Illinois Unsecured Installment Payment Promissory Note for Fixed Rate Illinois Form

What is the Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois

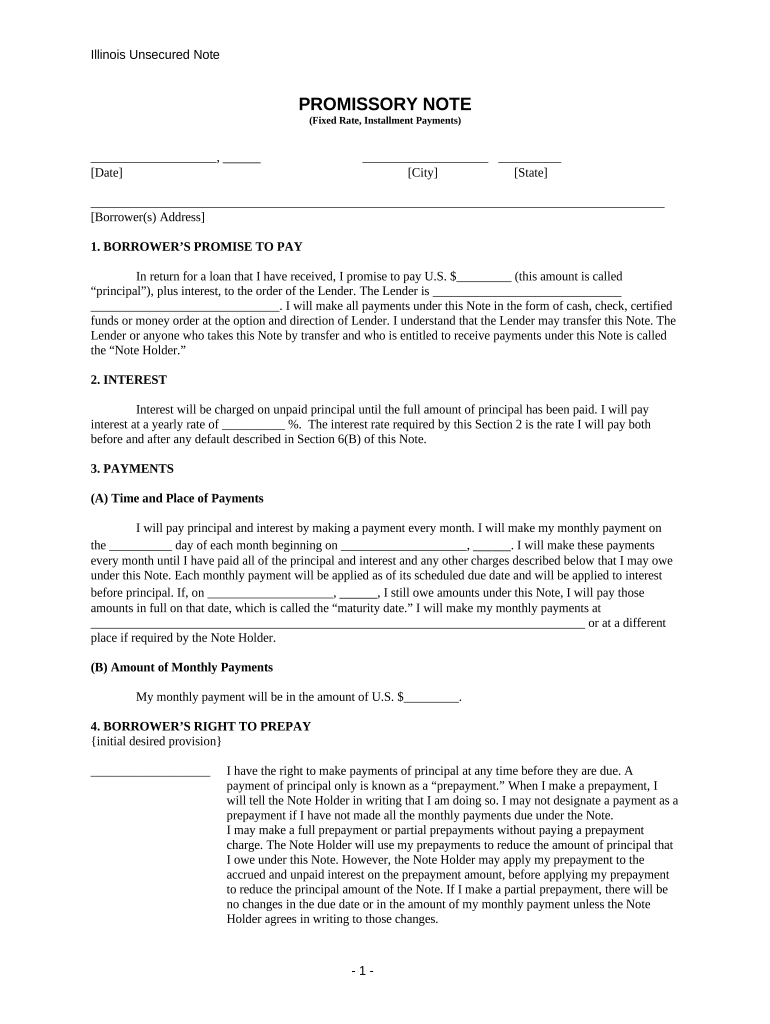

The Illinois Unsecured Installment Payment Promissory Note for Fixed Rate Illinois is a legal document that outlines a borrower's promise to repay a loan in fixed installments over a specified period. This form is particularly useful for individuals or businesses seeking to formalize a loan agreement without providing collateral. The note specifies the loan amount, interest rate, repayment schedule, and any applicable fees, ensuring clarity for both parties involved.

How to use the Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois

To use the Illinois Unsecured Installment Payment Promissory Note, both the lender and borrower must fill out the form accurately. The borrower should provide personal information, including their name and address, along with the loan details such as the principal amount and interest rate. The lender must also include their information and any specific terms related to the loan. Once completed, both parties should sign the document to make it legally binding.

Steps to complete the Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois

Completing the Illinois Unsecured Installment Payment Promissory Note involves several key steps:

- Gather necessary information, including names, addresses, and loan specifics.

- Fill in the loan amount and interest rate clearly.

- Specify the repayment schedule, detailing the frequency and amount of payments.

- Include any additional terms or conditions relevant to the loan.

- Both parties should review the document for accuracy.

- Sign and date the form to finalize the agreement.

Legal use of the Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois

The legal use of the Illinois Unsecured Installment Payment Promissory Note is grounded in its ability to create a binding agreement between the lender and borrower. For the note to be enforceable, it must comply with Illinois state laws regarding loan agreements. This includes proper documentation of terms, signatures from both parties, and adherence to any relevant regulations governing interest rates and repayment terms.

Key elements of the Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois

Key elements of this promissory note include:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the principal.

- Repayment Schedule: A detailed outline of when payments are due and the amounts.

- Default Terms: Conditions under which the borrower may be considered in default.

- Signatures: Required signatures from both the borrower and lender to validate the agreement.

State-specific rules for the Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois

Illinois has specific rules governing unsecured loans, which must be adhered to when using the Illinois Unsecured Installment Payment Promissory Note. This includes compliance with the Illinois Interest Act, which caps the maximum interest rate that can be charged. Additionally, the note must be clear and concise, ensuring that all terms are easily understood by both parties. It is advisable to consult with a legal professional to ensure compliance with all state regulations.

Quick guide on how to complete illinois unsecured installment payment promissory note for fixed rate illinois

Prepare Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily find the right form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents promptly without delays. Manage Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois on any device with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to edit and eSign Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois with ease

- Find Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois?

An Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois is a legal document that outlines the terms of a loan where the borrower agrees to repay the lender in fixed-rate installments. This type of note is unsecured, meaning that no collateral is required. It's designed to provide borrowers with a clear structure for repayment.

-

How can I create an Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois using airSlate SignNow?

You can easily create an Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois by using airSlate SignNow’s user-friendly document creation tools. Simply choose from our templates, fill in the necessary details, and customize it according to your needs. Once completed, you can eSign and share the document seamlessly.

-

What are the benefits of using airSlate SignNow for my Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois?

Using airSlate SignNow offers several benefits for your Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois. It enables quick and secure document signing, enhances collaboration with your clients, and provides a legally binding solution that meets state compliance. Additionally, it streamlines your workflow for efficient document management.

-

Are there any specific features in airSlate SignNow for Illinois Unsecured Installment Payment Promissory Notes?

Yes, airSlate SignNow includes key features tailored for Illinois Unsecured Installment Payment Promissory Notes, such as customizable templates, automated reminders for payments, and secure eSignature capabilities. These features help ensure that your loan agreements are managed efficiently and effectively, reducing the risk of missed deadlines.

-

Is there a cost associated with using airSlate SignNow for my Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses. The pricing plans are flexible and cater to different needs, allowing you to choose the right package for your usage level. Ultimately, the investment provides signNow value through improved efficiency and savings on administrative tasks.

-

Can I integrate airSlate SignNow with other tools for my Illinois Unsecured Installment Payment Promissory Note?

Absolutely! airSlate SignNow offers various integrations with popular business tools and software that can enhance the management of your Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois. You can connect it with platforms like CRM systems, cloud storage solutions, and other essential applications to create a more seamless experience.

-

How secure is my Illinois Unsecured Installment Payment Promissory Note with airSlate SignNow?

airSlate SignNow prioritizes security for your Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois by implementing robust security measures, including data encryption and secure access controls. Our platform is compliant with industry standards for document security, ensuring that your sensitive information remains protected throughout its lifecycle.

Get more for Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois

Find out other Illinois Unsecured Installment Payment Promissory Note For Fixed Rate Illinois

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast