Quitclaim Deed from Husband and Wife to LLC Idaho Form

What is the Quitclaim Deed From Husband And Wife To LLC Idaho

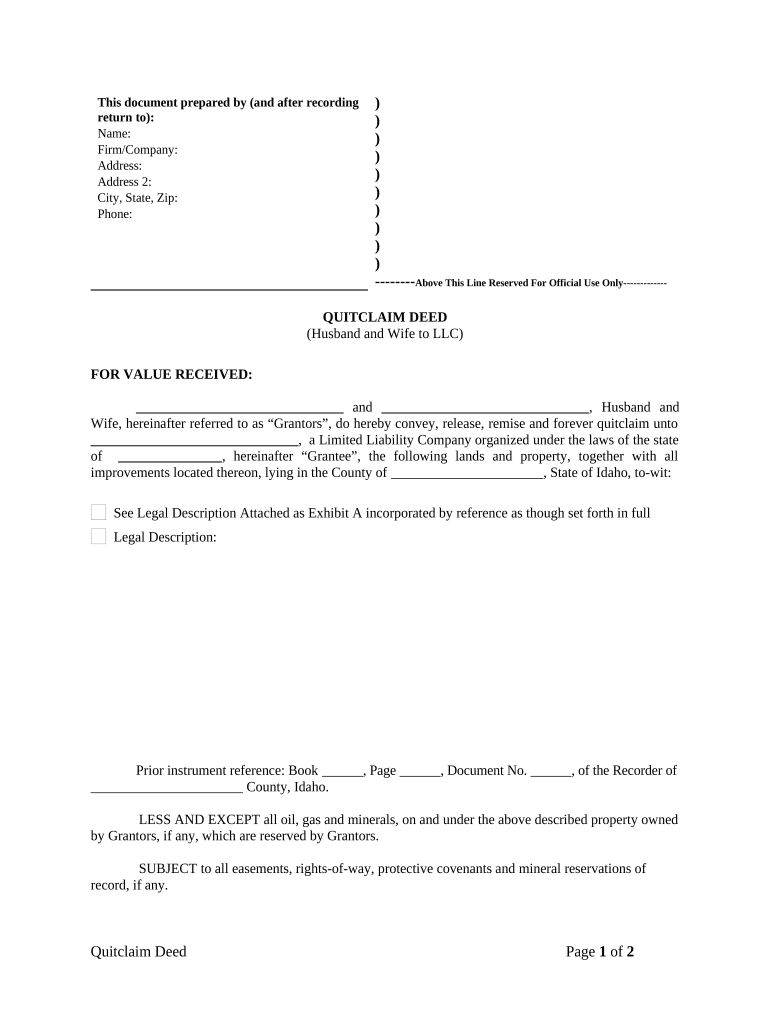

A quitclaim deed from husband and wife to an LLC in Idaho is a legal document that allows a married couple to transfer their interest in a property to a limited liability company (LLC). This type of deed does not guarantee that the property is free from liens or other claims; it simply conveys whatever interest the couple has in the property at the time of the transfer. This deed is often used for estate planning, asset protection, or business purposes, allowing couples to manage property through an LLC structure.

Steps to Complete the Quitclaim Deed From Husband And Wife To LLC Idaho

Completing a quitclaim deed from husband and wife to an LLC involves several steps:

- Gather necessary information, including the legal description of the property, the names of the grantors (husband and wife), and the name of the LLC.

- Draft the quitclaim deed, ensuring it includes all required elements such as the date, signatures, and notary acknowledgment.

- Have both spouses sign the deed in the presence of a notary public to ensure its validity.

- File the completed deed with the county recorder's office where the property is located to make the transfer official.

Key Elements of the Quitclaim Deed From Husband And Wife To LLC Idaho

Several key elements must be included in a quitclaim deed for it to be legally binding:

- Grantor Information: Names and addresses of the husband and wife transferring the property.

- Grantee Information: Name of the LLC receiving the property.

- Property Description: A detailed legal description of the property being transferred.

- Signatures: Signatures of both spouses, along with a notary acknowledgment to verify the authenticity of the signatures.

- Date of Transfer: The date when the deed is executed.

Legal Use of the Quitclaim Deed From Husband And Wife To LLC Idaho

The quitclaim deed from husband and wife to an LLC is legally recognized in Idaho, provided it meets state requirements. It is essential for the deed to be properly executed, which includes signing in front of a notary. This deed can be used to transfer property for various reasons, including estate planning and asset protection. However, it is important to understand that a quitclaim deed does not provide any warranty on the title, meaning the LLC assumes the property with any existing claims or liens.

State-Specific Rules for the Quitclaim Deed From Husband And Wife To LLC Idaho

Idaho has specific regulations governing the execution and filing of quitclaim deeds. The deed must be signed by both spouses and notarized. Additionally, it should be filed with the county recorder's office to ensure public record. Idaho law requires that the legal description of the property be included in the deed. It is advisable to consult local regulations or a legal professional to ensure compliance with all state-specific requirements.

How to Use the Quitclaim Deed From Husband And Wife To LLC Idaho

Using a quitclaim deed from husband and wife to an LLC involves preparing the document correctly and ensuring it is executed according to legal standards. After drafting the deed, both spouses must sign it in the presence of a notary. Once notarized, the deed should be filed with the appropriate county office to officially record the transfer. This process allows the couple to transfer their property interest to the LLC, which can then manage the property under its legal structure.

Quick guide on how to complete quitclaim deed from husband and wife to llc idaho

Easily prepare Quitclaim Deed From Husband And Wife To LLC Idaho on any gadget

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Quitclaim Deed From Husband And Wife To LLC Idaho on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to alter and eSign Quitclaim Deed From Husband And Wife To LLC Idaho effortlessly

- Find Quitclaim Deed From Husband And Wife To LLC Idaho and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Quitclaim Deed From Husband And Wife To LLC Idaho and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Husband And Wife To LLC in Idaho?

A Quitclaim Deed From Husband And Wife To LLC in Idaho is a legal document that transfers ownership of real estate from a married couple to a limited liability company (LLC). This deed does not guarantee that the property is free of liens or claims, making it essential for couples to understand the implications. Using airSlate SignNow can streamline this process, ensuring that all parties can securely eSign their documents.

-

How does airSlate SignNow facilitate the process of creating a Quitclaim Deed From Husband And Wife To LLC in Idaho?

airSlate SignNow provides an easy-to-use platform that guides you through the creation of a Quitclaim Deed From Husband And Wife To LLC in Idaho. With customizable templates and clear instructions, you can quickly draft your deed without the hassle of complex legal jargon. Additionally, our built-in electronic signature feature allows for a seamless signing process.

-

What are the costs associated with using airSlate SignNow for a Quitclaim Deed From Husband And Wife To LLC in Idaho?

The pricing for using airSlate SignNow varies depending on the plan you choose, but we offer affordable solutions suitable for individual users and businesses alike. Our goal is to provide a cost-effective way to manage documents, including the Quitclaim Deed From Husband And Wife To LLC in Idaho. Check our website for the latest pricing plans and options.

-

Are there any benefits to using airSlate SignNow for real estate transactions in Idaho?

Yes, using airSlate SignNow for real estate transactions, including a Quitclaim Deed From Husband And Wife To LLC in Idaho, offers numerous benefits. Our platform increases efficiency, reduces errors, and ensures compliance with local regulations. Moreover, the ability to eSign documents securely saves time and simplifies the entire process.

-

Is it possible to integrate airSlate SignNow with other software for property management?

Absolutely! airSlate SignNow offers various integrations with popular property management and workflow software. This means you can easily incorporate the process of a Quitclaim Deed From Husband And Wife To LLC in Idaho into your existing systems, improving overall efficiency and document management.

-

What types of documents can I create and eSign apart from Quitclaim Deeds in Idaho?

In addition to Quitclaim Deeds From Husband And Wife To LLC in Idaho, airSlate SignNow allows users to create and eSign a wide range of documents, including leases, contracts, and agreements. Our platform supports diverse document types to meet the needs of various transactions, helping you manage all your legal paperwork in one place.

-

How can I ensure the security and legality of my Quitclaim Deed From Husband And Wife To LLC in Idaho?

When using airSlate SignNow, you can rest assured that all your documents, including a Quitclaim Deed From Husband And Wife To LLC in Idaho, are secure. Our platform employs industry-standard encryption and follows legal guidelines to ensure the validity of your eSigned documents. It's essential to review local laws to ensure compliance when finalizing your deed.

Get more for Quitclaim Deed From Husband And Wife To LLC Idaho

- Nc wdir 100 form 367774798

- Clovis usd sports pre participation screening form

- Massachusetts certified payroll form

- Scholastic scope argument essay form

- Prohibition of ragging form

- Lego club lego club application smsk 8 form

- Application for a mb marriage document20190604eng pub form

- Area lebanon u s department of veterans affairs form

Find out other Quitclaim Deed From Husband And Wife To LLC Idaho

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe