Illinois Notice Default Form

What is the Illinois Notice Default

The Illinois Notice Default is a formal document used in the context of mortgage defaults. It serves as a notification to borrowers that they have fallen behind on their mortgage payments. This notice is typically issued by lenders or mortgage servicers and outlines the specific details of the default, including the amount overdue and the necessary steps the borrower must take to rectify the situation. Understanding this notice is crucial for homeowners facing financial difficulties, as it can lead to foreclosure if not addressed promptly.

How to use the Illinois Notice Default

Using the Illinois Notice Default involves several key steps. First, it is essential to read the notice carefully to understand the terms and conditions outlined by the lender. The notice will specify the amount owed, any applicable fees, and the timeline for resolving the default. Homeowners should gather relevant financial documents to assess their situation and consider contacting their lender to discuss options for repayment or loan modification. Seeking advice from a legal or financial professional can also provide valuable guidance during this process.

Steps to complete the Illinois Notice Default

Completing the Illinois Notice Default requires careful attention to detail. Follow these steps to ensure compliance:

- Review the notice thoroughly to understand the default terms.

- Gather all necessary financial documents, including recent pay stubs and bank statements.

- Contact the lender to discuss potential repayment options or modifications.

- Prepare a written response if required, addressing any discrepancies or outlining your plan to resolve the default.

- Submit any required documentation by the deadline specified in the notice.

Legal use of the Illinois Notice Default

The legal use of the Illinois Notice Default is governed by state laws and regulations. It is essential for lenders to follow proper procedures when issuing this notice to ensure it is legally valid. The notice must include specific information, such as the borrower’s name, property address, and details of the default. Homeowners have the right to contest the notice if they believe it was issued incorrectly. Understanding the legal implications of this notice can help borrowers protect their rights and explore available options.

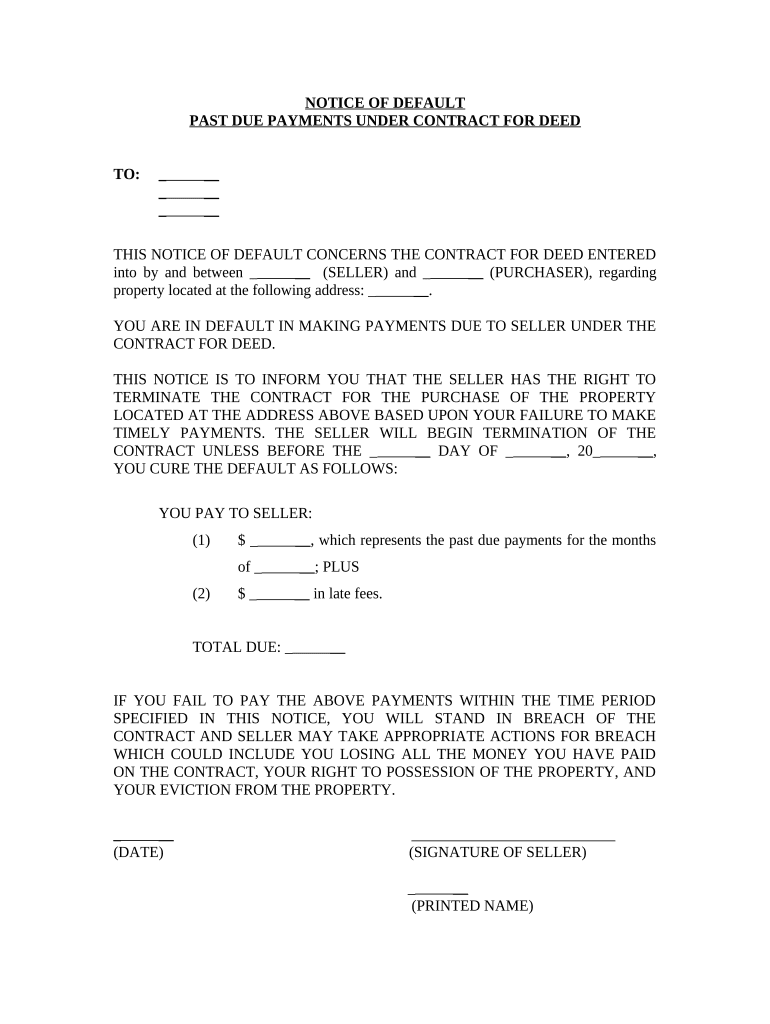

Key elements of the Illinois Notice Default

Several key elements comprise the Illinois Notice Default, making it a critical document for borrowers. These include:

- The name and contact information of the lender or mortgage servicer.

- The borrower’s name and the property address.

- The amount of overdue payments and any additional fees.

- A clear statement of the default and the consequences of inaction.

- The timeframe within which the borrower must respond or take action.

State-specific rules for the Illinois Notice Default

Illinois has specific rules governing the issuance and handling of the Notice Default. Lenders must adhere to state regulations regarding notification timelines and content requirements. For instance, Illinois law mandates that borrowers receive a notice at least thirty days before any foreclosure proceedings can begin. Additionally, the notice must be sent via certified mail to ensure proper delivery. Familiarity with these state-specific rules can help borrowers navigate the process more effectively.

Quick guide on how to complete illinois notice default 497305971

Complete Illinois Notice Default effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Handle Illinois Notice Default on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Illinois Notice Default with ease

- Obtain Illinois Notice Default and then click Get Form to commence.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from a device of your choice. Modify and eSign Illinois Notice Default and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Illinois notice default?

An Illinois notice default is a legal document that informs borrowers they are in default on their mortgage payments. This notice serves as a formal warning, outlining the potential consequences if the debt is not addressed. It's crucial for borrowers to understand their options after receiving an Illinois notice default.

-

How can airSlate SignNow help with managing Illinois notice default documents?

AirSlate SignNow provides a streamlined platform for managing Illinois notice default documents effectively. You can easily upload, eSign, and share these documents with all relevant parties, ensuring a quick response to any legal notifications. This not only saves time but also enhances the accuracy of your document management.

-

Is airSlate SignNow a cost-effective solution for handling Illinois notice default?

Yes, airSlate SignNow is a cost-effective solution for handling Illinois notice default documents. By offering competitive pricing plans, businesses can manage their document signing needs without incurring high costs. The efficiency gained from using our platform can also signNowly reduce potential legal fees.

-

What features does airSlate SignNow offer for Illinois notice default management?

AirSlate SignNow offers a variety of features tailored for Illinois notice default management, including document templates, customizable workflows, and extensive security options. These features simplify the creation and signing process while ensuring that your documents remain secure and compliant with legal standards. Users can easily track the status of their documents to stay updated.

-

Can I integrate airSlate SignNow with other tools for managing Illinois notice default?

Absolutely! AirSlate SignNow seamlessly integrates with various tools that can assist in managing Illinois notice default, such as CRM systems and cloud storage services. This integration helps create a comprehensive workflow, centralizing all document-related processes and ensuring smooth communication between teams.

-

What are the benefits of using airSlate SignNow for Illinois notice default?

Using airSlate SignNow for Illinois notice default offers numerous benefits, including increased efficiency, enhanced document security, and improved compliance issues. By automating the signing process, businesses can reduce turnaround time and ensure that all necessary documents are properly executed in a timely manner.

-

How secure is airSlate SignNow for processing Illinois notice default documents?

AirSlate SignNow prioritizes the security of all documents processed on the platform, including Illinois notice default. We use advanced encryption and secure access protocols to ensure that your sensitive information is protected. With our robust security measures, you can confidently manage your legal documents without worry.

Get more for Illinois Notice Default

Find out other Illinois Notice Default

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF