Brickstreet First Report of Injury 2008-2026

What is the Brickstreet First Report Of Injury

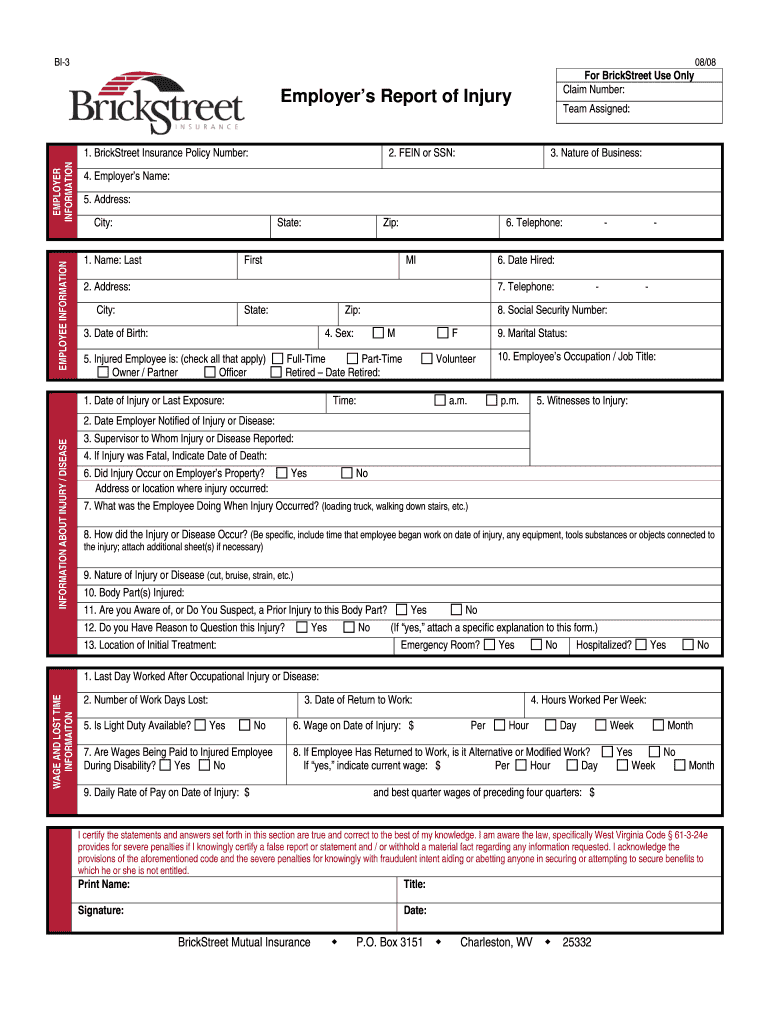

The Brickstreet First Report Of Injury is a crucial document used in the state of West Virginia for reporting workplace injuries. This form serves to officially notify the employer and the insurance provider about an employee's injury that occurred while performing job-related duties. It is a vital part of the workers' compensation process, ensuring that the injured party receives the necessary medical care and compensation for lost wages. Understanding this form is essential for both employees and employers to navigate the complexities of workplace injury claims effectively.

Steps to complete the Brickstreet First Report Of Injury

Completing the Brickstreet First Report Of Injury involves several key steps to ensure accuracy and compliance with state regulations. Follow these steps:

- Begin by gathering all relevant information about the injured employee, including their name, address, and contact details.

- Document the specifics of the injury, including the date, time, and location of the incident.

- Provide a detailed description of how the injury occurred, including any witnesses present at the time.

- Include information about the medical treatment received, if applicable, and the names of healthcare providers involved.

- Review the completed form for accuracy before submission to ensure all required fields are filled out correctly.

Legal use of the Brickstreet First Report Of Injury

The legal use of the Brickstreet First Report Of Injury is governed by West Virginia state law. This form must be submitted within a specific timeframe following the injury to comply with workers' compensation regulations. Failure to file this report promptly can result in delays in benefits for the injured employee and potential penalties for the employer. It is essential for employers to understand their legal obligations regarding this form to protect both their employees and their business interests.

Key elements of the Brickstreet First Report Of Injury

Several key elements must be included in the Brickstreet First Report Of Injury to ensure its validity and effectiveness. These elements include:

- The employee's personal information, such as name, address, and Social Security number.

- Details of the injury, including the nature of the injury and the body part affected.

- The circumstances surrounding the incident, including a description of the work being performed at the time.

- Information about any witnesses who can corroborate the details of the incident.

- The employer's information, including the company name and contact details.

How to obtain the Brickstreet First Report Of Injury

The Brickstreet First Report Of Injury can be obtained through various channels. Employers can access the form directly from Brickstreet Insurance's official website or through their human resources department. Additionally, many employers keep copies of this form readily available in the workplace to facilitate immediate reporting of injuries. It is advisable for employers to ensure that all employees are aware of where to find this form and how to complete it correctly.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Brickstreet First Report Of Injury can be done through several methods, depending on the employer's preference and the urgency of the report. The available submission methods include:

- Online submission through the Brickstreet Insurance portal, which allows for quick and efficient processing.

- Mailing the completed form to the appropriate Brickstreet Insurance office, ensuring it is sent promptly to meet deadlines.

- In-person submission at the employer's office or the local Brickstreet Insurance office, which can facilitate immediate confirmation of receipt.

Quick guide on how to complete employeramp39s report of injury brickstreet insurance

Explore the simpler method to manage your Brickstreet First Report Of Injury

The traditional approaches to finalizing and approving documents are excessively time-consuming compared to modern document management solutions. Previously, you had to look for appropriate paper forms, print them, fill in all the details, and mail them. Now, you can discover, fill out, and sign your Brickstreet First Report Of Injury within a single browser tab using airSlate SignNow. Preparing your Brickstreet First Report Of Injury has never been easier.

Steps to finalize your Brickstreet First Report Of Injury using airSlate SignNow

- Access the relevant category page and find your state-specific Brickstreet First Report Of Injury. Alternatively, utilize the search bar.

- Confirm that the version of the form is accurate by reviewing it.

- Click Obtain form and enter the editing mode.

- Fill out your document with the necessary information using the editing features.

- Review the provided information and click the Sign option to validate your form.

- Select the most suitable method to create your signature: generate it, draw your signature, or upload an image of it.

- Click FINISHED to apply the changes.

- Download the document to your device or go to Sharing options to send it digitally.

Robust online platforms like airSlate SignNow enhance the process of completing and submitting your forms. Try it out to discover the actual duration that document management and approval processes should take. You will save a considerable amount of time.

Create this form in 5 minutes or less

FAQs

-

How much paperwork does an employer have to fill out if an employee quits without putting their two weeks in?

Generally an exit interview is required to return company's items including but not limited to software. Hardware, passwords, company cars and more. The Dept head should sign as well as all the way up the ladder until human resources is satisfied with a clean break of employment

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

When I filled out my insurance form from my employer, they asked if I smoke. How can they verify this?

They can probably tell by smelling your breath or looking at your teeth, but no one is gong to challenge what you put on the form.HOWEVER…What will happen if you develop a smoking-related illness is that the insurance company can deny coverage based on your fraud when filling out the forms.That’s they way insurance contracts always work. For example, you could get cheaper car insurance if you tell them your car is a cheaper model. Then, if you have an accident and put in a claim to repair a more costly model, they deny it saying that’s not the car they insured. Or perhaps you have a homeowner policy in which you declared all electrical work had be done by licensed electricians. Then there is a fire and they find you had done some of your own wiring to finish a basement room. Coverage denied.So, no one is going to question your answers. But the insurance will be pretty worthless if you lie on the application. They will accept your statements as fact and take your money, but when it comes time to collect, they can deny payment based on your lies.

-

How should I fill out an employment background check form if I have a criminal history? (The background check is post-offer.)

When looking for records on the net try a website such as backgroundtool.com It is both open public and also exclusive information. It will go further than what just one supplier is able to do for you or what yahoo and google might present you with. You have entry to public information, social websites analysis, a all round world wide web research, court public records, criminal offender records, mobile phone data (both open public and exclusive repositories ), driving information and a lot more.How should I fill out an employment background check form if I have a criminal history? (The background check is post-offer.)Understand Employment Background ChecksWhat Is A Background Check? - An Employment Background Check may be best described as an Application Verification. An employment background check allows an employer to verify information provided by an applicant on a resume or job application. Independent sources such as criminal and civil court records, prior employers, educational institutions, and departments of motor vehicles are researched. The information obtained is then compared to the information provided by the applicant and reviewed for any negative material.Most Employers Do Background Checks - Most employers do some form of an employment background check. This can be as simple a reference check, or as in-depth as covering everything from criminal record checks to interviewing friends and neighbors.Why Employers Do Background Checks - Employers conduct background checks to meet regulatory, insurance, and customer requirements; increase applicant and new hire quality; reduce workplace violence; avoid bad publicity; protect against negligent hiring liability; reduce employee dishonesty losses; reduce employee turnover; and hire the right person the first time. An employer has the obligation to provide a safe workplace for employees, customers, and the public. See Why Background Checks?What Do They Look For In A Background Check? - Employers look for discrepancies between an applicant’s claims and what is reported by schools, prior employers, etc. They also look for negative reports such as a bad Driving Record or a Criminal History that would impact the applicant's job qualifications. See What Do Employers Look For in a Background Check?What Is In A Background Check For Employment? - Anything from an applicant's history CAN come up. It depends how detailed the background check is, who conducts the background check, how far back they go, who they talk to, what information they check, and what laws apply in the particular situation. If there are any black marks in an applicant's past, it is pretty hard to keep them a secret. See What Shows Up On A Background Check For Employment?A typical basic background check may include county criminal record checks, a social security number scan, employment history verification, and education verification. Depending on the job, a more complete background check may include common items such as a motor vehicle report, a credit report, license and certification verification, reference checks, a sex offender registry check, or county civil record searches. See Comprehensive Background Check.Your Rights - The FCRA (Fair Credit Reporting Act) is the primary federal law regulating employment background checks. Despite its name the FCRA applies to all employment backgrounds checks conducted by a third party whether they include a credit report or not. See A Summary of Your Rights Under the Fair Credit Reporting Act.In addition to the FCRA, there are many other Federal, State, and Local laws and regulations that may impact a particular employment background check. See Background Check Laws & Regulations.

-

I want to invest my IRS withholdings. How do I fill out a W-4 so my employer does not do federal withholding?

Legally you can’t. Those withholdings are not yours. They are payments towards your tax liability, made at the time that you earn the income. Pay as you go. It makes sense.So what you want to do is borrow money that isn’t really yours, interest free, invest it for a few months, and then pay it back the next year. Is that correct? While it’s not really permitted you can manage to get away with it. You can’t easily get away with stopping all withholding. That requires stating that you expect to pay zero taxes for the year, which you know is false. It looks suspicious and is easy for the feds to check. Instead, what you can do is reduce your withholding by claiming a large number of exemptions. That’s not nearly as suspicious. When you complete your return you’ll owe a lot of tax, which is clearly against the rules, but you’ll probably get away with it at least for a year or two and maybe longer depending on how lax the IRS is in enforcing the law on scamsters like yourself.I used to claim a large number of exemptions. It was legitimate since I actually had a lot of deductions at that time. But a couple of years I accidentally withheld too little money, more than a couple of thousand dollars. I paid the tax with my return and adjusted my withholding going forward and the IRS didn’t penalize me or question it afterwards. But if you’re talking about under withholding by a lot more than that and year after year then good luck. You might get caught, forced to pay a penalty and interest, and be flagged for special attention in the future.

-

If an old employer closed down its business, how do you fill out the "phone" section of an online job application?

This happened to me. I just put the last number I had available, and let HR figure it out. Not my problem. I also got one of the jobs I was applying for with this situation . I really doubt they put as much stock in these "verification of employment things" as long as there is not a pattern of inconsistent information on the rest of the application.

-

How do I fill out the employment and income section on the UK visa application if sponsored by a partner?

The answer depends on what kind of visa you are seeking, and also what you mean by the word “sponsored”…If you wish to VISIT the UK then all that your partner can do is cover the costs of your trip. The visa officer still needs to be sure that you are likely to return home after your holiday, and usually that means that you have to demonstrate that you have a decent job and a reasonable income at home.If you wish to SETTLE in the UK then what is important is your partner’s income, since that income will have to support you as well. Information about what you earn in your home country is not really relevant, since presumably you would be leaving your job in order to move to Britain.

Create this form in 5 minutes!

How to create an eSignature for the employeramp39s report of injury brickstreet insurance

How to generate an electronic signature for the Employeramp39s Report Of Injury Brickstreet Insurance online

How to generate an electronic signature for your Employeramp39s Report Of Injury Brickstreet Insurance in Google Chrome

How to generate an electronic signature for putting it on the Employeramp39s Report Of Injury Brickstreet Insurance in Gmail

How to make an electronic signature for the Employeramp39s Report Of Injury Brickstreet Insurance straight from your mobile device

How to make an electronic signature for the Employeramp39s Report Of Injury Brickstreet Insurance on iOS devices

How to create an electronic signature for the Employeramp39s Report Of Injury Brickstreet Insurance on Android devices

People also ask

-

What is the Brickstreet First Report Of Injury and how does it work?

The Brickstreet First Report Of Injury is a crucial document used to report workplace injuries. With airSlate SignNow, businesses can easily fill out and eSign this report electronically, ensuring compliance and swift processing. Our platform simplifies the creation and submission of the Brickstreet First Report Of Injury, making it accessible and efficient for all users.

-

How can airSlate SignNow help me with the Brickstreet First Report Of Injury?

airSlate SignNow streamlines the process of completing the Brickstreet First Report Of Injury by providing an intuitive interface for eSigning and managing documents. You can easily upload, edit, and send necessary forms, ensuring that your reports are completed accurately and quickly. This saves time and reduces the likelihood of errors in your submissions.

-

Is there a cost associated with using airSlate SignNow for the Brickstreet First Report Of Injury?

Yes, airSlate SignNow offers various pricing plans to suit different business needs when handling the Brickstreet First Report Of Injury. Our plans are designed to be cost-effective, providing excellent value for features that enhance document management and eSigning processes. You can choose a plan that fits your budget while ensuring compliance and efficiency.

-

What features does airSlate SignNow provide for the Brickstreet First Report Of Injury?

airSlate SignNow includes several features for efficiently managing the Brickstreet First Report Of Injury, such as customizable templates, automated workflows, and secure eSigning. These features help streamline the reporting process, ensuring that all necessary information is captured and submitted on time. Additionally, our platform offers tracking and notifications to keep stakeholders informed.

-

Can I integrate airSlate SignNow with other systems for the Brickstreet First Report Of Injury?

Absolutely! airSlate SignNow integrates seamlessly with various applications and systems, allowing you to connect your existing tools with the Brickstreet First Report Of Injury process. This integration capability enhances productivity by enabling automatic data transfer and reducing manual entry. You can easily link your HR systems or case management software for a more cohesive workflow.

-

How secure is airSlate SignNow for handling the Brickstreet First Report Of Injury?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the Brickstreet First Report Of Injury. Our platform employs advanced encryption and compliance with industry standards to protect your data. This ensures that all submitted reports are secure and only accessible by authorized personnel.

-

What benefits does eSigning the Brickstreet First Report Of Injury offer?

Using airSlate SignNow for eSigning the Brickstreet First Report Of Injury offers numerous benefits, including faster turnaround times, reduced paper usage, and improved tracking of document status. eSigning eliminates the need for printing, scanning, and mailing physical documents, making the process more efficient. Plus, it ensures that all stakeholders can sign from anywhere at any time, enhancing accessibility.

Get more for Brickstreet First Report Of Injury

Find out other Brickstreet First Report Of Injury

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement