Living Trust for Husband and Wife with Minor and or Adult Children Illinois Form

What is the Living Trust For Husband And Wife With Minor And Or Adult Children Illinois

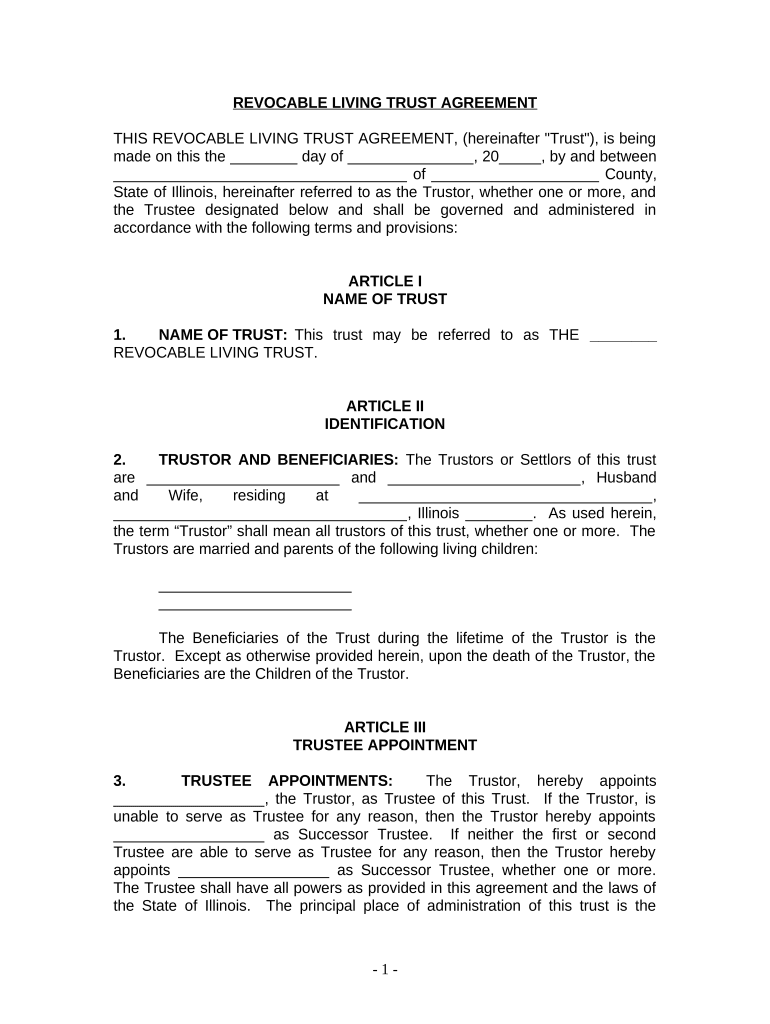

A living trust for husband and wife with minor and/or adult children in Illinois is a legal document that allows couples to manage their assets during their lifetime and specify how those assets will be distributed upon their death. This type of trust helps avoid probate, ensuring a smoother transition of assets to heirs. It can include various assets, such as real estate, bank accounts, and investments. By creating this trust, couples can maintain control over their assets and provide for their children, whether they are minors or adults, according to their wishes.

Steps to Complete the Living Trust For Husband And Wife With Minor And Or Adult Children Illinois

Completing a living trust for husband and wife with minor and/or adult children in Illinois involves several key steps:

- Identify all assets to be included in the trust, such as property, bank accounts, and investments.

- Choose a trustee, which can be one or both spouses or a third party.

- Draft the trust document, outlining how assets will be managed and distributed.

- Sign the trust document in the presence of a notary public to ensure its validity.

- Fund the trust by transferring ownership of the identified assets into the trust.

Key Elements of the Living Trust For Husband And Wife With Minor And Or Adult Children Illinois

Several key elements must be included in a living trust for husband and wife with minor and/or adult children in Illinois:

- Trustee Information: Clearly state who will manage the trust.

- Beneficiaries: Identify the beneficiaries, including minor and adult children.

- Asset Distribution: Specify how and when assets will be distributed to beneficiaries.

- Revocation Clause: Include a clause allowing the trust to be revoked or amended as needed.

Legal Use of the Living Trust For Husband And Wife With Minor And Or Adult Children Illinois

The legal use of a living trust for husband and wife with minor and/or adult children in Illinois provides several benefits. It allows couples to manage their assets efficiently and ensures that their wishes are honored after death. This trust can help minimize estate taxes and avoid probate, which can be time-consuming and costly. Additionally, it provides a clear framework for asset distribution, reducing potential conflicts among heirs.

State-Specific Rules for the Living Trust For Husband And Wife With Minor And Or Adult Children Illinois

In Illinois, specific rules govern the creation and execution of living trusts. The trust must be in writing and signed by the grantors in the presence of a notary public. Illinois law allows for the inclusion of specific provisions that cater to the needs of minor children, such as stipulating how funds will be managed until they reach adulthood. It is crucial to comply with state laws to ensure the trust is enforceable and valid.

How to Obtain the Living Trust For Husband And Wife With Minor And Or Adult Children Illinois

Obtaining a living trust for husband and wife with minor and/or adult children in Illinois can be done through various methods. Couples can consult with an attorney specializing in estate planning to draft a customized trust document. Alternatively, there are online platforms that offer templates and guidance for creating a living trust. It is essential to ensure that any document complies with Illinois state laws to maintain its legal validity.

Quick guide on how to complete living trust for husband and wife with minor and or adult children illinois

Complete Living Trust For Husband And Wife With Minor And Or Adult Children Illinois effortlessly on any device

Managing documents online has gained signNow traction among companies and individuals. It offers a sustainable alternative to conventional printed and signed forms, allowing you to find the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Living Trust For Husband And Wife With Minor And Or Adult Children Illinois on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Living Trust For Husband And Wife With Minor And Or Adult Children Illinois effortlessly

- Find Living Trust For Husband And Wife With Minor And Or Adult Children Illinois and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or conceal confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your updates.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Living Trust For Husband And Wife With Minor And Or Adult Children Illinois and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With Minor And Or Adult Children Illinois?

A Living Trust For Husband And Wife With Minor And Or Adult Children Illinois is a legal arrangement that allows you to manage your assets while you are alive and specify how they will be distributed after your death. This type of trust offers flexibility and control over your estate and can help avoid the probate process.

-

How much does it cost to create a Living Trust For Husband And Wife With Minor And Or Adult Children Illinois?

The cost of creating a Living Trust For Husband And Wife With Minor And Or Adult Children Illinois can vary depending on the complexity of your estate and the legal fees involved. Generally, you can expect to pay anywhere from a few hundred to a couple thousand dollars. It's advisable to consult with an estate planning attorney for an accurate estimate.

-

What are the main benefits of a Living Trust For Husband And Wife With Minor And Or Adult Children Illinois?

One of the primary benefits of a Living Trust For Husband And Wife With Minor And Or Adult Children Illinois is the ability to manage your assets during your lifetime and avoid probate after your passing. Additionally, this type of trust can help provide for your minor children by specifying how and when they will receive their inheritance.

-

Can I change my Living Trust For Husband And Wife With Minor And Or Adult Children Illinois after it's created?

Yes, one of the key features of a Living Trust For Husband And Wife With Minor And Or Adult Children Illinois is that it is revocable. This means you can amend, add, or remove assets and beneficiaries as your circumstances change, ensuring your trust remains aligned with your current wishes.

-

Do I need an attorney to set up a Living Trust For Husband And Wife With Minor And Or Adult Children Illinois?

While it's possible to create a Living Trust For Husband And Wife With Minor And Or Adult Children Illinois without an attorney using online templates, it's highly recommended to consult a legal professional. An attorney can ensure that your trust complies with Illinois law and meets your specific needs.

-

What happens to my Living Trust For Husband And Wife With Minor And Or Adult Children Illinois if I move to another state?

If you move to another state, your Living Trust For Husband And Wife With Minor And Or Adult Children Illinois will generally still be valid. However, you may need to review and potentially update your trust to comply with the new state's laws regarding trusts and estate planning.

-

How does a Living Trust For Husband And Wife With Minor And Or Adult Children Illinois integrate with other estate planning tools?

A Living Trust For Husband And Wife With Minor And Or Adult Children Illinois can work in conjunction with other estate planning tools like wills, powers of attorney, and healthcare directives. By integrating these elements, you can create a comprehensive estate plan that addresses all aspects of your financial and personal wishes.

Get more for Living Trust For Husband And Wife With Minor And Or Adult Children Illinois

Find out other Living Trust For Husband And Wife With Minor And Or Adult Children Illinois

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement