Indiana Installments Fixed Rate Promissory Note Secured by Personal Property Indiana Form

What is the Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana?

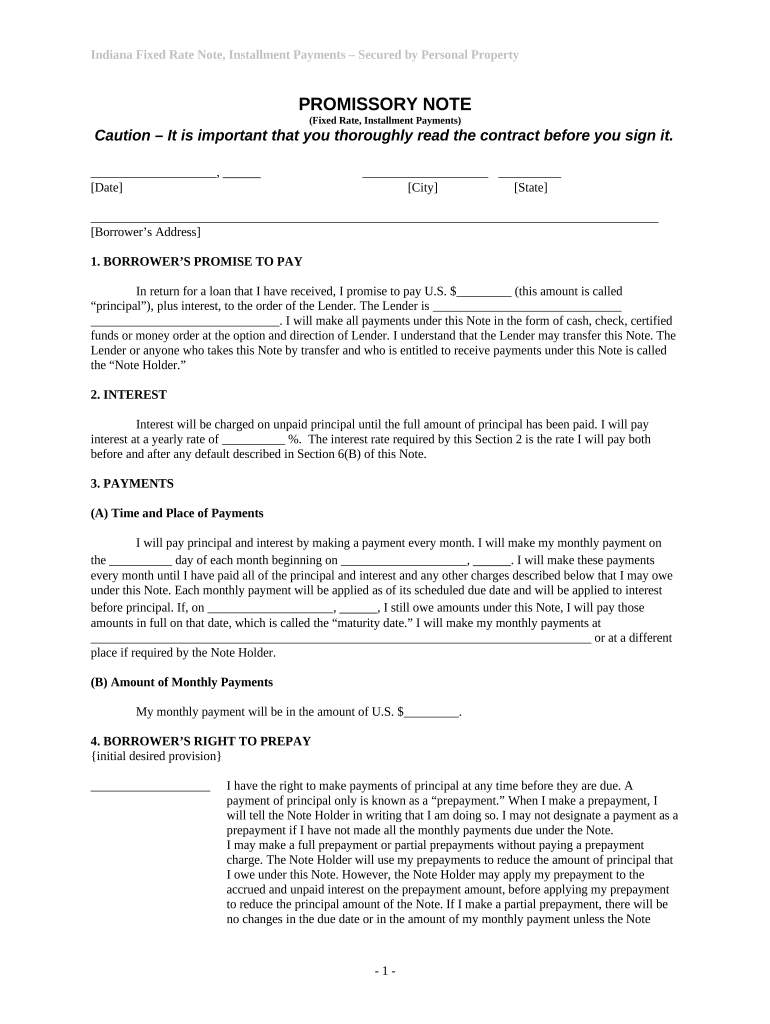

The Indiana Installments Fixed Rate Promissory Note Secured By Personal Property is a legally binding document that outlines the terms of a loan agreement between a borrower and a lender. This note specifies that the borrower will repay the loan in fixed installments over a predetermined period. The unique aspect of this promissory note is that it is secured by personal property, meaning that the lender has a claim to the specified personal assets if the borrower defaults on the loan. This form protects the lender's interests while providing the borrower with a clear repayment structure.

How to Use the Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana

Using the Indiana Installments Fixed Rate Promissory Note involves several key steps. First, both parties should review the terms of the agreement, including the loan amount, interest rate, and repayment schedule. Once both parties agree, they can complete the form by filling in the required information, such as names, addresses, and details about the personal property securing the loan. After filling out the document, both parties must sign it to make it legally binding. It is advisable to keep a copy for personal records and provide one to the other party.

Steps to Complete the Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana

Completing the Indiana Installments Fixed Rate Promissory Note involves a series of straightforward steps:

- Gather necessary information, including the names and addresses of both the borrower and lender.

- Determine the loan amount, interest rate, and repayment schedule.

- Identify the personal property being used as collateral.

- Fill out the form with the gathered information accurately.

- Review the document to ensure all details are correct.

- Both parties should sign and date the document.

- Distribute copies to all parties involved.

Legal Use of the Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana

This promissory note is legally recognized in Indiana, provided it meets specific requirements set forth by state law. It must clearly outline the loan terms and be signed by both parties. Additionally, the personal property used as collateral must be clearly described in the document. By adhering to these legal standards, the promissory note can be enforced in a court of law if necessary, providing protection for both the lender and borrower.

Key Elements of the Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana

Several key elements are essential to the Indiana Installments Fixed Rate Promissory Note:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the loan.

- Repayment Schedule: The timeline for making payments, including the frequency and amount of each installment.

- Collateral Description: A detailed description of the personal property securing the loan.

- Signatures: Signatures of both the borrower and lender, along with the date of signing.

State-Specific Rules for the Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana

Indiana has specific regulations governing promissory notes, particularly those secured by personal property. It is important for both parties to understand these rules to ensure compliance. For instance, the note must be in writing and signed by the borrower. Additionally, the personal property used as collateral must be clearly identified to establish the lender's rights in case of default. Familiarity with these state-specific rules can help prevent legal disputes and ensure a smooth transaction.

Quick guide on how to complete indiana installments fixed rate promissory note secured by personal property indiana

Complete Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana on any platform with airSlate SignNow Android or iOS applications and streamline any document-centered task today.

How to modify and eSign Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana effortlessly

- Locate Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Leave behind the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Alter and eSign Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana?

An Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana is a legal document that outlines a borrower’s promise to repay a loan through fixed monthly installments. This note is secured by personal property, providing lenders with an assurance of repayment. It is commonly used in various financial transactions to formalize agreements.

-

What are the benefits of using an Indiana Installments Fixed Rate Promissory Note?

Using an Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana offers numerous benefits, including clear repayment terms, predictable financial planning, and legal protection for both parties. This structured repayment plan helps to avoid misunderstandings and ensures compliance with state laws governing such agreements.

-

How do I create an Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana?

Creating an Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana is easy with airSlate SignNow. You can utilize our user-friendly templates to fill in necessary details and generate a legally binding document quickly. Our platform simplifies the process, ensuring all legal requirements are met.

-

Is eSigning an Indiana Installments Fixed Rate Promissory Note legal?

Yes, eSigning an Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana is completely legal and recognized under the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This means you can execute your agreements securely and conveniently online.

-

What integrations does airSlate SignNow offer for managing Indiana Installments Fixed Rate Promissory Notes?

airSlate SignNow offers various integrations to streamline the management of your Indiana Installments Fixed Rate Promissory Notes Secured By Personal Property Indiana. You can connect with popular tools like Google Drive, Dropbox, and various CRMs, making document management more efficient and enhancing your workflow.

-

What is the pricing model for creating an Indiana Installments Fixed Rate Promissory Note?

Our pricing model for creating Indiana Installments Fixed Rate Promissory Notes Secured By Personal Property Indiana is designed to be cost-effective. We offer various subscription plans to cater to different business needs, ensuring you only pay for what you use without hidden costs. Check our website for detailed pricing options.

-

What features does airSlate SignNow provide for Indiana Installments Fixed Rate Promissory Notes?

airSlate SignNow provides robust features for Indiana Installments Fixed Rate Promissory Notes Secured By Personal Property Indiana, including customizable templates, secure eSigning, and tracking capabilities. Our platform also includes compliance tools to ensure your documents meet legal standards, enhancing both security and reliability.

Get more for Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana

Find out other Indiana Installments Fixed Rate Promissory Note Secured By Personal Property Indiana

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist