Indiana Lien Form

What is the Indiana Lien

The Indiana lien is a legal claim against a property that secures the payment of a debt or obligation. This type of lien can arise from various circumstances, such as unpaid taxes, loans, or other financial obligations. When a lien is placed on a property, it can affect the owner's ability to sell or refinance the property until the debt is satisfied. Understanding the nature of the Indiana lien is crucial for property owners and creditors alike, as it outlines the rights and responsibilities associated with the property in question.

How to use the Indiana Lien

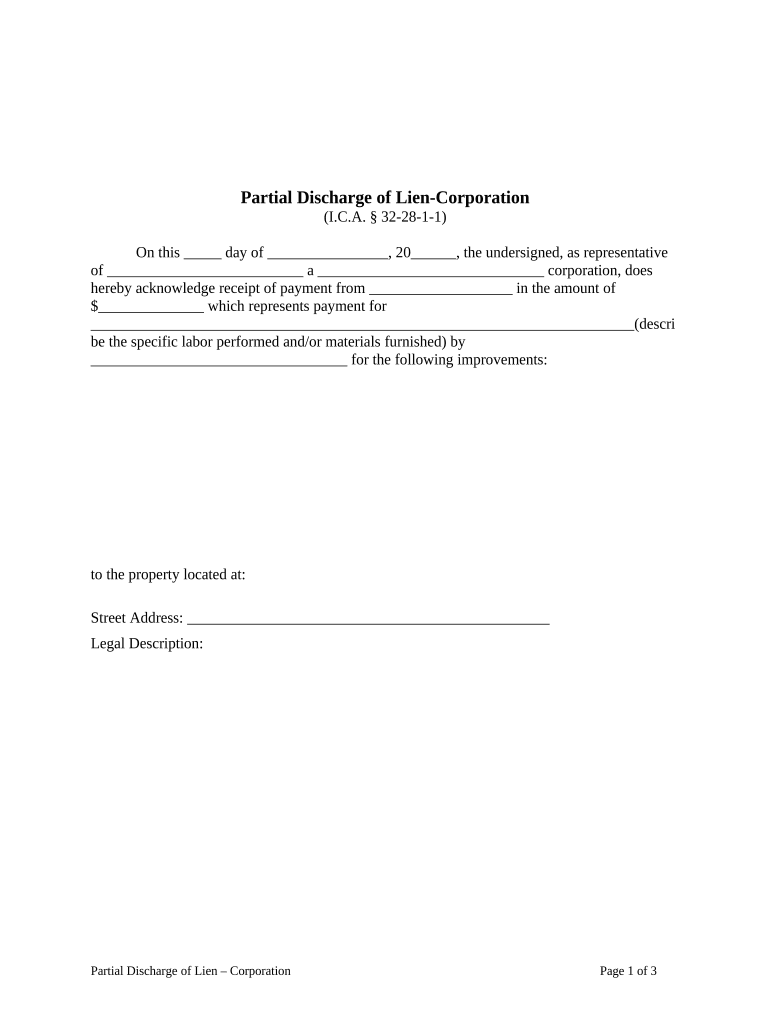

Utilizing the Indiana lien involves several key steps. First, it is essential to identify the specific debt or obligation that warrants the lien. Next, the appropriate documentation must be completed to formally establish the lien. This may include filling out the Indiana lien form and ensuring that all required information is accurately provided. Once the form is completed, it should be submitted to the appropriate county office for recording. This process not only legitimizes the lien but also ensures that it is publicly accessible, thereby protecting the creditor's interests.

Steps to complete the Indiana Lien

Completing the Indiana lien form requires careful attention to detail. Here are the steps involved:

- Gather necessary information about the debtor and the property.

- Fill out the Indiana lien form, ensuring all fields are completed accurately.

- Sign the form, as required, to validate the claim.

- Submit the completed form to the appropriate county office for recording.

- Keep a copy of the filed document for your records.

Legal use of the Indiana Lien

The legal use of the Indiana lien is governed by state laws and regulations. It is important for creditors to understand the legal framework surrounding liens to ensure compliance. This includes knowing the types of debts that can result in a lien, the proper procedures for filing, and the rights of property owners. Failure to adhere to these legal standards can result in the lien being deemed invalid, which may jeopardize the creditor's ability to collect the owed amount.

Key elements of the Indiana Lien

Several key elements define the Indiana lien. These include:

- The identification of the debtor and the property subject to the lien.

- The specific amount owed, including any interest or fees.

- The date the lien was filed, which establishes priority over other claims.

- The legal basis for the lien, such as a contract or statute.

Filing Deadlines / Important Dates

Filing deadlines for the Indiana lien are critical to ensure that the lien is enforceable. Generally, liens must be filed within a specific timeframe following the occurrence of the debt. It is advisable to check with local regulations to determine the exact deadlines, as these can vary based on the type of lien and the nature of the debt. Missing a filing deadline may result in the loss of the right to enforce the lien.

Quick guide on how to complete indiana lien 497306842

Complete Indiana Lien effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Indiana Lien on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign Indiana Lien without hassle

- Find Indiana Lien and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors requiring new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Indiana Lien and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Indiana lien?

An Indiana lien is a legal right or interest that a lender has in a debtor's property, granted until the debt obligation is satisfied. In Indiana, liens can be established for various reasons, including unpaid taxes or loans, and it's important to understand how they affect your financial standing.

-

How can airSlate SignNow help with creating Indiana liens?

airSlate SignNow simplifies the process of drafting and signing documents related to Indiana liens. With its intuitive interface, you can easily create lien documents, ensuring they meet all legal requirements while maintaining a streamlined workflow.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for managing Indiana liens. You can choose from monthly or annual subscriptions, ensuring you get the best value for your business operations.

-

Does airSlate SignNow integrate with other software for managing Indiana liens?

Yes, airSlate SignNow integrates with major software platforms like CRM systems and document management tools, facilitating the management of Indiana liens. This seamless integration ensures you can handle all aspects of lien management from a single platform.

-

What features does airSlate SignNow offer for handling Indiana liens?

airSlate SignNow includes features such as eSignatures, document templates, and cloud storage, making it easy to manage Indiana liens. These tools help streamline the document process, ensuring compliance and reducing the administrative burden.

-

Is airSlate SignNow legally compliant for Indiana lien documents?

Yes, airSlate SignNow ensures that all documents created, including Indiana lien documents, comply with state and federal regulations. This compliance gives you peace of mind, knowing that your legal documents are valid and enforceable.

-

How does airSlate SignNow enhance the efficiency of managing Indiana liens?

By utilizing airSlate SignNow, you can manage Indiana liens more efficiently through electronic workflows and automated notifications. This helps reduce turnaround times for document signing and approval, allowing you to focus on other critical aspects of your business.

Get more for Indiana Lien

Find out other Indiana Lien

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast