13 Bankruptcy Indiana Form

What is the 13 Bankruptcy Indiana

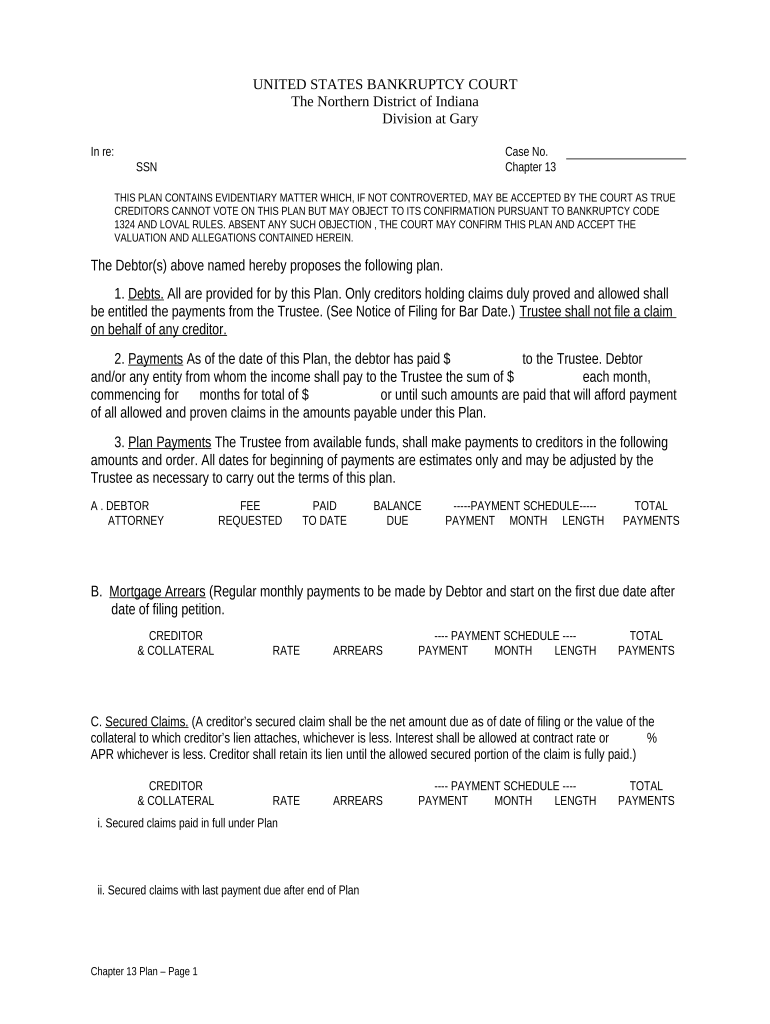

The 13 Bankruptcy in Indiana, also known as Chapter 13 bankruptcy, is a legal process that allows individuals with a regular income to reorganize their debts. This type of bankruptcy enables debtors to create a repayment plan to pay back all or part of their debts over a specified period, usually three to five years. Unlike Chapter 7 bankruptcy, which involves liquidating assets, Chapter 13 allows individuals to keep their property while making manageable payments to creditors.

Steps to Complete the 13 Bankruptcy Indiana

Completing the Chapter 13 bankruptcy process involves several key steps:

- Credit Counseling: Before filing, individuals must complete a credit counseling session with an approved agency.

- Filing the Petition: The debtor files a bankruptcy petition with the court, including schedules of assets, liabilities, income, and expenses.

- Repayment Plan: A repayment plan must be proposed, outlining how debts will be repaid over the designated period.

- Meeting of Creditors: A meeting is held where creditors can question the debtor about their finances.

- Confirmation Hearing: The court will hold a hearing to confirm the repayment plan.

- Making Payments: The debtor must begin making payments according to the confirmed plan.

Legal Use of the 13 Bankruptcy Indiana

Chapter 13 bankruptcy is legally recognized in Indiana and provides a structured way for individuals to manage their debts. It is essential for debtors to adhere to the legal requirements set forth by the bankruptcy court, including timely payments and compliance with the repayment plan. Failure to comply with these legal obligations can result in the dismissal of the bankruptcy case.

Required Documents

To file for Chapter 13 bankruptcy in Indiana, several documents are necessary:

- Completed bankruptcy petition and schedules.

- Proof of income, such as pay stubs or tax returns.

- List of debts and creditors.

- Credit counseling certificate.

- Documentation of monthly expenses.

Eligibility Criteria

To qualify for Chapter 13 bankruptcy in Indiana, individuals must meet specific eligibility criteria:

- Must have a regular income.

- Unsecured debts must be less than $419,275.

- Secured debts must be less than $1,257,850.

- Must complete credit counseling before filing.

Form Submission Methods

Individuals can submit their Chapter 13 bankruptcy forms through various methods:

- Online: Many courts allow electronic filing through their websites.

- By Mail: Forms can be mailed to the appropriate bankruptcy court.

- In-Person: Individuals may also file forms in person at the bankruptcy court.

Quick guide on how to complete 13 bankruptcy indiana

Effortlessly Prepare 13 Bankruptcy Indiana on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the required format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without delays. Manage 13 Bankruptcy Indiana on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and eSign 13 Bankruptcy Indiana with Ease

- Find 13 Bankruptcy Indiana and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or cover sensitive information using tools that airSlate SignNow specifically provides for those tasks.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching for forms, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign 13 Bankruptcy Indiana and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an in chapter paper and how does airSlate SignNow help?

An in chapter paper refers to a section within a larger document that is focused on a specific topic. airSlate SignNow streamlines the process of managing in chapter papers by allowing businesses to create, send, and eSign documents efficiently. This ensures that all stakeholders can collaborate seamlessly on specific sections of text.

-

How does airSlate SignNow ensure the security of my in chapter papers?

airSlate SignNow prioritizes the security of your in chapter papers with robust encryption and secure authentication protocols. This ensures that your documents are protected from unauthorized access or data bsignNowes. You can confidently share sensitive in chapter papers knowing they are safeguarded.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to different business needs. These plans give you access to features that improve the workflow for in chapter papers, such as eSigning and document management. You can choose a plan that suits your budget and requirements for handling in chapter papers.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates seamlessly with numerous applications to enhance your workflow. This is particularly useful for managing in chapter papers alongside other tools like CRMs and cloud storage solutions. Integrations save time and simplify the use of in chapter papers within your existing systems.

-

What features does airSlate SignNow offer for managing in chapter papers?

airSlate SignNow provides a range of features that facilitate the management of in chapter papers. Key features include customizable templates, bulk sending, and real-time tracking of document statuses. These tools make it easy to create and manage in chapter papers efficiently.

-

How does airSlate SignNow improve collaboration on in chapter papers?

airSlate SignNow enhances collaboration on in chapter papers by allowing multiple users to review and sign documents simultaneously. Features like comments and in-app notifications keep everyone informed about changes and approvals. This fosters a more productive environment for working on in chapter papers.

-

Is airSlate SignNow suitable for both small and large businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small and large organizations. Its scalable features and pricing plans ensure that companies handling numerous in chapter papers can find a suitable solution tailored to their needs.

Get more for 13 Bankruptcy Indiana

- Beedi pension application form pdf

- Pdf background color change online form

- 8th grade science staar review reporting category 1 answer key form

- Radioactive decay worksheet pdf form

- Family details form 270995561

- Aflac forms printable 31476469

- Application for citizenship and issuanceof certif form

- Uscis expands premium processing for applicants form

Find out other 13 Bankruptcy Indiana

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template