Business Credit Application Illinois Form

What is the Business Credit Application Illinois

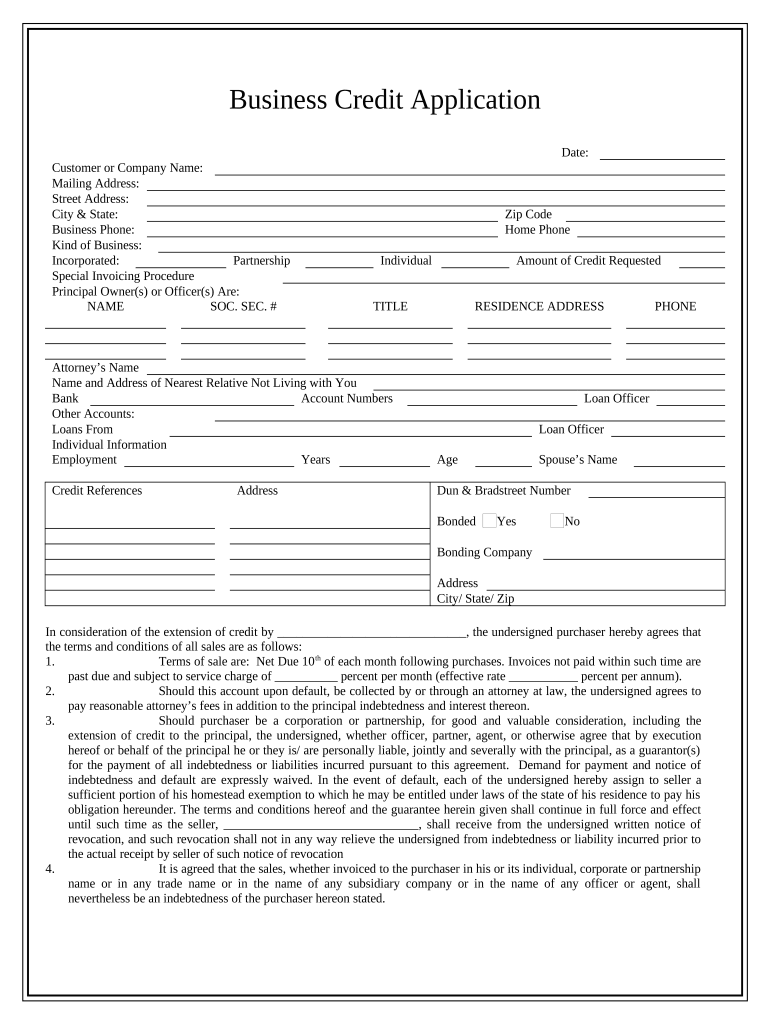

The Business Credit Application Illinois is a formal document used by businesses in Illinois to apply for credit from lenders or suppliers. This application gathers essential information about the business, including its legal structure, financial status, and credit history. By providing this information, businesses can establish their creditworthiness and secure funding or credit lines necessary for operations and growth.

Key Elements of the Business Credit Application Illinois

Several critical components make up the Business Credit Application Illinois. Understanding these elements is vital for completing the form accurately:

- Business Information: This section includes the legal name, address, and contact details of the business.

- Ownership Details: Information about the owners or partners, including their names and ownership percentages.

- Financial Information: Applicants must provide financial statements, including income statements and balance sheets, to demonstrate financial health.

- Credit History: A summary of the business's credit history, including any existing debts and payment history with other creditors.

- Purpose of Credit: A brief explanation of how the credit will be used, which helps lenders assess risk.

Steps to Complete the Business Credit Application Illinois

Completing the Business Credit Application Illinois involves several steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary documents, including financial statements and identification of business owners.

- Fill Out the Application: Complete each section of the application form, ensuring all information is accurate and up-to-date.

- Review for Accuracy: Double-check all entries for errors or omissions, as inaccuracies can delay processing.

- Submit the Application: Send the completed application to the lender or supplier, either digitally or via mail.

Legal Use of the Business Credit Application Illinois

The Business Credit Application Illinois is legally binding when completed and signed correctly. To ensure its validity, businesses must comply with relevant laws and regulations governing eSignatures, such as the ESIGN Act and UETA. Using a reliable eSignature platform can enhance the security and legality of the document, providing a digital certificate that verifies the signer's identity and intention.

Eligibility Criteria

To qualify for credit through the Business Credit Application Illinois, businesses must meet specific eligibility criteria, which may include:

- Establishment of a legal business entity, such as an LLC or corporation.

- A minimum period of operation, often ranging from six months to one year.

- Demonstration of a stable financial history and sufficient revenue streams.

- Provision of personal guarantees from business owners, if required by the lender.

Form Submission Methods

The Business Credit Application Illinois can be submitted through various methods, depending on the lender's requirements:

- Online Submission: Many lenders accept digital applications through their websites or secure portals, allowing for quicker processing.

- Mail Submission: Businesses can also print the completed application and send it via postal mail to the lender's address.

- In-Person Submission: Some lenders may require or allow applicants to submit the form in person, providing an opportunity for immediate feedback.

Quick guide on how to complete business credit application illinois

Effortlessly prepare Business Credit Application Illinois on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without any delays. Manage Business Credit Application Illinois on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Business Credit Application Illinois with ease

- Locate Business Credit Application Illinois and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which only takes a few seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to apply your changes.

- Select your preferred method of delivering your form—whether via email, text message (SMS), or an invitation link—or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and electronically sign Business Credit Application Illinois while ensuring excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application Illinois?

A Business Credit Application Illinois is a formal document that businesses use to apply for credit from financial institutions or suppliers in the state of Illinois. This application gathers essential information about your business, allowing lenders to assess your creditworthiness effectively.

-

How can airSlate SignNow help with the Business Credit Application Illinois?

airSlate SignNow streamlines the process of submitting a Business Credit Application Illinois by allowing users to create, send, and eSign documents seamlessly. This digital solution not only saves time but also enhances the security and efficiency of managing credit applications.

-

What are the benefits of using airSlate SignNow for Business Credit Application Illinois?

Using airSlate SignNow for your Business Credit Application Illinois provides a range of benefits, including faster processing times, reduced paperwork, and improved accuracy. Additionally, this platform integrates electronic signatures for quick approvals, making your application submission hassle-free.

-

Is there a cost associated with using airSlate SignNow for Business Credit Application Illinois?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs regarding the Business Credit Application Illinois. These plans are designed to be cost-effective, ensuring that businesses of all sizes can access essential eSignature functionalities without breaking the bank.

-

What features does airSlate SignNow offer for Business Credit Application Illinois?

airSlate SignNow provides features that are particularly useful for Business Credit Application Illinois, including customizable templates, automated workflows, and secure cloud storage. These tools enable businesses to manage their credit applications more effectively and track progress in real-time.

-

Can I integrate airSlate SignNow with other tools for my Business Credit Application Illinois?

Absolutely! airSlate SignNow supports integrations with various third-party applications and services, allowing you to manage your Business Credit Application Illinois alongside other business systems. This interoperability makes it easier to keep your workflows organized and efficient.

-

How secure is my information when using airSlate SignNow for Business Credit Application Illinois?

Security is a top priority when using airSlate SignNow for your Business Credit Application Illinois. The platform employs industry-standard encryption and compliance measures to protect your sensitive data, ensuring that your credit application information remains confidential and secure.

Get more for Business Credit Application Illinois

- Child enrollment form for day care homes doh 4419 health ny

- Food mood diary pdf form

- Ecotraveller roaming application form

- Properties of matter crossword puzzle pdf form

- Class b volunteer form special olympics florida l b5z

- Sunnyvale youth basketball league form

- Medical aesthetics intake form calgary

- Bethesda hospital admissions form

Find out other Business Credit Application Illinois

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo