Living Trust Property Record Illinois Form

What is the Living Trust Property Record Illinois

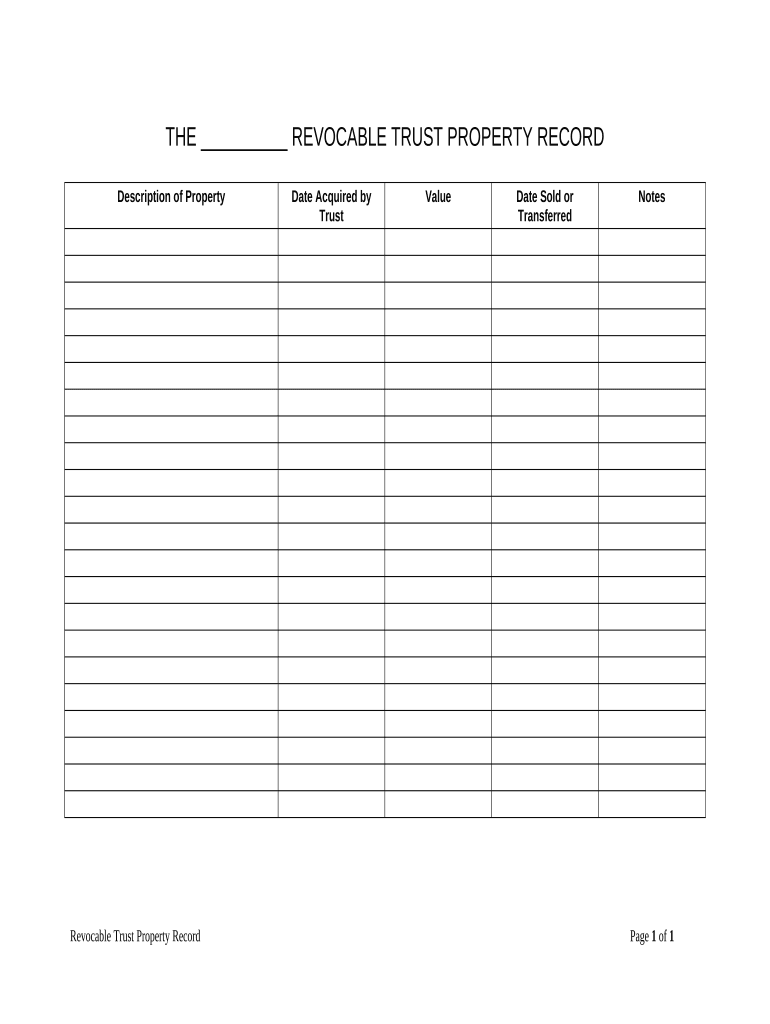

The Living Trust Property Record in Illinois is a legal document that outlines the assets held within a living trust. This record serves as an official declaration of ownership and management of the trust's properties, ensuring that the grantor's wishes are honored during their lifetime and after their passing. The document typically includes details such as the names of the trustees, beneficiaries, and a comprehensive list of assets, including real estate, investments, and personal property. Understanding this record is crucial for effective estate planning and asset management.

Steps to complete the Living Trust Property Record Illinois

Completing the Living Trust Property Record in Illinois involves several key steps to ensure accuracy and compliance with state laws. First, gather all necessary information about the assets to be included in the trust. This includes property deeds, financial account statements, and any other relevant documentation. Next, fill out the form with precise details, including the names of the trustees and beneficiaries. It is essential to review the document thoroughly to avoid any errors. Finally, sign the form in the presence of a notary public to validate the document legally.

How to obtain the Living Trust Property Record Illinois

To obtain the Living Trust Property Record in Illinois, individuals can start by contacting a local attorney who specializes in estate planning. Many law firms offer templates and guidance for creating living trusts. Additionally, the Illinois Secretary of State's office may provide resources or forms related to living trusts. It is important to ensure that any documents obtained are compliant with Illinois state laws and regulations regarding trusts.

Key elements of the Living Trust Property Record Illinois

The key elements of the Living Trust Property Record in Illinois include the identification of the trust, details about the grantor, and a comprehensive list of assets included in the trust. Other important components are the names and contact information of the trustees and beneficiaries, as well as any specific instructions regarding the management and distribution of the assets. Properly documenting these elements is vital for the trust's effectiveness and legal standing.

Legal use of the Living Trust Property Record Illinois

The Living Trust Property Record in Illinois is legally binding and serves to protect the interests of the grantor and beneficiaries. It is essential for ensuring that the assets are managed according to the grantor's wishes, both during their lifetime and after their death. This document can be used in legal proceedings to establish ownership and control of the trust assets, making it a critical component of estate planning.

State-specific rules for the Living Trust Property Record Illinois

Illinois has specific rules governing the creation and management of living trusts. These rules include requirements for the documentation of the trust, the necessity of a notary public for signatures, and the need to comply with state laws regarding asset transfer. Understanding these regulations is essential for ensuring that the Living Trust Property Record is valid and enforceable in Illinois.

Quick guide on how to complete living trust property record illinois

Complete Living Trust Property Record Illinois effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Living Trust Property Record Illinois on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Living Trust Property Record Illinois with ease

- Find Living Trust Property Record Illinois and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Select important sections of your documents or hide sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional hand-signed signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Living Trust Property Record Illinois to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust Property Record in Illinois?

A Living Trust Property Record in Illinois is a legal document that outlines the assets held in a living trust. It provides clarity on the ownership and management of these assets, which can help streamline the process of transferring property upon the granter's passing. Understanding this document can be crucial for estate planning.

-

How can I create a Living Trust Property Record in Illinois?

Creating a Living Trust Property Record in Illinois typically involves drafting a trust document that outlines your assets and the terms of the trust. It’s advisable to consult a legal professional to ensure that the document complies with Illinois laws and effectively protects your property. airSlate SignNow offers electronic signing capabilities to simplify the process.

-

What are the benefits of using airSlate SignNow for my Living Trust Property Record in Illinois?

Using airSlate SignNow for your Living Trust Property Record in Illinois provides a cost-effective and efficient way to manage your documents. With features like eSignature and document tracking, you can ensure that your trust documents are securely signed and stored. This streamlines the process of updating or sharing your property records.

-

Are there any fees associated with creating a Living Trust Property Record in Illinois?

The fees associated with creating a Living Trust Property Record in Illinois can vary depending on whether you hire an attorney or choose to create one yourself using templates and online services. While using airSlate SignNow is cost-effective for document signing, additional legal fees may apply if you require professional guidance. Always review the associated costs before starting.

-

Can airSlate SignNow integrate with other tools for managing my Living Trust Property Record in Illinois?

Yes, airSlate SignNow offers integrations with various software and tools that can assist with the management of your Living Trust Property Record in Illinois. This allows for seamless workflow from document creation to signing and storage. Check out our integration options to find the best fit for your needs.

-

How secure is my Living Trust Property Record in Illinois when using airSlate SignNow?

Your Living Trust Property Record in Illinois will be highly secure when using airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your sensitive information. Additionally, you retain control over who has access to your documents at all times.

-

How long does it take to complete a Living Trust Property Record in Illinois with airSlate SignNow?

The time to complete a Living Trust Property Record in Illinois using airSlate SignNow can vary based on individual needs. However, our platform is designed to make the process faster, allowing you to create, edit, and sign documents in a matter of minutes. Efficient eSigning features help reduce delays in finalizing your record.

Get more for Living Trust Property Record Illinois

- Linn county small claims court form

- Nys child support direct deposit form

- Health goals worksheet form

- Jury duty exemption online form

- Unemployment insurance application for ex servicemembers and federal employees de 1101iab form

- Medicare admissions form

- Ciro by medical solutions on the app store form

- Notice to employee of offer of suitable employment form

Find out other Living Trust Property Record Illinois

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement