D 0 1 0 2 2 0 F 0 0 1Residence Homestead Exemption 2020-2026

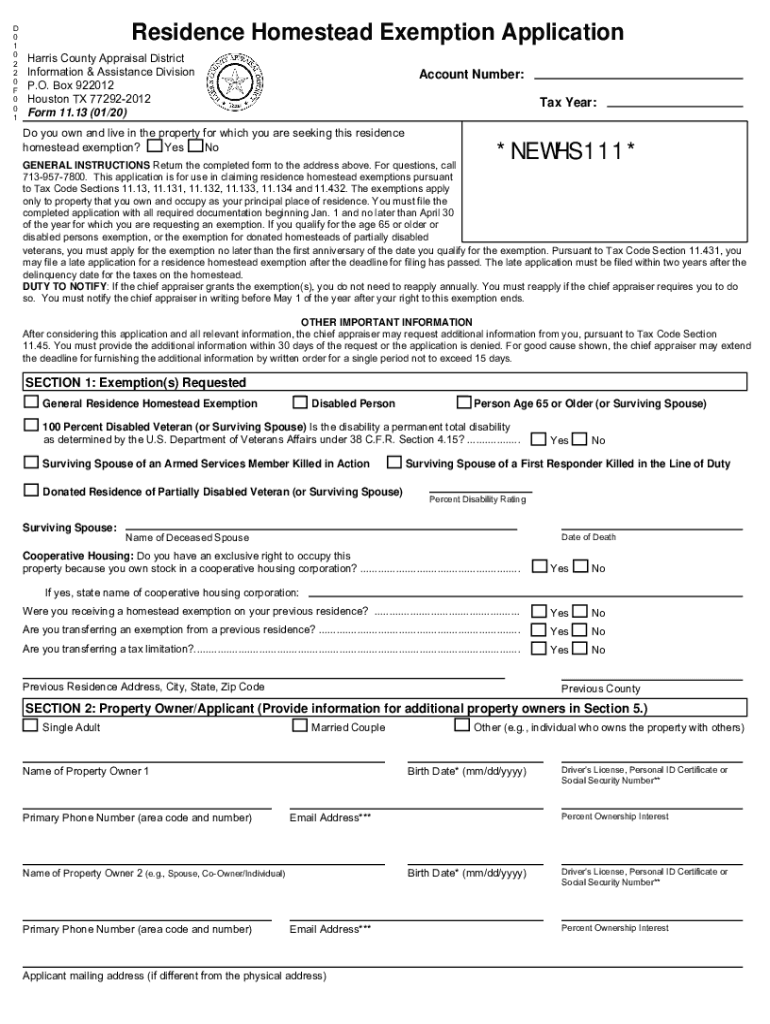

What is the Texas Form Homestead Exemption?

The Texas Form Homestead Exemption is a legal document that allows homeowners to reduce their property taxes on their primary residence. This exemption is designed to provide financial relief to homeowners by lowering the taxable value of their property. By filing this form, eligible homeowners can benefit from a reduction in their property tax burden, making homeownership more affordable.

Eligibility Criteria for the Homestead Exemption

To qualify for the Texas Form Homestead Exemption, homeowners must meet specific criteria:

- Must own the property as of January first of the tax year.

- The property must be the homeowner's primary residence.

- Homeowners must occupy the property as their principal residence.

- Only one homestead exemption can be claimed per household.

Steps to Complete the Texas Form Homestead Exemption

Filing the Texas Form Homestead Exemption involves several steps:

- Obtain the appropriate form, typically Form 50-114, from your local appraisal district.

- Fill out the form with accurate information, including your name, address, and details about the property.

- Provide any required documentation, such as proof of ownership or identification.

- Submit the completed form to your local appraisal district office by the deadline, usually by April 30th of the tax year.

Required Documents for Submission

When submitting the Texas Form Homestead Exemption, homeowners should prepare the following documents:

- Proof of identity, such as a driver's license or state ID.

- Documentation proving ownership of the property, such as a deed or tax statement.

- Any additional information requested by the local appraisal district.

Form Submission Methods

The Texas Form Homestead Exemption can be submitted using various methods:

- Online submission through the local appraisal district's website, if available.

- Mailing the completed form to the appropriate appraisal district office.

- In-person submission at the local appraisal district office during business hours.

Key Elements of the Homestead Exemption

Understanding the key elements of the Texas Form Homestead Exemption is essential for homeowners:

- The exemption applies only to residential properties that are the homeowner's primary residence.

- Homeowners may qualify for additional exemptions, such as for seniors or disabled individuals.

- The exemption reduces the assessed value of the property for tax purposes, leading to lower property tax bills.

Quick guide on how to complete d 0 1 0 2 2 0 f 0 0 1residence homestead exemption

Effortlessly prepare D 0 1 0 2 2 0 F 0 0 1Residence Homestead Exemption on any device

Digital document management has gained traction among organizations and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly and without issues. Manage D 0 1 0 2 2 0 F 0 0 1Residence Homestead Exemption on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign D 0 1 0 2 2 0 F 0 0 1Residence Homestead Exemption with ease

- Find D 0 1 0 2 2 0 F 0 0 1Residence Homestead Exemption and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with the tools specifically designed for this purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to confirm your changes.

- Choose your preferred method to send your form via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device. Modify and electronically sign D 0 1 0 2 2 0 F 0 0 1Residence Homestead Exemption while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct d 0 1 0 2 2 0 f 0 0 1residence homestead exemption

Create this form in 5 minutes!

How to create an eSignature for the d 0 1 0 2 2 0 f 0 0 1residence homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas form homestead exemption?

The Texas form homestead exemption is a legal provision that allows homeowners to reduce their property taxes by exempting a portion of their home's value. This form can be easily filled out and submitted to local tax authorities, ensuring savings for Texas homeowners. Understanding how to properly complete the Texas form homestead exemption is vital for maximizing your tax benefits.

-

How do I apply for the Texas form homestead exemption?

To apply for the Texas form homestead exemption, you need to complete the application form and submit it to your local appraisal district. This typically involves providing proof of residency and ownership. Once your application for the Texas form homestead exemption is approved, you'll receive a reduction in your property tax bill.

-

What are the eligibility requirements for the Texas form homestead exemption?

To be eligible for the Texas form homestead exemption, you must own the property, use it as your primary residence, and apply for the exemption within the designated time frame. Different exemptions may apply based on age, disability, or veteran status. It's essential to review specific eligibility criteria for the Texas form homestead exemption to ensure you qualify.

-

What is the deadline to submit the Texas form homestead exemption?

The deadline to submit the Texas form homestead exemption is usually by April 30th of the tax year in which you are applying. Late submissions may still be considered but will depend on local regulations. Ensure you submit your application on time to avoid missing out on tax savings associated with the Texas form homestead exemption.

-

Can I apply for the Texas form homestead exemption online?

Many local appraisal districts in Texas offer online applications for the Texas form homestead exemption, making the process more convenient. You can find the relevant application on your district’s website. Be sure to check for any specific instructions or requirements to ensure a smooth submission for the Texas form homestead exemption.

-

What are the benefits of the Texas form homestead exemption?

The benefits of the Texas form homestead exemption include reduced property taxes, which can lead to signNow savings for homeowners. This exemption can also provide additional protections against creditors. Understanding these benefits can help homeowners make an informed decision about applying for the Texas form homestead exemption.

-

How does the Texas form homestead exemption impact my mortgage?

The Texas form homestead exemption does not directly impact your mortgage but can decrease your overall housing costs by reducing property taxes. This reduction may also improve your ability to make mortgage payments more comfortably. Knowing how the Texas form homestead exemption affects your finances can aid in better financial planning.

Get more for D 0 1 0 2 2 0 F 0 0 1Residence Homestead Exemption

- Sss b 300 form

- District governor meeting and club visitation report lionsclubs form

- Alien worker no download needed form

- If8793 french answer key form

- Distributor application form forever living

- Typical ceo employment agreement form

- Saint paul park police department form

- Form centerrequest for police data

Find out other D 0 1 0 2 2 0 F 0 0 1Residence Homestead Exemption

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast