete Credit Application effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Credit Application on any device using airSlate SignNow Android or iOS applications and streamline any document-based workflow today.

How to adjust and eSign Credit Application with ease

- Obtain Credit Application and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Adjust and eSign Credit Application and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit application 5527123

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a generic credit application?

A generic credit application is a standardized form used by businesses to gather financial information from applicants. This application simplifies the credit approval process by providing a consistent format that can be easily reviewed and compared by lenders.

-

How does airSlate SignNow enhance the generic credit application process?

airSlate SignNow streamlines the generic credit application process by allowing users to create and send digital forms for eSigning. This makes it easier for applicants to complete the forms quickly, while businesses can track submissions and approvals in real-time.

-

Are there any specific pricing plans for using airSlate SignNow for a generic credit application?

Yes, airSlate SignNow offers several affordable pricing plans that cater to different business needs, including options specifically tailored for managing a generic credit application workflow. Each plan is designed to provide valuable features that optimize document management and eSigning.

-

What features does airSlate SignNow offer for a generic credit application?

airSlate SignNow includes features like customizable templates, document tracking, and automated reminders, all of which enhance the experience of handling a generic credit application. Additionally, built-in security features protect sensitive applicant information throughout the process.

-

Can I integrate airSlate SignNow with other platforms for my generic credit application?

Yes, airSlate SignNow allows seamless integration with various third-party applications, enabling you to enhance your generic credit application workflow. Whether you use CRM software or accounting platforms, you can synchronize data and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for a generic credit application?

Using airSlate SignNow for your generic credit application provides benefits such as reduced processing time, lower operational costs, and improved accuracy in data collection. It helps ensure a smooth experience for both applicants and businesses alike.

-

Is airSlate SignNow secure for handling a generic credit application?

Absolutely, airSlate SignNow prioritizes security and compliance, using advanced encryption protocols to protect all data related to a generic credit application. This focus on security ensures that sensitive information remains confidential and safe from unauthorized access.

Get more for Credit Application

- No petitionerplaintiff note for calendar civilprobate form

- Petitionerrespondent vs plaintiffdefendant this may form

- Case announcements colorado supreme court monday april 9 form

- Ericka aguilar author at philippines free legal forms

- State of wisconsin plaintiff respondent v findlaw form

- Nolos deposition handbook conduct a deposition or be form

- Injury claim coach personal injury victims guide to form

- State of wisconsin plaintiff appellant v adam findlaw form

Find out other Credit Application

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter