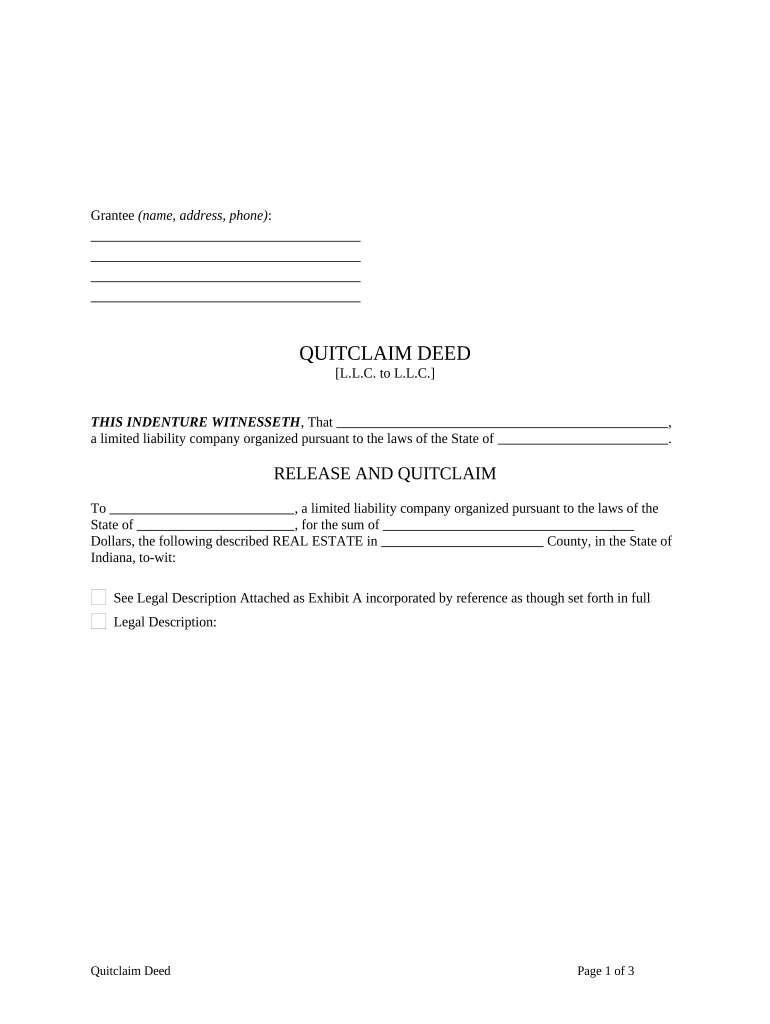

Limited Liability Llc Form

What is the Limited Liability LLC?

A Limited Liability Company (LLC) is a flexible business structure that combines the benefits of both a corporation and a partnership. It provides limited liability protection to its owners, known as members, meaning that personal assets are generally protected from business debts and liabilities. This structure is particularly popular among small business owners in Indiana due to its simplicity and tax advantages. An LLC can have one or more members, and it can be managed by its members or designated managers.

Steps to Complete the Limited Liability LLC

Completing the Limited Liability LLC form involves several key steps to ensure compliance with Indiana state requirements. Here’s a concise overview:

- Choose a unique name: The name must include "Limited Liability Company" or an abbreviation like "LLC".

- Designate a registered agent: This is an individual or business entity authorized to receive legal documents on behalf of the LLC.

- File the Articles of Organization: Submit this document to the Indiana Secretary of State, which officially establishes your LLC.

- Create an Operating Agreement: Although not mandatory, this document outlines the management structure and operating procedures of the LLC.

- Obtain an Employer Identification Number (EIN): This is necessary for tax purposes and to open a business bank account.

Legal Use of the Limited Liability LLC

The Limited Liability LLC is legally recognized in Indiana, providing various protections and benefits. It allows members to operate their business while limiting personal liability for business debts. This means that creditors cannot pursue personal assets of the members to satisfy business obligations. Additionally, the LLC structure offers flexibility in management and tax treatment, allowing members to choose how they wish to be taxed—either as a corporation or as pass-through entities.

Required Documents

To establish a Limited Liability LLC in Indiana, several documents must be prepared and submitted:

- Articles of Organization: This foundational document includes essential information about the LLC, such as its name, registered agent, and purpose.

- Operating Agreement: While not required, this document helps clarify the roles and responsibilities of members and management.

- Employer Identification Number (EIN): Required for tax purposes, this number is obtained from the IRS.

State-Specific Rules for the Limited Liability LLC

Indiana has specific regulations governing the formation and operation of Limited Liability LLCs. These include:

- All LLCs must file their Articles of Organization with the Indiana Secretary of State.

- Indiana requires LLCs to maintain a registered agent with a physical address in the state.

- Annual reports must be filed to maintain good standing, along with any applicable fees.

How to Obtain the Limited Liability LLC

To obtain a Limited Liability LLC in Indiana, follow these steps:

- Visit the Indiana Secretary of State's website to access the necessary forms.

- Complete the Articles of Organization form with accurate information.

- Submit the form online or via mail, along with the required filing fee.

- Wait for confirmation of your LLC's formation, which will be sent by the Secretary of State.

Quick guide on how to complete limited liability llc

Complete Limited Liability Llc effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can find the right form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly without any hold-ups. Manage Limited Liability Llc on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to edit and eSign Limited Liability Llc with ease

- Obtain Limited Liability Llc and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and eSign Limited Liability Llc and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Indiana limited liability company (LLC)?

An Indiana limited liability company (LLC) is a business structure that offers personal liability protection to its owners while allowing them to benefit from the flexibility of a partnership. This means that owners are not personally liable for business debts, separating personal assets from business liabilities. LLCs in Indiana enjoy various tax benefits and are popular among small business owners due to their ease of management.

-

How can airSlate SignNow assist with setting up an Indiana limited liability company?

airSlate SignNow simplifies the process of setting up an Indiana limited liability company by providing users with easy-to-use document templates for filing necessary paperwork. With its eSignature capabilities, you can quickly sign and send forms securely. This efficiency helps new business owners get their Indiana LLC established without the hassle of traditional paperwork.

-

What are the costs associated with forming an Indiana limited liability company using airSlate SignNow?

Forming an Indiana limited liability company typically involves state filing fees and potential costs for legal assistance. airSlate SignNow offers affordable pricing plans that provide access to essential features for document management and eSigning. This cost-effective solution can ultimately save you money when establishing your Indiana LLC by streamlining the entire process.

-

What legal protections does an Indiana limited liability company offer?

An Indiana limited liability company offers limited liability protection, meaning that the owners' personal assets are generally protected from business debts and lawsuits. This setup helps to mitigate risks associated with running a business, allowing owners to operate their Indiana LLC with peace of mind. Additionally, it enhances the credibility of the business among clients and suppliers.

-

What features of airSlate SignNow are beneficial for Indiana limited liability companies?

AirSlate SignNow provides a range of features that are highly beneficial for Indiana limited liability companies, including secure eSigning, document templates, and integration with other productivity tools. These features streamline the workflow, making it easier for LLCs to manage contracts and agreements efficiently. The platform is designed to enhance collaboration and save time for business owners.

-

Can airSlate SignNow integrate with other software for Indiana limited liability companies?

Yes, airSlate SignNow integrates seamlessly with numerous popular software applications that Indiana limited liability companies may already be using, such as CRM and project management tools. This integration allows for a more cohesive workflow, making it easy to manage documents and communications. Such capabilities ensure that your business operates efficiently and maintains productivity across various platforms.

-

What are the benefits of using airSlate SignNow for Indiana limited liability companies?

Using airSlate SignNow provides several benefits for Indiana limited liability companies, including improved efficiency in document management, faster turnaround times with eSignatures, and the ability to track document status in real-time. This robust solution helps save time and reduces the administrative burden on your business. Additionally, it offers a user-friendly interface that is accessible for both tech-savvy and non-tech-savvy users.

Get more for Limited Liability Llc

Find out other Limited Liability Llc

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later