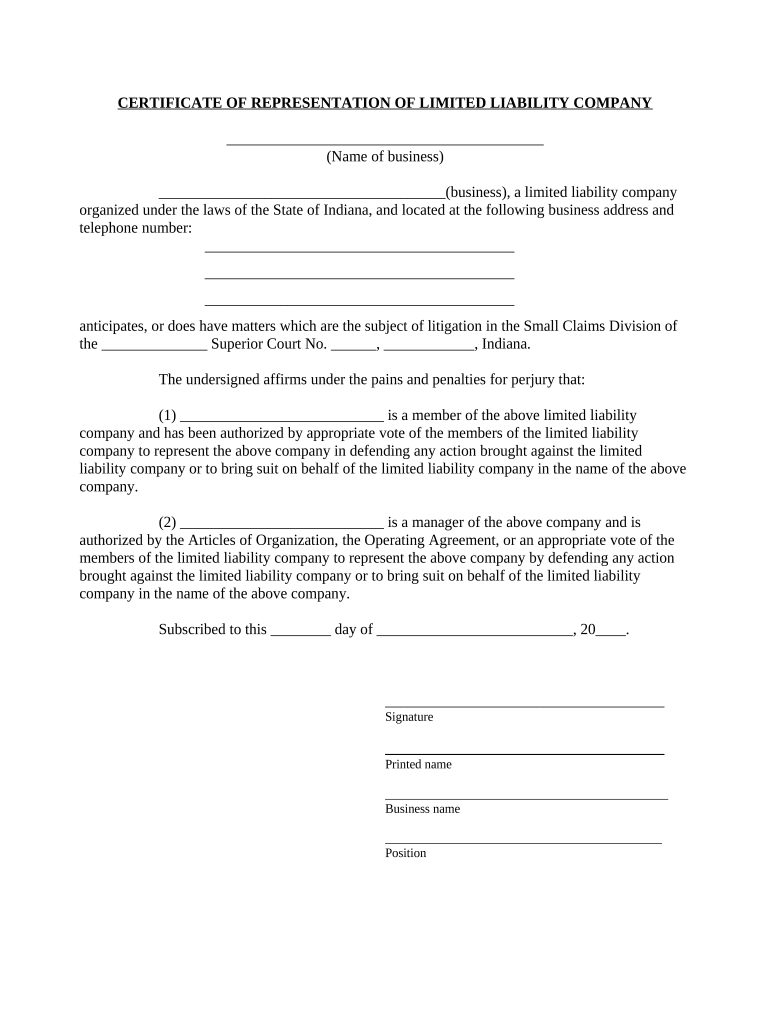

Indiana Limited Company Form

What is the Indiana Limited Company

The Indiana limited company, commonly referred to as an LLC, is a popular business structure that combines the flexibility of a partnership with the liability protection of a corporation. This entity type is designed to protect its owners, known as members, from personal liability for business debts and claims. In Indiana, forming an LLC requires compliance with state regulations, which include filing the necessary documents with the Secretary of State and adhering to specific operational guidelines.

How to obtain the Indiana Limited Company

To obtain an Indiana limited company, you must follow a series of steps that ensure compliance with state laws. First, choose a unique name for your LLC that complies with Indiana's naming requirements. Next, file the Articles of Organization with the Indiana Secretary of State, which can be done online or via mail. You will also need to pay the required filing fee. After your LLC is established, consider creating an operating agreement to outline the management structure and operational procedures.

Steps to complete the Indiana Limited Company

Completing the formation of an Indiana limited company involves several key steps:

- Choose a suitable name for your LLC, ensuring it includes "Limited Liability Company" or an abbreviation like "LLC."

- Designate a registered agent who will receive legal documents on behalf of the LLC.

- File the Articles of Organization with the Indiana Secretary of State, providing necessary details such as the LLC name, registered agent, and management structure.

- Pay the filing fee, which is typically required at the time of submission.

- Draft an operating agreement that outlines the rights and responsibilities of members.

Legal use of the Indiana Limited Company

The Indiana limited company is legally recognized as a separate entity, which means it can own property, enter contracts, and incur debts independently of its members. This structure provides personal liability protection, shielding members' personal assets from business liabilities. It is crucial for LLCs to maintain compliance with state laws, including filing annual reports and adhering to tax obligations, to ensure continued legal protection.

Key elements of the Indiana Limited Company

Several key elements define the Indiana limited company structure:

- Limited Liability: Members are not personally liable for the debts or obligations of the LLC.

- Pass-Through Taxation: Profits and losses are passed through to members, avoiding double taxation.

- Flexible Management: LLCs can be managed by members or designated managers, allowing for operational flexibility.

- Compliance Requirements: LLCs must adhere to state regulations, including filing annual reports and maintaining a registered agent.

State-specific rules for the Indiana Limited Company

Indiana has specific rules governing the formation and operation of limited companies. These include requirements for naming the LLC, maintaining a registered agent, and filing annual reports. Additionally, Indiana law mandates that LLCs comply with state tax obligations and maintain proper records. Understanding these regulations is essential for ensuring the lawful operation of your Indiana limited company.

Quick guide on how to complete indiana limited company

Effortlessly prepare Indiana Limited Company on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without hassles. Manage Indiana Limited Company on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The easiest way to modify and electronically sign Indiana Limited Company with ease

- Locate Indiana Limited Company and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with resources that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Indiana Limited Company to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Indiana limited company?

An Indiana limited company, often referred to as an LLC, is a business structure that combines the benefits of both corporations and partnerships. It provides personal liability protection to its owners, also known as members, while allowing for flexible tax treatment. If you're considering starting an Indiana limited company, it's vital to understand the legal requirements and benefits.

-

How do I create an Indiana limited company?

To create an Indiana limited company, you need to file Articles of Organization with the Indiana Secretary of State. You also must choose a unique business name and appoint a registered agent for your LLC. Once these steps are completed, you can legally operate your Indiana limited company and enjoy the benefits it offers.

-

What are the benefits of an Indiana limited company?

An Indiana limited company offers several advantages, including limited liability protection, which safeguards personal assets from business debts. Additionally, it provides flexibility in management and taxation options. Operating an Indiana limited company can also enhance your credibility with clients and partners.

-

What is the cost of forming an Indiana limited company?

The cost of forming an Indiana limited company varies, primarily based on filing fees and any additional services you may require. As of now, the standard filing fee for the Articles of Organization is around $100. It is advisable to budget for ongoing expenses, such as annual reports and state fees.

-

Can I manage my Indiana limited company using airSlate SignNow?

Yes, you can efficiently manage your Indiana limited company using airSlate SignNow. Our platform allows you to create, send, and eSign important documents seamlessly, which is essential for operating your business. With its user-friendly interface, managing contracts and agreements for your Indiana limited company becomes hassle-free.

-

What features does airSlate SignNow offer for Indiana limited companies?

airSlate SignNow offers features tailored for Indiana limited companies, such as customizable templates, multi-party signing, and real-time tracking of document status. These tools streamline the signing process and ensure your business remains compliant. The ability to integrate with other business applications enhances workflow efficiency.

-

Does airSlate SignNow integrate with accounting software for Indiana limited companies?

Absolutely! airSlate SignNow can integrate with popular accounting software, making it an ideal solution for Indiana limited companies. These integrations help you link your financial documents, like contracts and invoices, directly with your accounting system for better organization and tracking.

Get more for Indiana Limited Company

- Astrology workbook pdf form

- Physician prosthetic assessment form

- Rti intervention tracking the curriculum corner form

- Great plains laboratory test requisition form

- Mshmis street amp shelter intake form 3 917a mihomeless

- Mad juv 014 form

- Icwa 090 form

- Statement of issues contentions and proposed disposition of the form

Find out other Indiana Limited Company

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast