Nova Tax Form

What is the Nova Tax Form

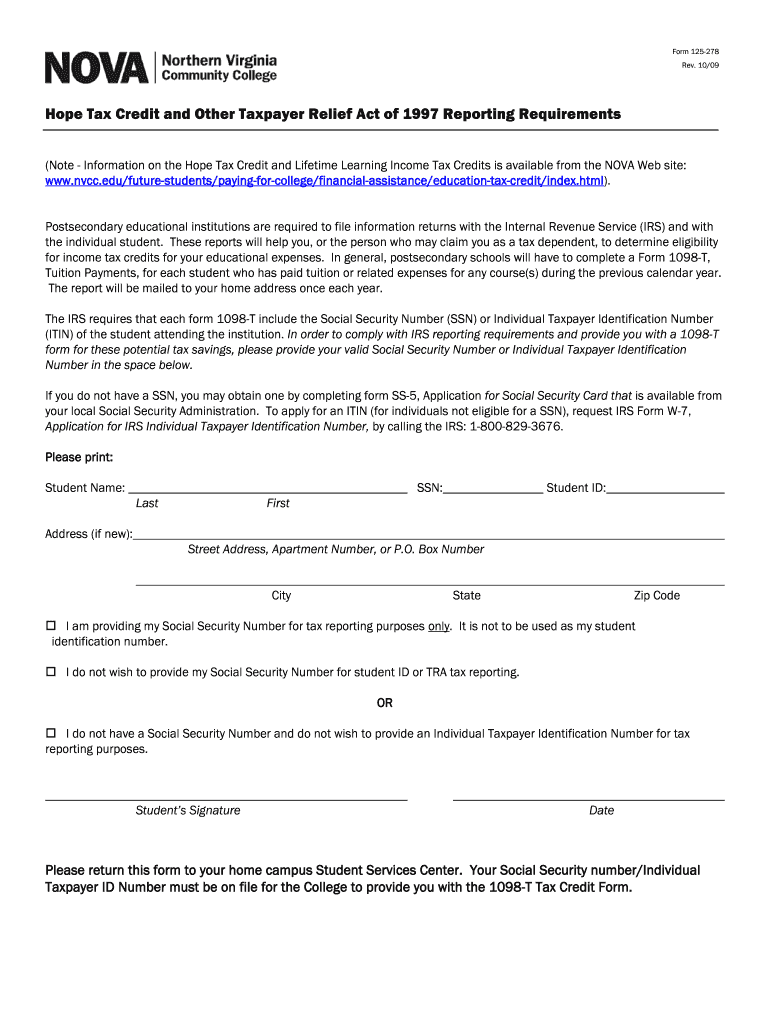

The Nova Tax Form, specifically the nova 1098 t form, is a crucial document issued by educational institutions, such as Northern Virginia Community College. This form is used to report qualified tuition and related expenses paid by students during the tax year. It provides essential information for students and their families when filing federal income tax returns, allowing them to claim education-related tax benefits.

How to use the Nova Tax Form

Using the nova 1098 t form involves understanding its components and how they relate to your tax situation. Students should review the form carefully to ensure all reported amounts are accurate. The information on the form can help determine eligibility for tax credits, such as the American Opportunity Credit or the Lifetime Learning Credit. Proper usage of the form can significantly impact the tax benefits you may receive.

Steps to complete the Nova Tax Form

Completing the nova 1098 t form requires several steps:

- Gather necessary documentation, including tuition payment receipts and any related expenses.

- Fill out the form with accurate amounts reflecting qualified expenses.

- Ensure that all personal information, such as Social Security numbers, is correctly entered.

- Review the completed form for any errors before submission.

Following these steps helps ensure that the form is filled out correctly and can be used effectively for tax filing.

Legal use of the Nova Tax Form

The nova 1098 t form is legally recognized for reporting educational expenses. It must be filled out according to IRS guidelines to maintain its validity. Compliance with tax laws is essential, as inaccuracies can lead to penalties or the denial of tax credits. Understanding the legal implications of the form helps ensure that it is used appropriately in tax filings.

Who Issues the Form

The nova 1098 t form is issued by educational institutions, such as Northern Virginia Community College. These institutions are responsible for providing accurate information regarding tuition payments and related expenses. Students should expect to receive this form from their school by the end of January each year, ensuring they have it in time for tax season.

Filing Deadlines / Important Dates

Students should be aware of key deadlines associated with the nova 1098 t form. Typically, the form is issued by the educational institution by January 31. Taxpayers should file their federal income tax returns by April 15. Being mindful of these dates helps ensure timely filing and the possibility of receiving any eligible tax refunds.

Examples of using the Nova Tax Form

Examples of using the nova 1098 t form include:

- A student who paid qualified tuition and fees can use the form to claim the American Opportunity Credit.

- A parent filing on behalf of a dependent student may use the form to report educational expenses for tax deductions.

These examples illustrate the practical applications of the form in maximizing educational tax benefits.

Quick guide on how to complete nova tax form

Complete Nova Tax Form effortlessly on any device

Digital document management has become widespread among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily access the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Nova Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to alter and eSign Nova Tax Form with ease

- Locate Nova Tax Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional written signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Modify and eSign Nova Tax Form and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nova tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nova 1098 t and how can it benefit my business?

The nova 1098 t is an essential tool for businesses looking to streamline their document signing process. By using airSlate SignNow, you can electronically sign and manage your documents efficiently, saving time and reducing paperwork. This solution helps simplify the 1098 t process, ensuring compliance and enhancing your overall productivity.

-

How much does the nova 1098 t feature in airSlate SignNow cost?

The pricing for airSlate SignNow, including the nova 1098 t features, is competitive and tailored to meet the needs of businesses of all sizes. You can choose from different subscription plans based on your requirements, whether you are a small startup or a large enterprise. Each plan offers great value with a range of features to facilitate easy document management.

-

What key features does the nova 1098 t offer?

The nova 1098 t offers a variety of features such as customizable templates, real-time tracking, and secure cloud storage. These capabilities allow you to efficiently prepare, send, and eSign your documents while maintaining integration with existing workflows. The user-friendly interface also ensures that even non-technical users can navigate with ease.

-

Can I integrate the nova 1098 t with other software solutions?

Absolutely! The nova 1098 t can be seamlessly integrated with various software platforms like CRM and accounting tools. This integration allows you to enhance your business processes by connecting document management with customer relationship management and financial systems, ensuring a smooth workflow across your organization.

-

Is the nova 1098 t compliant with legal standards?

Yes, the nova 1098 t provided by airSlate SignNow meets all legal and regulatory requirements for electronic signatures. This means you can confidently use it for filing and authentication purposes without worrying about compliance issues. Keeping your business secure and your documents legally binding is a top priority.

-

How does the nova 1098 t improve the signing process?

The nova 1098 t simplifies the signing process by allowing users to rapidly sign documents digitally from anywhere. It minimizes the hassle of printing, scanning, and mailing documents, which can signNowly delay operations. By using airSlate SignNow, you ensure quicker turnaround times and a more efficient workflow.

-

What support options are available for the nova 1098 t users?

Users of the nova 1098 t can access a range of support options, including online resources, customer service, and tutorials. The comprehensive help center and dedicated support team ensure that you have all the assistance you need to maximize the benefits of airSlate SignNow. We are committed to providing excellent support for a seamless user experience.

Get more for Nova Tax Form

- Florida alf medication destruction form

- Kanji practice sheet blank pdf form

- Cloze worksheets pdf form

- Micare helpline form

- Letter of intent to become a distributor form

- Ecobank registrars e dividend form

- S41 modelo de compromiso de aval de entidad bancaria form

- S43 modelo de aval para la concesin de aplazamientos form

Find out other Nova Tax Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document