Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children Illinois Form

What is the Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Illinois

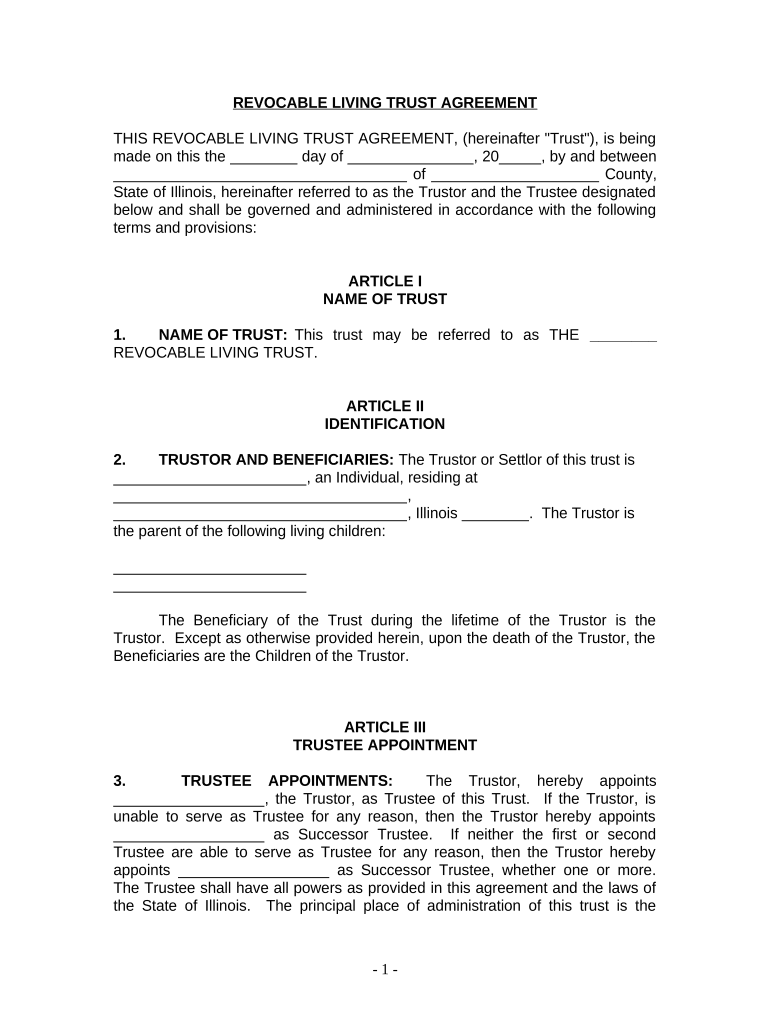

A living trust for individuals who are single, divorced, or widowed with children in Illinois is a legal document that allows a person to manage their assets during their lifetime and dictate how those assets will be distributed upon their death. This type of trust is particularly beneficial for individuals with children, as it provides a structured way to ensure that their assets are passed on according to their wishes. The trust becomes effective immediately upon creation, allowing the individual to retain control over their assets while also providing a clear plan for their children’s inheritance.

How to use the Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Illinois

Using a living trust involves several key steps. First, the individual must create the trust document, outlining the terms and conditions of the trust. This document should specify the assets included in the trust, the beneficiaries, and the trustee who will manage the trust. Once the trust is established, the individual should transfer ownership of their assets into the trust. This may include real estate, bank accounts, and other valuable possessions. Finally, it is important to regularly review and update the trust to reflect any changes in circumstances, such as the birth of additional children or changes in financial status.

Steps to complete the Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Illinois

Completing a living trust involves a series of straightforward steps:

- Determine the assets to be included in the trust.

- Choose a trustee who will manage the trust.

- Draft the trust document, outlining the terms and conditions.

- Sign the trust document in front of a notary public.

- Transfer ownership of assets into the trust by changing titles and designations.

- Review the trust periodically to ensure it meets current needs and circumstances.

Legal use of the Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Illinois

The legal use of a living trust in Illinois allows individuals to bypass the probate process, which can be lengthy and costly. By placing assets in a trust, the individual ensures that their estate is managed according to their wishes without the need for court intervention. This is particularly important for those with children, as it allows for a smooth transition of assets to the next generation. Additionally, a living trust can provide privacy, as the terms of the trust do not become public record upon the individual's death.

Key elements of the Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Illinois

Key elements of a living trust include:

- The trustor: the individual creating the trust.

- The trustee: the person or entity responsible for managing the trust.

- The beneficiaries: the individuals or entities who will receive the trust assets.

- The trust document: the legal instrument that outlines the terms of the trust.

- Assets included: all properties, accounts, and valuables transferred into the trust.

State-specific rules for the Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Illinois

In Illinois, specific rules govern the creation and management of living trusts. The trust must be in writing and signed by the trustor. It is advisable to have the document notarized to enhance its legal standing. Illinois law allows for revocable living trusts, meaning the trustor can alter or revoke the trust at any time during their lifetime. Additionally, the trust should comply with state laws regarding asset transfers and beneficiary designations to ensure that it is valid and enforceable.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children illinois

Effortlessly Prepare Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Illinois on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It serves as an ideal sustainable alternative to conventional printed and signed documentation, allowing you to easily locate the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Illinois on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Illinois with Ease

- Locate Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Illinois and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools offered by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Illinois and guarantee effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for individuals who are single, divorced, or widowed with children in Illinois?

A Living Trust for individuals who are single, divorced, or widowed with children in Illinois is a legal document that allows you to manage your assets while you are alive and specify how they should be distributed after your death. This type of trust can be instrumental in ensuring that your children receive their inheritance without the complexities of probate.

-

How can a Living Trust benefit single parents in Illinois?

A Living Trust can provide signNow benefits for single parents in Illinois by ensuring that your children are cared for according to your wishes. It allows you to designate guardians and manage assets on behalf of your minors, thus offering peace of mind knowing your children are financially protected in the event of your passing.

-

What are the costs associated with creating a Living Trust for individuals in Illinois?

The cost of creating a Living Trust for individuals who are single, divorced, or widowed with children in Illinois can vary based on the complexity of the estate and the legal assistance required. Generally, you can expect to pay anywhere from a few hundred to a few thousand dollars, depending on the services you choose.

-

Is a Living Trust necessary if I already have a will in Illinois?

While having a will is important, a Living Trust provides advantages that a will does not, such as avoiding probate and maintaining privacy about your assets. For individuals who are single, divorced, or widowed with children in Illinois, establishing a Living Trust can be a strategic way to safeguard the distribution of your estate.

-

How does a Living Trust work for divorced individuals with children in Illinois?

For divorced individuals in Illinois with children, a Living Trust allows you to specify how assets should be managed and distributed post-divorce. It can help in ensuring that your children receive the intended benefits without interference from an ex-spouse, and it can also help prevent disputes among family members.

-

Can I modify my Living Trust in Illinois if my circumstances change?

Yes, a Living Trust is a flexible legal tool that can be modified as your circumstances change. Whether you get remarried, have additional children, or wish to alter asset distributions, you can amend your Living Trust to reflect your current situation and preferences.

-

What integration options does airSlate SignNow offer for Living Trust documentation?

AirSlate SignNow provides seamless integration options to streamline the management of Living Trust documentation. You can easily send, eSign, and store all relevant documents electronically, ensuring that your Living Trust for individuals who are single, divorced, or widowed with children in Illinois is efficiently handled.

Get more for Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Illinois

Find out other Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children Illinois

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT