Assignment to Living Trust Indiana Form

What is the Assignment To Living Trust Indiana

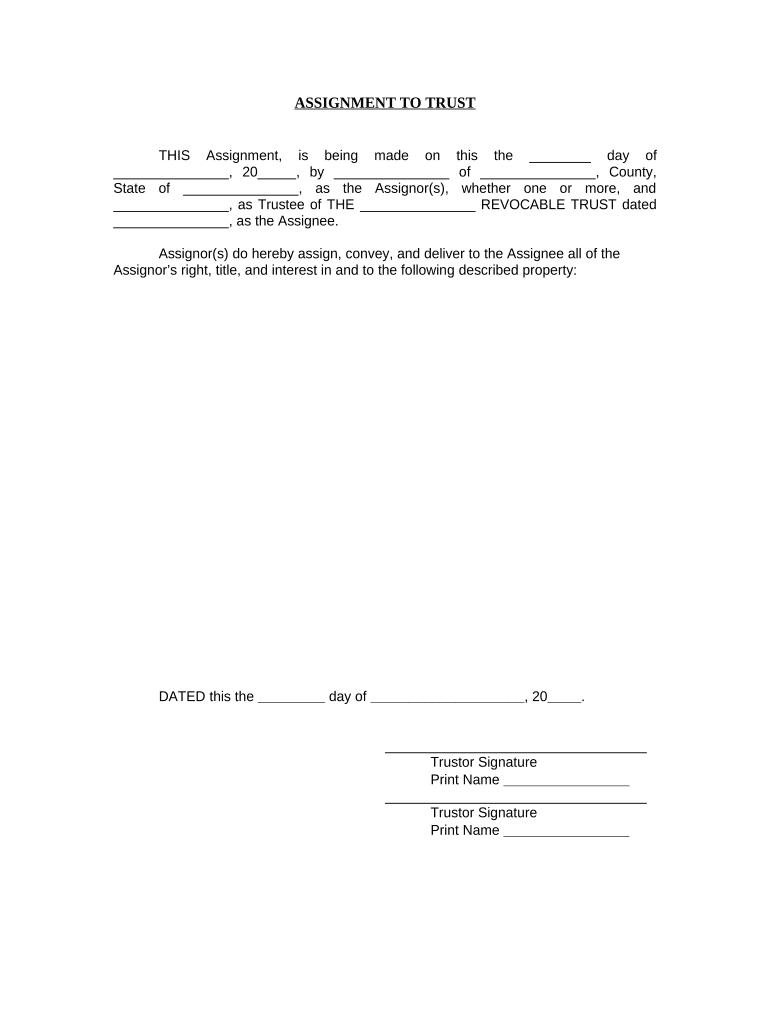

The Assignment To Living Trust Indiana is a legal document used to transfer ownership of assets into a living trust. A living trust is an estate planning tool that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death. By assigning assets to a living trust, the individual retains control over them while ensuring a smoother transition to beneficiaries upon passing. This document is essential for those looking to avoid probate and streamline the estate settlement process.

How to use the Assignment To Living Trust Indiana

Using the Assignment To Living Trust Indiana involves several key steps. First, individuals must identify the assets they wish to transfer into the trust, which may include real estate, bank accounts, and personal property. Next, the individual must complete the assignment form with accurate details about the trust and the assets being transferred. After filling out the form, it is important to sign it in accordance with Indiana state laws, which often require notarization. Once completed, the assignment should be kept with the trust documents to ensure that all assets are properly managed under the trust.

Steps to complete the Assignment To Living Trust Indiana

Completing the Assignment To Living Trust Indiana involves a systematic approach:

- Gather information about the assets to be assigned, including titles and account numbers.

- Obtain the Assignment To Living Trust form, which can be found through legal resources or estate planning professionals.

- Fill out the form, providing necessary details such as the name of the trust, the trustee, and the specific assets being assigned.

- Review the completed form for accuracy and completeness.

- Sign the form in the presence of a notary public to ensure its legal validity.

- Store the signed document with other estate planning documents for future reference.

Key elements of the Assignment To Living Trust Indiana

Several key elements must be included in the Assignment To Living Trust Indiana to ensure its validity:

- Trust Name: Clearly state the name of the living trust to which assets are being assigned.

- Trustee Information: Include the name and contact information of the trustee responsible for managing the trust.

- Description of Assets: Provide a detailed description of each asset being transferred, including any identifying numbers or titles.

- Signatures: Ensure that the document is signed by the individual assigning the assets and notarized.

- Date: Include the date of the assignment to establish a timeline for the transfer.

State-specific rules for the Assignment To Living Trust Indiana

Indiana has specific rules regarding the Assignment To Living Trust, which must be adhered to for the document to be legally binding. These include:

- Notarization: The assignment must be signed in the presence of a notary public.

- Asset Identification: All assets must be clearly identified and described to avoid ambiguity.

- Compliance with State Laws: The assignment must comply with Indiana's laws governing trusts and estates.

Legal use of the Assignment To Living Trust Indiana

The Assignment To Living Trust Indiana serves a legal purpose in estate planning. By transferring assets into a trust, individuals can avoid probate, ensuring that their beneficiaries receive their inheritance without unnecessary delays or legal complications. This document must be used correctly and in accordance with Indiana law to maintain its legal standing. Failure to comply with legal requirements may result in challenges to the trust's validity or the distribution of assets.

Quick guide on how to complete assignment to living trust indiana

Complete Assignment To Living Trust Indiana effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Assignment To Living Trust Indiana on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Assignment To Living Trust Indiana without hassle

- Locate Assignment To Living Trust Indiana and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign function, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your delivery method for the form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Assignment To Living Trust Indiana and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Assignment To Living Trust in Indiana?

An Assignment To Living Trust in Indiana is a legal document that transfers ownership of assets into a living trust. This process protects your assets, avoids probate, and simplifies transfer upon death. Understanding this concept is essential for those looking to manage their estate effectively.

-

How does airSlate SignNow assist with an Assignment To Living Trust in Indiana?

airSlate SignNow offers an efficient platform to create, sign, and manage your Assignment To Living Trust in Indiana. With our easy-to-use tools, you can generate customized documents and securely eSign them from any device. This streamlines the process and ensures compliance with Indiana state laws.

-

What are the pricing options for creating an Assignment To Living Trust in Indiana with airSlate SignNow?

airSlate SignNow provides competitive pricing plans to accommodate various needs for creating an Assignment To Living Trust in Indiana. We offer flexible monthly and annual subscriptions that grant you access to all our features, including document templates and eSigning functionalities. Explore our pricing page for detailed information.

-

Can I integrate airSlate SignNow with my existing software for managing an Assignment To Living Trust in Indiana?

Yes, airSlate SignNow seamlessly integrates with numerous applications, making it easy to manage your Assignment To Living Trust in Indiana. Whether you use CRM systems, document management tools, or other business applications, our integrations ensure smooth workflows. Check out our integrations page for a complete list.

-

What benefits does using airSlate SignNow provide for managing an Assignment To Living Trust in Indiana?

Using airSlate SignNow for your Assignment To Living Trust in Indiana offers signNow benefits, such as enhanced security, time savings, and user-friendly document management. Our platform simplifies collaboration with family members and advisors, ensuring that your estate planning process is both efficient and effective. Experience peace of mind knowing your documents are secure.

-

Is airSlate SignNow legally compliant for an Assignment To Living Trust in Indiana?

Absolutely! airSlate SignNow is designed to comply with all legal standards for an Assignment To Living Trust in Indiana. Our electronic signatures are legally binding and recognized under Indiana law, ensuring your documents are valid and enforceable. Trust in our platform for your estate planning needs.

-

What types of assets can be transferred using an Assignment To Living Trust in Indiana?

With an Assignment To Living Trust in Indiana, you can transfer a variety of assets, including real estate, bank accounts, stocks, and personal property. This flexibility allows you to manage all your valuable assets comprehensively. Properly assigning these assets can help you avoid probate and facilitate a smoother transition to your heirs.

Get more for Assignment To Living Trust Indiana

- Photo of usa hospital document form

- Notify post office of address change form

- Contractor registration application lombard il form

- Opposition to motion for summary judgment form

- Annual agreement form

- Ontario retail sales tax purchase exemption certificate form

- Oregon state government organizational chart form

- Css profile waiver request for the noncustodial parent css profile waiver request for the noncustodial parent form

Find out other Assignment To Living Trust Indiana

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile

- Sign Wisconsin LLC Operating Agreement Mobile

- Can I Sign Wyoming LLC Operating Agreement

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure