Deed Husband Wife Form

What is the deed husband wife?

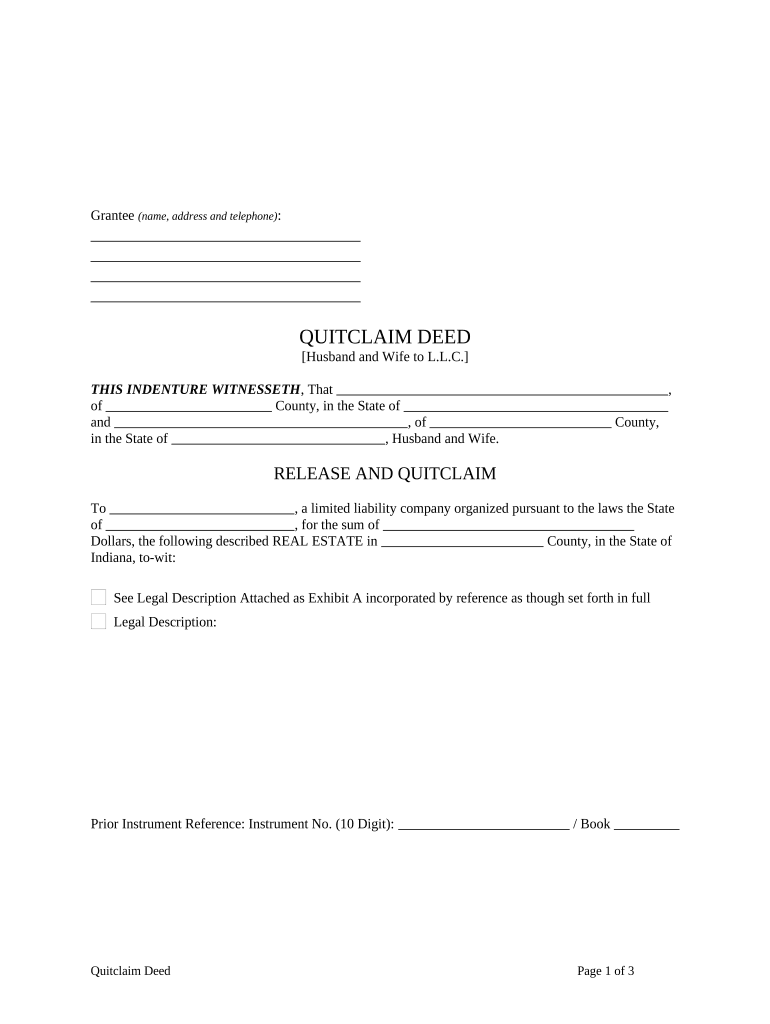

The deed husband wife is a legal document used to transfer property ownership between spouses. This type of deed is commonly utilized in the United States to ensure that both partners have equal rights to the property. It serves to clarify ownership and can be particularly important in situations involving marital property, ensuring that both parties are recognized as co-owners. The deed typically includes details such as the names of the spouses, a description of the property, and the signatures of both parties.

Steps to complete the deed husband wife

Completing the deed husband wife involves several key steps to ensure its validity and compliance with legal standards. First, gather necessary information, including the full names of both spouses, the property address, and a legal description of the property. Next, choose the appropriate type of deed, such as a quitclaim deed or warranty deed, based on your needs. After drafting the deed, both spouses must sign it in the presence of a notary public to ensure it is legally binding. Finally, file the completed deed with the local county recorder's office to make the transfer official.

Legal use of the deed husband wife

The legal use of the deed husband wife is primarily to facilitate the transfer of property between spouses, ensuring that both parties have clear ownership rights. This deed can be used in various situations, such as during a divorce, to clarify ownership, or when one spouse wishes to gift their interest in the property to the other. It is essential to understand the legal implications of using this type of deed, as it may affect property rights, tax liabilities, and future transactions involving the property.

Key elements of the deed husband wife

Key elements of the deed husband wife include the names of both spouses, a detailed description of the property being transferred, and the type of deed being used. Additionally, the document must contain the signatures of both spouses, notarization details, and the date of execution. It is also important to include any relevant legal descriptions or parcel numbers associated with the property to avoid ambiguity. These elements ensure that the deed is legally enforceable and properly recorded.

State-specific rules for the deed husband wife

State-specific rules for the deed husband wife can vary significantly across the United States. Each state may have different requirements regarding the form of the deed, the necessity of notarization, and filing procedures. It is crucial to consult local laws and regulations to ensure compliance. Some states may also have unique provisions concerning marital property rights that could influence the execution of the deed. Understanding these rules helps to avoid potential legal complications in the future.

Examples of using the deed husband wife

Examples of using the deed husband wife include transferring ownership of a family home from both spouses to one spouse during a divorce settlement or gifting property from one spouse to another as part of estate planning. Another common scenario is when spouses jointly purchase a new property and want to establish clear ownership rights from the outset. These examples illustrate the versatility and importance of the deed in managing marital property effectively.

Quick guide on how to complete deed husband wife 497306839

Effortlessly Prepare Deed Husband Wife on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly option to traditional printed and signed paperwork, as you can easily access the correct template and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly and without issues. Handle Deed Husband Wife on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to Edit and eSign Deed Husband Wife with Ease

- Obtain Deed Husband Wife and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information thoroughly and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Deed Husband Wife and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a wife LLC and how can it benefit my business?

A wife LLC refers to a limited liability company recommended for a wife to manage assets or business ventures effectively. It offers personal asset protection, potential tax benefits, and flexibility in management. Establishing a wife LLC can streamline operations, ensuring that the business is both compliant and secure.

-

How do I create a wife LLC using airSlate SignNow?

Creating a wife LLC with airSlate SignNow is straightforward and efficient. You can access customizable templates to draft your LLC documents. With our electronic signature features, you can execute and manage paperwork quickly and securely, eliminating the hassle of physical documents.

-

What are the pricing options for using airSlate SignNow for a wife LLC?

airSlate SignNow offers various pricing plans tailored to businesses, including those managing a wife LLC. Depending on your needs, you can choose from monthly or annual subscriptions that provide full access to our eSigning features. Start with a free trial to evaluate how our cost-effective solutions can benefit your LLC.

-

Can I integrate airSlate SignNow with other tools for managing my wife LLC?

Yes, airSlate SignNow can be integrated with numerous applications, enhancing your wife LLC’s operational efficiency. Popular integrations include Google Drive, Dropbox, and various CRM platforms. These integrations simplify document management and ensure seamless workflows across your business.

-

What features of airSlate SignNow are beneficial for a wife LLC?

Key features of airSlate SignNow for a wife LLC include customizable templates, bulk sending of documents, and advanced eSigning capabilities. These features make it easy to manage contracts and agreements while ensuring compliance and security. Additionally, our audit trail provides transparency for every signature collected.

-

Is airSlate SignNow secure for managing documents related to a wife LLC?

Absolutely, airSlate SignNow prioritizes security for all documents associated with your wife LLC. We utilize bank-level encryption and comply with regulatory standards to keep your information safe. You can confidently manage sensitive documents without worrying about unauthorized access.

-

What customer support options does airSlate SignNow provide for wife LLC users?

airSlate SignNow offers comprehensive customer support for users managing a wife LLC. You can access a knowledge base, video tutorials, and directly contact our support team via chat or email. We strive to ensure that your experience is smooth and that all your queries regarding your LLC are promptly addressed.

Get more for Deed Husband Wife

Find out other Deed Husband Wife

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors