Form ST 809 New York State and Local Sales and Use Tax Return for Part Quarterly Monthly Filers Revised 124 2024

Overview of Form ST 809

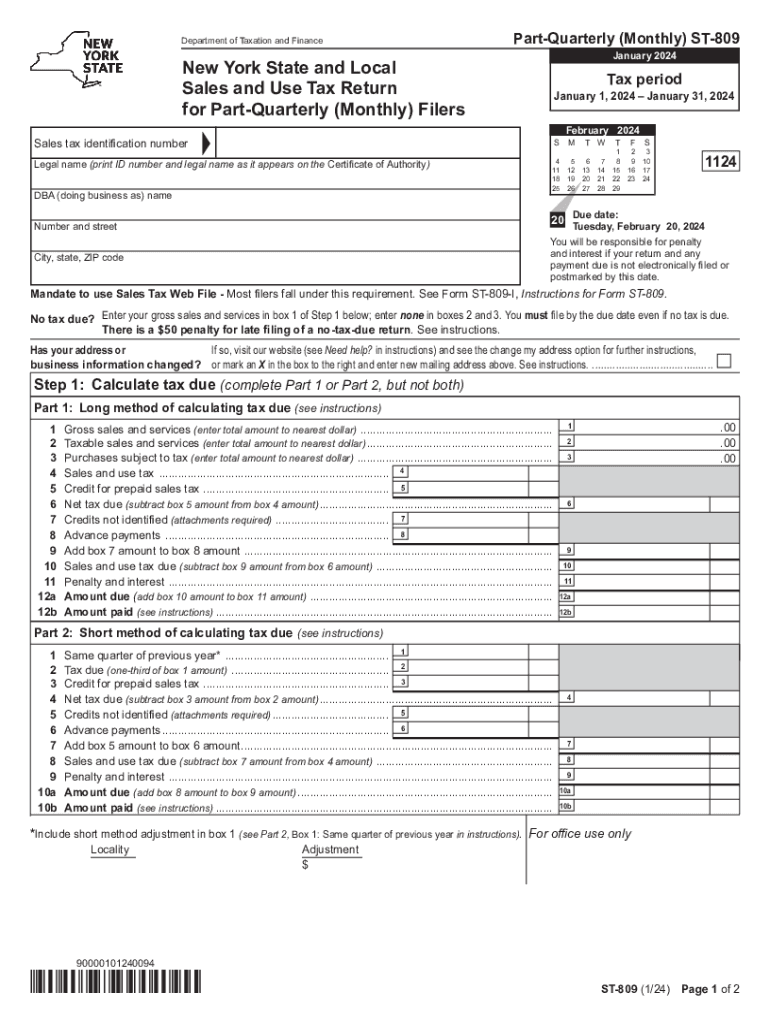

The Form ST 809 is the New York State and Local Sales and Use Tax Return for Part Quarterly and Monthly Filers. This form is essential for businesses that collect sales tax in New York. It allows them to report and remit the sales tax they have collected from customers. The form is revised periodically, with the latest version being revised in 2024. Understanding the purpose and requirements of this form is crucial for compliance with state tax regulations.

Steps to Complete Form ST 809

Completing the Form ST 809 involves several key steps to ensure accurate reporting of sales tax. First, gather all necessary financial records, including sales receipts and previous tax returns. Next, fill out the form with your business information, including your sales tax identification number. Report the total sales and the amount of sales tax collected during the reporting period. After completing the form, double-check for accuracy before submitting it to the New York State Department of Taxation and Finance.

Obtaining Form ST 809

Form ST 809 can be obtained through the New York State Department of Taxation and Finance website. It is available for download in a printable format, making it easy for businesses to access and complete the form. Additionally, physical copies may be available at local tax offices or through request via mail. Ensure that you are using the most current version of the form to avoid any compliance issues.

Key Elements of Form ST 809

Several key elements must be included when filling out Form ST 809. These include the business name, address, and sales tax identification number. The form requires detailed reporting of total sales, taxable sales, and the amount of sales tax collected. Additionally, any exemptions or deductions must be clearly stated. Understanding these elements is vital for accurate tax reporting and compliance with New York state tax laws.

Legal Use of Form ST 809

The legal use of Form ST 809 is primarily for businesses that are required to collect and remit sales tax in New York. This form serves as a legal document that reports sales tax obligations to the state. Failure to properly complete and submit this form can result in penalties and interest charges. Therefore, it is important for businesses to understand the legal implications of using this form and to ensure timely and accurate submissions.

Filing Deadlines for Form ST 809

Filing deadlines for Form ST 809 vary depending on whether a business is a monthly or quarterly filer. Monthly filers must submit their forms by the 20th of the following month after the reporting period. Quarterly filers have deadlines on the 20th of the month following the end of each quarter. It is essential to adhere to these deadlines to avoid late fees and potential penalties from the New York State Department of Taxation and Finance.

Create this form in 5 minutes or less

Find and fill out the correct form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 124

Create this form in 5 minutes!

How to create an eSignature for the form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 124

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is st809 and how does it relate to airSlate SignNow?

The st809 is a unique identifier for a specific feature set within airSlate SignNow. It allows users to easily access and utilize advanced eSigning capabilities, ensuring a seamless document management experience. By leveraging st809, businesses can enhance their workflow efficiency and improve overall productivity.

-

What are the pricing options for airSlate SignNow with st809 features?

airSlate SignNow offers competitive pricing plans that include access to st809 features. These plans are designed to cater to businesses of all sizes, providing flexibility and scalability. You can choose from monthly or annual subscriptions, ensuring you get the best value for your investment.

-

What key features does st809 offer in airSlate SignNow?

The st809 features in airSlate SignNow include advanced eSignature capabilities, document templates, and real-time collaboration tools. These features are designed to streamline the signing process and enhance user experience. With st809, users can also track document status and receive notifications, making it easier to manage workflows.

-

How can st809 benefit my business?

Utilizing st809 within airSlate SignNow can signNowly benefit your business by reducing turnaround times for document signing. This leads to faster decision-making and improved customer satisfaction. Additionally, st809 helps in maintaining compliance and security, ensuring that your documents are handled with care.

-

Can I integrate st809 with other software applications?

Yes, airSlate SignNow with st809 features can be easily integrated with various software applications. This includes popular CRM systems, project management tools, and cloud storage services. These integrations enhance your workflow by allowing seamless data transfer and improved collaboration across platforms.

-

Is there a mobile app for airSlate SignNow with st809 capabilities?

Absolutely! airSlate SignNow offers a mobile app that includes all the st809 features, allowing you to manage your documents on the go. The app is user-friendly and provides the same level of functionality as the desktop version. This ensures that you can send and eSign documents anytime, anywhere.

-

What kind of customer support is available for st809 users?

airSlate SignNow provides comprehensive customer support for users utilizing st809 features. This includes access to a knowledge base, live chat, and email support. Our dedicated support team is available to assist you with any questions or issues you may encounter while using st809.

Get more for Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 124

Find out other Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 124

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors